Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 28, 2021

2021 is the pivot year for energy company strategies

A global sense of urgency around the impacts of climate change reflects the record-breaking series of disasters around the world over the past two years. As some 75% of global greenhouse gas (GHG) emissions come from the use of energy, the pressure for action is squarely on changing the future fuel mix - and quickly.

Four sets of key actors in policy, regulation and investment continue to ramp up pressure for change:

- Government policies strengthened to reduce Greenhouse Gases (GHGs) faster. By May of this year, some 73% of global GHG emissions were covered under some form of state net zero emissions target.

- Companies increased emissions reductions targets. Multiple energy and non-energy companies announced much stronger emissions reduction commitments 2020 as they were faced with demands for more stringent goals and more specific milestones.

- Financial sector pressures increased on companies. Financial investors ramped up demands for portfolio risk assessments, disclosures consistent with the Task Force on Climate-related Disclosures (TCFD) recommendations, and strong targets to reduce emissions across the value chain. Companies are increasingly being requested by investors and shareholders to explain how their portfolios would perform in a transition toward a net zero or 1.5ºC world—whether or not they expect that future to be a reality.

- Activists and shareholders won climate-related resolutions, replaced board members, and sued companies, arguing that lower emissions were a matter of human rights.

But targets are only words until they turn into actions. Change is already here, and more is coming. But how quickly can a global economic infrastructure with 80% of primary energy needs currently met by fossil fuels (oil, coal and natural gas) shift to lower carbon sources?

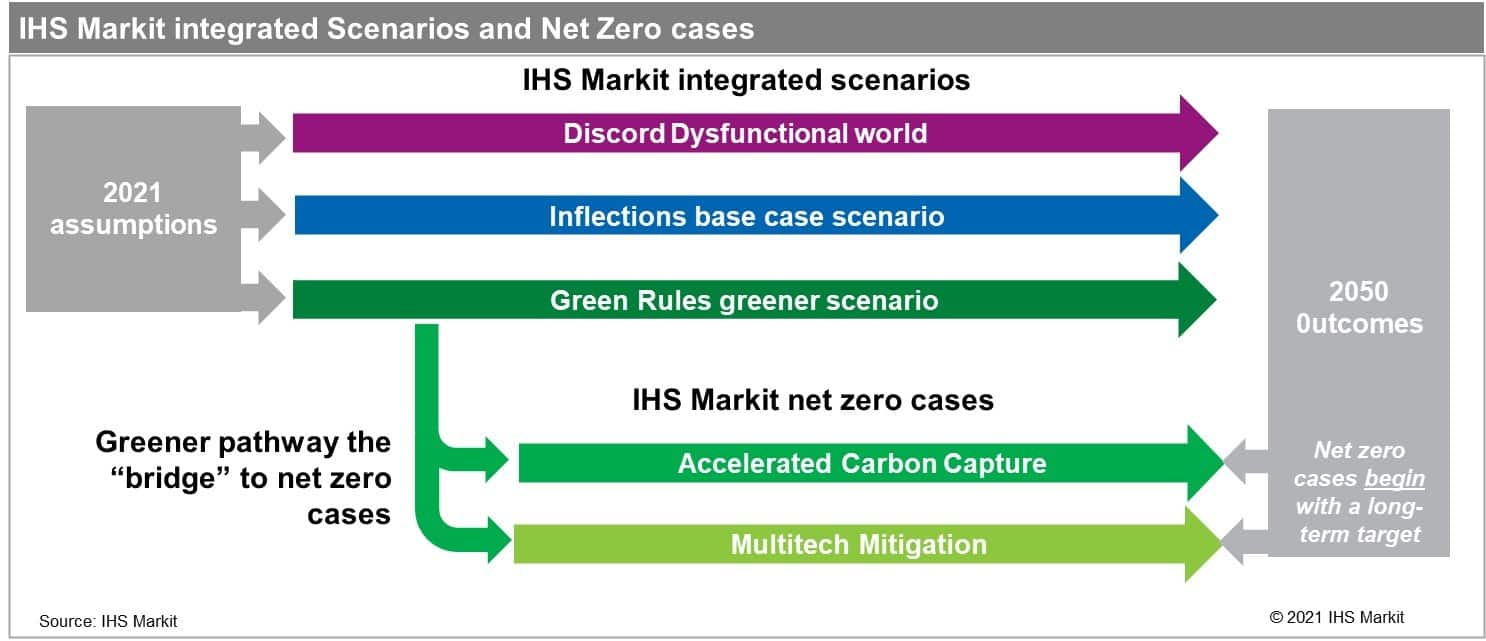

To answer this question and provide companies with more than one potential future, IHS Markit outlines three forward-looking energy outlooks to 2050 built bottom-up by our country and sector experts. In addition, we outline two net zero cases that start from the predetermined goal of reaching a pathway to net zero global GHG emissions by 2050 and work backwards.

Scenarios and net zero assumptions

Each of the integrated outlooks embodies different economic, geopolitical, climate policy, costs and technology assumptions that are plausible.

- Inflections, the base case scenario, includes pivotal shifts in social, policy, and market forces that drive fundamental change in energy markets. Although governments are strongly committed at the outset to climate change actions, the marketplace and company actions are often the leading drivers in moving investment toward clean fuels. The energy transition accelerates—but moves in different ways and at different speeds around the world.

- Green Rules outlines a super-charged reaction following the pandemic and climate-related disasters where populations demand strong government action and cooperation to provide security around health and physical environment. There is a revolutionary shift in the energy transition, but even then not all climate targets are met.

- Discord projects a dysfunctional world in which the political turmoil of 2020 returns after a short rebound, hampering economic growth and creating investment uncertainty and inertia. Some trends toward decarbonization continue, but many fade away.

