Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 06, 2023

Balancing affordability and the power sector energy transition in Southeast Asia

View a full list of topics in our Southeast Asia Energy Transition series.

Countries in Southeast Asia mostly regulate electricity prices at a lower level to support economic growth. However, the regulated pricing system appears unsustainable due to the rising domestic and imported energy costs. Energy affordability remains a major concern in most of the SEA countries, as the current pricing mechanisms have led to huge financial burdens on utilities and national budgets.

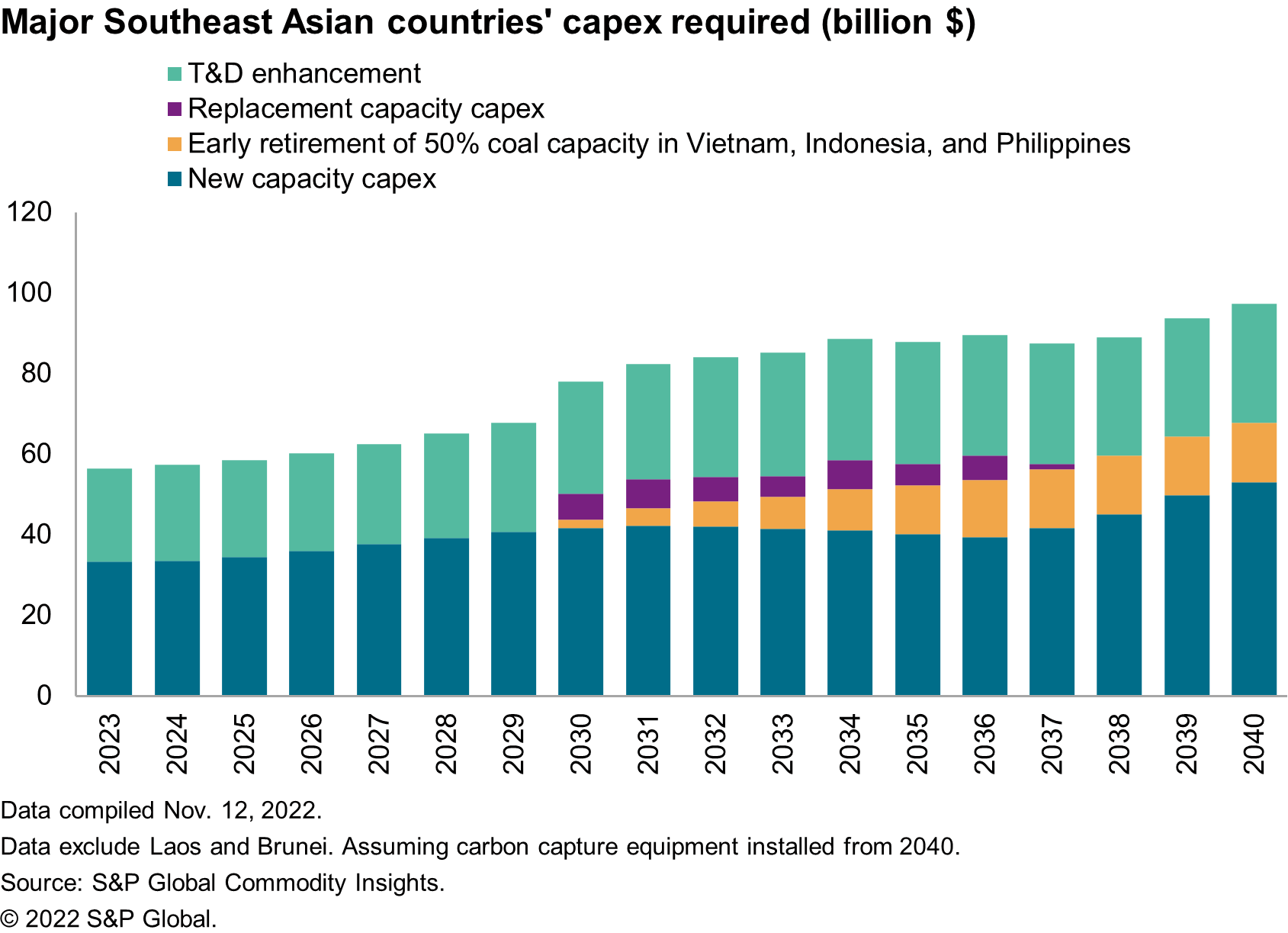

Furthermore, the region is aiming to transition to a more sustainable power system, that will involve accelerated coal capacity retirement, grid enhancements, the adoption of low-carbon and emission abatement technologies, etc. The power sector's transition is forecast to require a substantial capex and this investment will push the cost of electricity higher.

