Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 29, 2024

A review of 2023 and the five big questions facing Southeast Asia’s power markets in 2024

As 2024 begins, S&P Global Commodity Insights looks back at the power market events and highlights the most pertinent issues for the sector in Southeast Asia. Below are the five big questions facing in 2024 that are expected to influence discussions on Southeast Asian power and renewables markets:

What areas or technologies will be the focal points in the upcoming power plans?

Energy transition in the region is poised to accelerate in 2024, should the government establish the requisite supporting policies. Thailand's power development plan (PDP) in 2024 likely will emphasizes a clean trajectory as in the 2023 draft, Indonesia is focusing on updating its Electricity Supply Business Plan (RUPTL) 2024 with a net-zero scenario, and the Philippines aims to increase the renewable energy share, awaiting finalization of the delayed Philippine Energy Plan (PEP) in 2024.

Will large-scale renewables tenders continue to drive renewables growth?

Major Southeast Asia countries have moved from feed in tariffs to competitive tenders to build renewable power capacity. Despite some delays in the Philippines' GEA3 and Thailand's 3.66GW auction, the fundamental motivations for renewable tender issuances remain unchanged across Southeast Asian countries and the trend toward renewable tenders are expected to continue in 2024, albeit at a smaller scale than in 2023.

Will there be continued policy advances in allowing third party access (TPA) to facilitate the renewable energy exchange?

The introduction of TPA frameworks is pivotal to facilitate corporate RE procurement in the vertically integrated market structure. Malaysia focused on developing a transparent wheeling charge within the TPA framework, with detailed rules and regulations expected in 2024. Indonesia is in dire need of a power wheeling scheme but pending on the presidential election planned in February 2024. Vietnam is delayed in introducing a wheeling fee, which has impeded the long overdue implementation of the pilot direct power purchase agreement mechanism.

Will the various financing initiatives help set early coal retirements in motion?

Coal retirement is a critical yet challenging component of Southeast Asia's energy transition strategy. The Energy Transition Mechanism (ETM) and the Joint Energy Transition Partnership (JETP) are the two major financing initiatives set up to support this costly endeavor, and 2024 will be a key year to monitor how some of their early efforts will play out.

How will the key markets ensure coal supply to meet the surging coal demand from the power sector?

A strong coal-fired generation in 2024 is expected, especially in heavily coal-reliant nations. The Philippines has engaged in diplomatic efforts to ensure a steady coal supply from Indonesia, while Vietnam aims to increase both domestic production and imports, in collaborations with Laos, to address an anticipated coal demand of over 63 million metric tons by 2024.

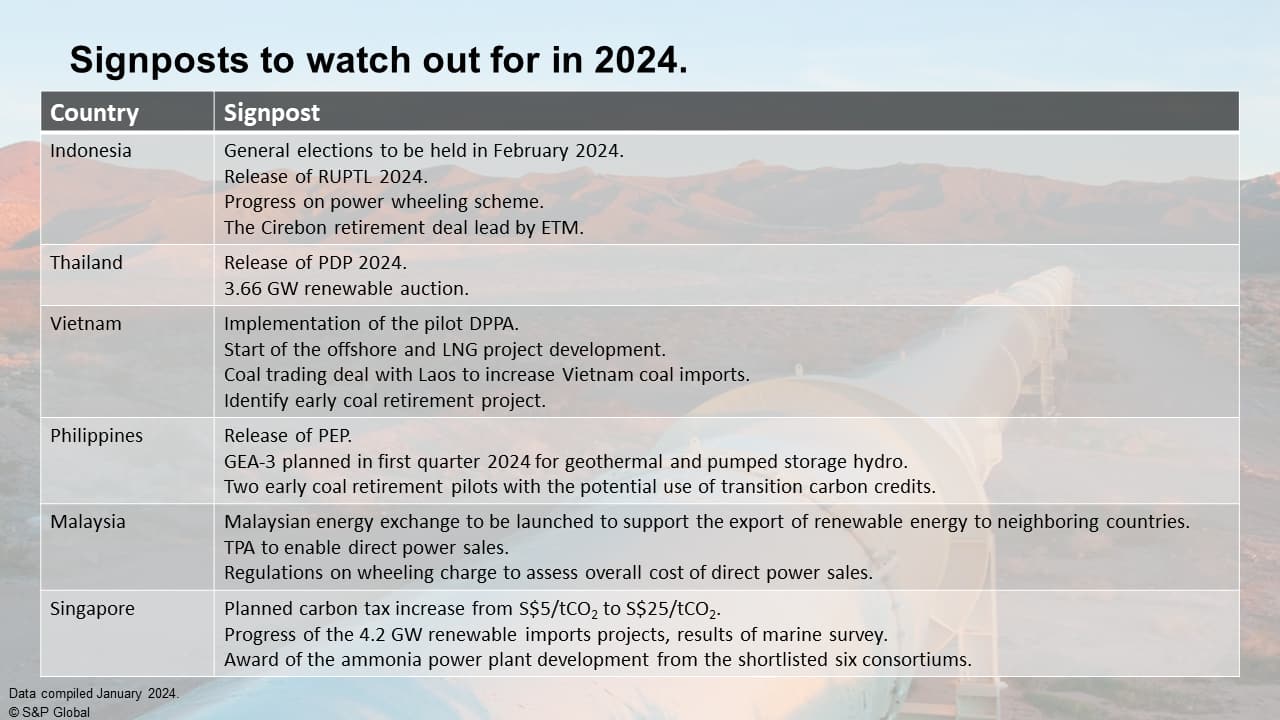

The S&P Global Commodity Insights' Southeast Asian Power and Renewables team will continue to watch the signposts for the region. Please refer to the full report on Connect.

If you are interested in learning more about our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fa-review-of-2023-and-the-five-big-questions-facing-southeast-a.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fa-review-of-2023-and-the-five-big-questions-facing-southeast-a.html&text=A+review+of+2023+and+the+five+big+questions+facing+Southeast+Asia%e2%80%99s+power+markets+in+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fa-review-of-2023-and-the-five-big-questions-facing-southeast-a.html","enabled":true},{"name":"email","url":"?subject=A review of 2023 and the five big questions facing Southeast Asia’s power markets in 2024 | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fa-review-of-2023-and-the-five-big-questions-facing-southeast-a.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+review+of+2023+and+the+five+big+questions+facing+Southeast+Asia%e2%80%99s+power+markets+in+2024+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fa-review-of-2023-and-the-five-big-questions-facing-southeast-a.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}