Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 23, 2023

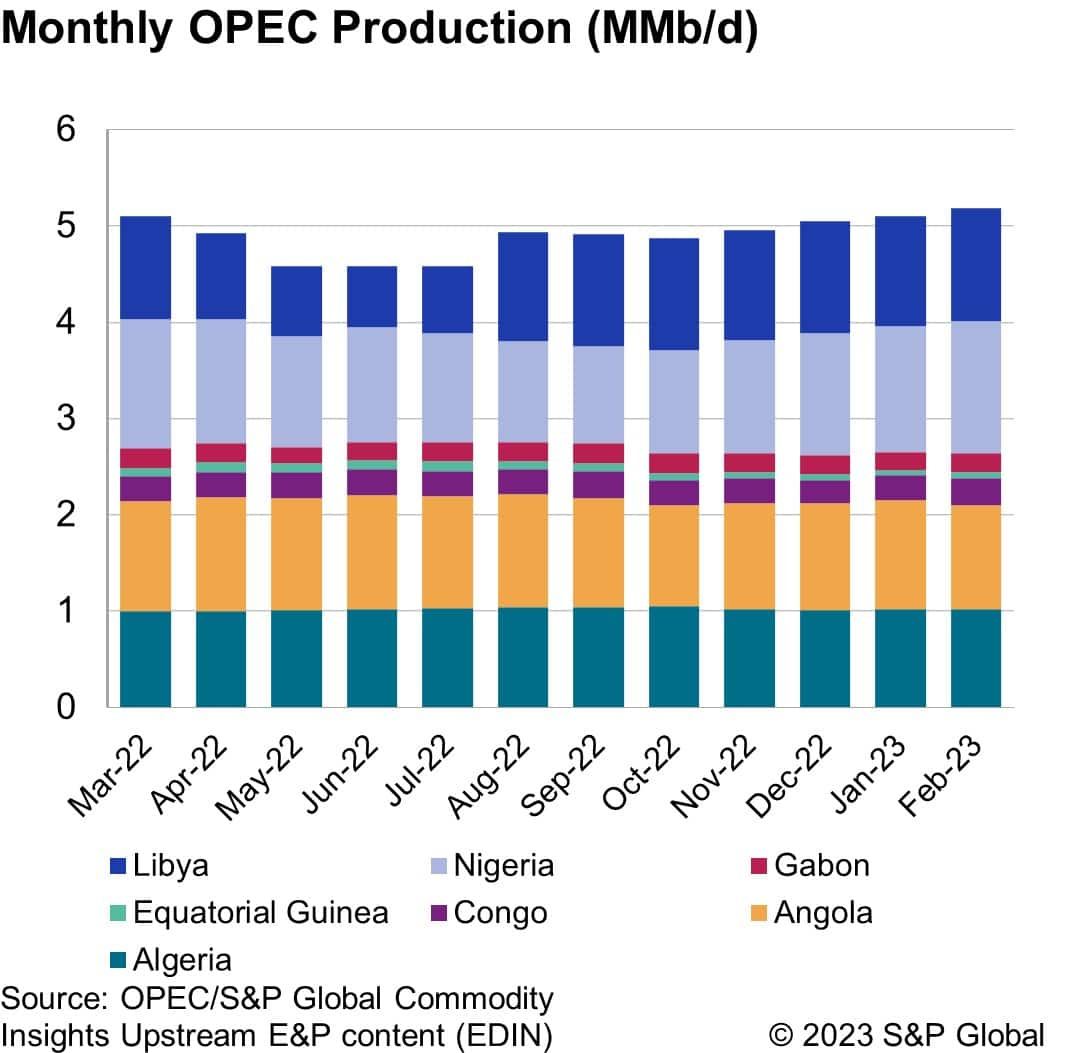

African OPEC heavyweights still underproducing, but 2023 has started brighter

Nigeria and Angola are seemingly unable to return to pre-pandemic levels of production, where Nigeria would produce between 1.7 & 1.8 MMbo/d and Angola between 1.4 & 1.5 MMbo/d. However, African countries fared well in the first few months of the new year with growing production in Nigeria, Congo and initially Angola. According to OPEC Nigeria pumped 1.38 MMbo/d in February, up 109,000 b/d from December and the highest since February 2022, as the key grade Agbami returned from maintenance and recently troubled flows of Forcados and Bonga saw continued rebounds. Congo was also a big gainer in the first few months of the year, boosting its monthly production by 36,000 b/d over December 2022. This is positive, but as of February 2023, Nigeria was over 350,000 bo/d less than its quota of 1.74 MMbo/d and Angola was around 370,000 bo/d below its quota of 1.45 MMbo/d. March production will be affected by an expected decline in Angola output related to a five-week maintenance block at the Dalia FPSO.

It seems years of underinvestment, political uncertainty, country

unrest, ageing infrastructure and producing assets are combining to

make it almost impossible for certain African producers to return

to their pre-pandemic production level.

***

Want to access more upstream content? Visit S&P EDIN & Vantage.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fafrican-opec-heavyweights-still-underproducing-but-2023-has-st.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fafrican-opec-heavyweights-still-underproducing-but-2023-has-st.html&text=African+OPEC+heavyweights+still+underproducing%2c+but+2023+has+started+brighter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fafrican-opec-heavyweights-still-underproducing-but-2023-has-st.html","enabled":true},{"name":"email","url":"?subject=African OPEC heavyweights still underproducing, but 2023 has started brighter | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fafrican-opec-heavyweights-still-underproducing-but-2023-has-st.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=African+OPEC+heavyweights+still+underproducing%2c+but+2023+has+started+brighter+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fafrican-opec-heavyweights-still-underproducing-but-2023-has-st.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}