In this report, we described the current pricing and investment pattern, assessed the funding required for energy transition, and proposed actions to balance the rising prices and electricity affordability.

Energy affordability remains a major concern in most Southeast Asian countries

In the past decade, Southeast Asian countries have made significant efforts to extend electricity access to all users, with major countries achieving close to 100% electrification rates. Despite the substantial investment in the power sector, from generation to transmission and distribution (T&D) infrastructure, the power retail tariffs are mostly regulated and have remained relatively low over the years.

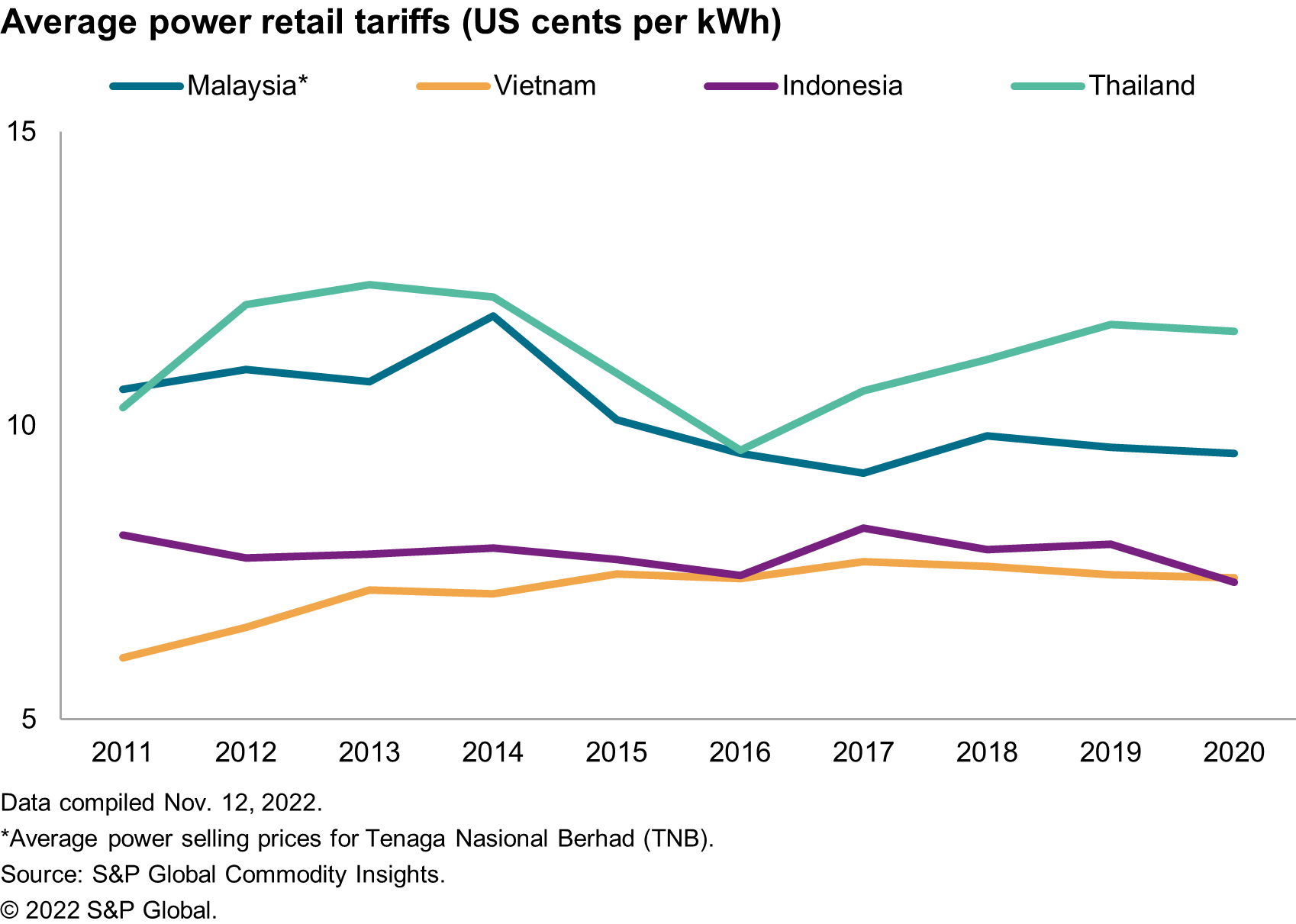

Figure 1 shows that the power tariffs (in US cents per kilowatt-hour) in Peninsular Malaysia and Indonesia are lower now than 10 years ago. This is because the tariffs in local currency terms increased by a small amount, and the small tariff increases have all been offset by the depreciation of local currencies. Tariffs in Vietnam and Thailand increased by 22% and 13%, respectively, in the past 10 years, lower than the overall increase of the living costs (consumer price index) at 42% and 14%, respectively, in the same period.