A bridge to net zero

Net zero cases are fundamentally different from forward-looking scenarios that project outcomes based on articulated and plausible assumptions. Our net zero cases, conversely, begin with a predetermined outcome of reaching global net zero GHG emissions by 2050 and "backcast" to the present.

Unlike some outside analyses, we do not believe that the massive energy and industrial infrastructure of today can change overnight. Instead, we construct a "bridge" from our faster transformation scenario, Green Rules, to the net zero cases. We assume that even very strict and global climate-related policies put into effect in the next few years could not start to impact emissions until around 2027. This emissions "overshoot" creates the need to compensate in later years to reach the final goal of net zero.

We outline two different cases which reflect both the uncertainty around the long-term scale of carbon capture and the differences of opinion among policy makers over the use of an "enabler" of hydrocarbons.

- Accelerated Carbon Capture and Sequestration (ACCS) includes widespread use of CCS to offset emissions from energy as well as hard-to-abate industrial sectors. Annual sequestration by 2050 equals about one-quarter of today's energy-related emissions.

- Multitech Mitigation (MTM) includes only a small amount of CCS, and instead relies on diversification of energy supply and extensive electrification of all sectors and economies based on renewable capacity. This case also includes strong advances in end-use efficiency and conservation.

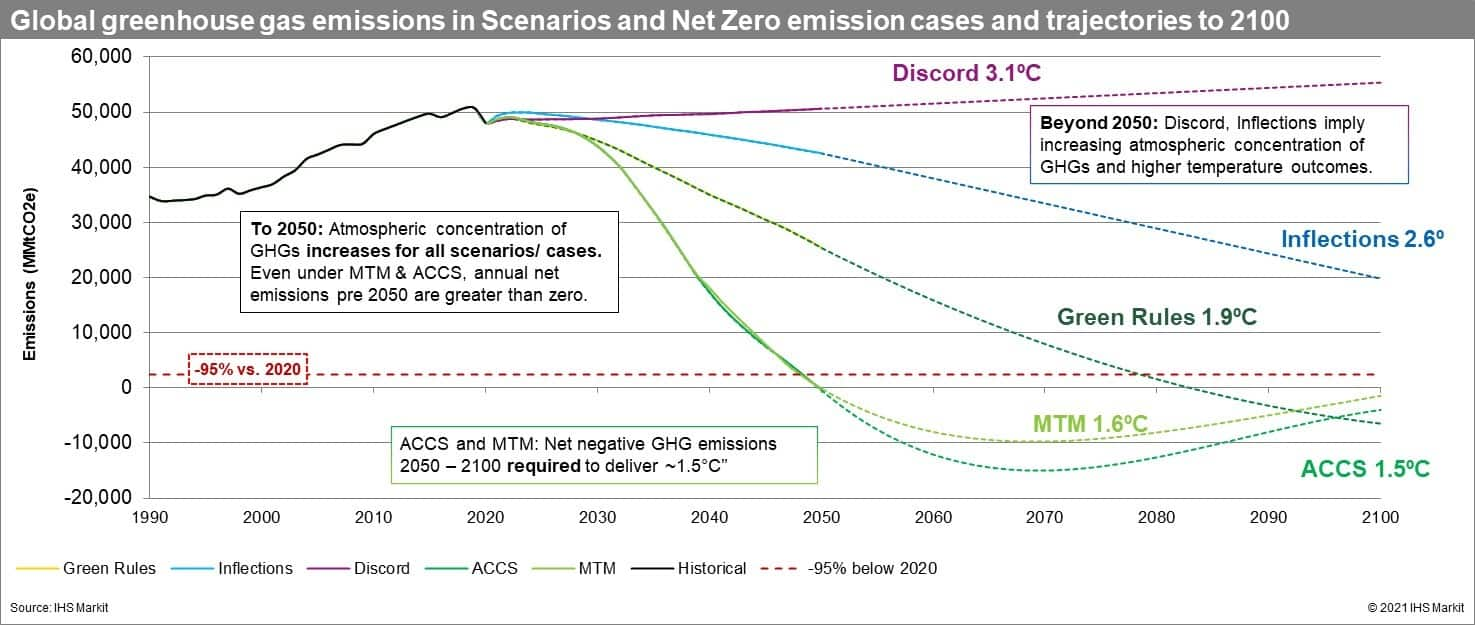

Emissions and energy outcomes differ widely by scenario and case

Each of the three scenarios and two net zero cases has different implications for primary and final energy demand, and for global GHG emissions and temperature paths going forward. None of the scenarios gets close to net zero by 2050. The net zero cases, which by definition reach their goal, must continue to produce negative emissions for decades after mid-century in order to reach the Paris Agreement target of limiting global average temperature rise to 1.5⁰C by 2100.

Learn more about our Energy and Climate Scenarios research.

Access the full report and 250+ other deliverables on the Climate and Sustainability Hub. Sign up for your access today.

Susan Farrell, Vice President on the Climate and Sustainability team, heads the IHS Markit Energy and Climate Scenarios, which project five different integrated trajectories for oil, gas, coal, wind, solar, nuclear, and other energy sources out to 2050 at a global and key country level.

Posted on 28 July 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2021-is-the-pivot-year-for-energy-company-strategies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2021-is-the-pivot-year-for-energy-company-strategies.html&text=2021+is+the+pivot+year+for+energy+company+strategies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2021-is-the-pivot-year-for-energy-company-strategies.html","enabled":true},{"name":"email","url":"?subject=2021 is the pivot year for energy company strategies | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2021-is-the-pivot-year-for-energy-company-strategies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=2021+is+the+pivot+year+for+energy+company+strategies+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2021-is-the-pivot-year-for-energy-company-strategies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}