The most important reason to keep power tariffs low is that the industrial sector is the most sensitive to price changes; thus, keeping power tariffs low is critical to attracting foreign investment for emerging Southeast Asian countries such as Malaysia, Vietnam, Indonesia, and Thailand that are being industrialized. Another reason to maintain low tariffs is to help the large low-income population in the region.

However, power pricing reforms in these emerging Southeast Asian countries remained stagnant. Regulated power prices are sometimes lower than the power supply cost, resulting in financial losses for utilities and the need for national subsidies. The current pricing mechanisms become unsustainable and are under scrutiny for market reform, a major part of which is to privatize the power sector and implement a market-based pricing mechanism. As fossil fuels will account for a significant share of total power generation in the medium term, the variation of fuel prices will have a big impact on power costs

Additionally, as the region is on its way to gradually phasing out energy subsidies and is unlikely to introduce a new subsidy scheme to tackle rising power costs, this will impair electricity affordability at a time when most Southeast Asian countries are willing to transition to more cost-reflective pricing. Theoretically, pricing reform will introduce market-based prices into the system, with consumers bearing the cost, but this is extremely difficult for developing countries that currently have regulated prices. Thailand and Malaysia have been exploring the fuel pass-through mechanism, trying to ensure that power prices reflect the costs and to keep utilities profitable while supplying affordable power. The mechanisms work smoothly, but during the COVID-19 pandemic these two countries were not able to increase power tariffs, and the loss was shared by the utilities and state budgets.

Pricing reform is one of the important components of power sector market reform, and it likely will take a longer time for the region to fully liberalize its power markets.

Energy transition is confirmed but in funding hunger

Southeast Asian countries are endowed with a variety of fossil fuel resources. As the governments of Southeast Asia appeared to be committed to the energy transition, it will have significant implications for the evolution of the power market and economic growth. The major energy transition paths involve retiring coal-fired power generation and introducing renewables and other new technologies, which have proven to be not only technically challenging but also prohibitively expensive.

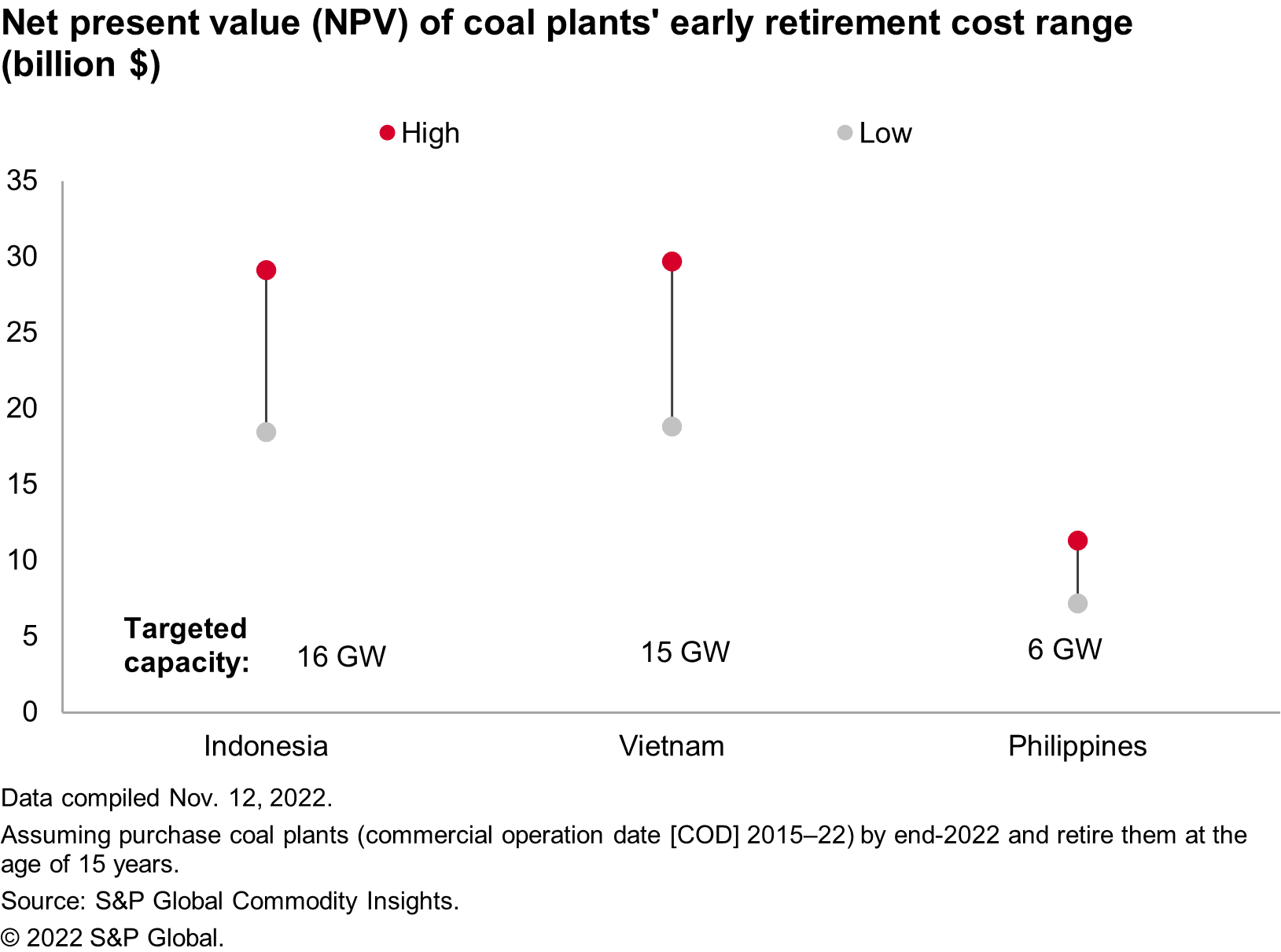

Figure 2 illustrate the cost estimate of the early retirement mechanism to retire coal plants when they reach 15 years old, compared with the fact that coal plants in this region usually operate for 40 years or longer, 37 GW of coal plants commissioned between 2015 and 2022 were from coal-dependent countries such as Indonesia, Vietnam, and the Philippines. These are very young power fleets that will not retire unless an early retirement mechanism is implemented, which is estimated to cost US$ 7-30 billion, excluding additional investment to build replacement capacity.

Aside from deploying renewable energy resources to reduce the countries' reliance on fossil fuels, Southeast Asian countries have a variety of decarbonization plans in place, including carbon capture systems installed in power plants, biomass or ammonia cofiring in coal plants, and hydrogen blending in gas-fired power plants. However, research and development (R&D) and commercialization of new technologies are both technically and financially challenging. Building a sustainable and low-carbon power system in Southeast Asia, including generation and grid expansion, is forecast to cost US$ 56-97 billion per year (figure 3), and that will require higher private participation to supplement the insufficient public funding.

Simultaneously, policy supports that consistently meet affordability, reliability, and emission reduction challenges are vital to providing investors with confidence and attracting low-cost financing. Governments are encouraged to implement more policies and measures to attract private investment to complement the tight public funding. Additionally, a sustainable energy transition will inevitably raise power supply costs, and the region must examine how higher power prices will shape the future fuel mix and initiate concerted actions to turn risks into opportunities.

Actions to balance the rising prices and electricity affordability

The energy transition will continue, and further price increases are inevitable. Hence, investors and developers would be encouraged to bring up concerted solutions that could help mitigate the short-term increases in energy prices while striking a balance between implementation costs and ensuring long-term affordability of electricity for consumers.

Adaptations measures— controlling cost with innovative financing while expanding new payment funds— are recommended to cope with short-term price hike, as well as to strive for long-term price stabilization.

As the energy transition to a low-emission economy continues or even accelerates, with both avoided costs and additional benefits being considered, the whole energy transition process would generate greater economic benefits in the longer term.

This post is an abstract of a featured topic from the S&P Global Commodity Insights series on energy transition in Southeast Asia, where we deep dive into various aspects of the region's power sector energy transition.

Sign up for updates of strategic reports that will answer some of the thorniest questions on energy transition in the region, drilling deeper into each of the markets we follow.

Learn more about our Asia-Pacific energy research.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbalancing-affordability-and-the-power-sector-energy-transition.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbalancing-affordability-and-the-power-sector-energy-transition.html&text=Balancing+affordability+and+the+power+sector+energy+transition+in+Southeast+Asia+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbalancing-affordability-and-the-power-sector-energy-transition.html","enabled":true},{"name":"email","url":"?subject=Balancing affordability and the power sector energy transition in Southeast Asia | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbalancing-affordability-and-the-power-sector-energy-transition.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Balancing+affordability+and+the+power+sector+energy+transition+in+Southeast+Asia+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbalancing-affordability-and-the-power-sector-energy-transition.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}