Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 02, 2022

Brazil offshore drilling market - The upcycle gains momentum

The global offshore drilling market is picking up strongly since the past year and the uptick accelerated during the current year. The offshore drilling segment, which is commonly seen as one of the most critical components of the drilling value chain, is getting stronger and gradually tighter. This is underscored by trends observed across key indicators such as global marketed utilization, average contract duration, and day rates across both shallow and deepwater segments. All of them experienced an inflection point around 2018 and are consistently growing despite minor retreats during the COVID-19 outbreak.

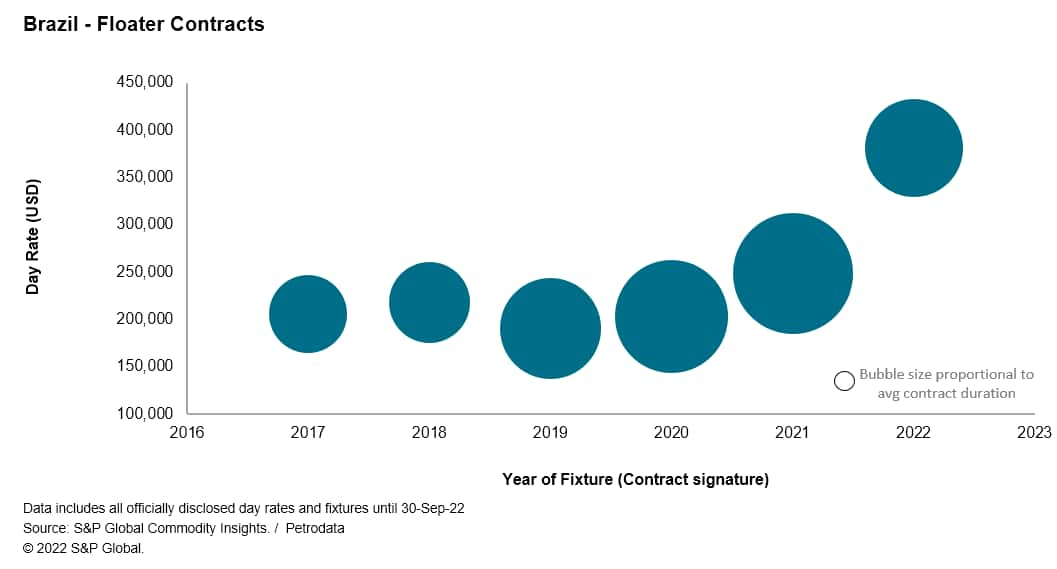

The Brazilian offshore drilling market constitutes one of the most important demand regions for high-specification floaters - the country is within the coveted "golden triangle" of the global offshore drilling market alongside GoM and West Africa. And the recent trends in the Brazilian rig market mimic the rebound and gradual tightening observed worldwide: day rates are increasing alongside contract duration as shown in the following chart. There also growing signs of bottlenecks across the specialized drilling supply chain and local labor market: from unprecedented lead times for specialized drilling equipment to concerns around the availability of experienced and qualified professionals, these constraints pose risks to current and future drilling projects. The market is expected to level off at some point, but the main question revolves around how fast this balance can be achieved. After all, this is a highly capital-intensive industry, with sharp and unpredictable cycles, which was heavily battered for most of the past decade and is now experiencing a resurgence amid a controversial duality of energy transition and energy security. Long-term fundamentals and a favorable risk-reward scenario perceived by major industry players are key to spurring additional investment across the supply chain and relieving any existing or eventual bottlenecks

From a demand standpoint, we expect as many as 100 offshore wells to be drilled yearly on average until 2026, which could push the demand for offshore drilling rigs to the range of 35 to 40 units between 2025 and 2026. Petrobras has always been the key customer and will continue to play such a role with 14 production units planned to come onstream by 2026, which should account for the bulk of development wells expected to be drilled in the country over the next five years. However, IOCs and local independents should also have a growing important role in the overall local customer base for offshore drilling services. We expect between 30-35% of both development and exploration wells to be drilled by Operators other than Petrobras by 2026. This is an interesting trend since the Brazilian NOC accounted for over 80% of all offshore wells drilled in the country between 2016-21. Therefore, higher diversification across the local drilling customer base is expected over the next years.

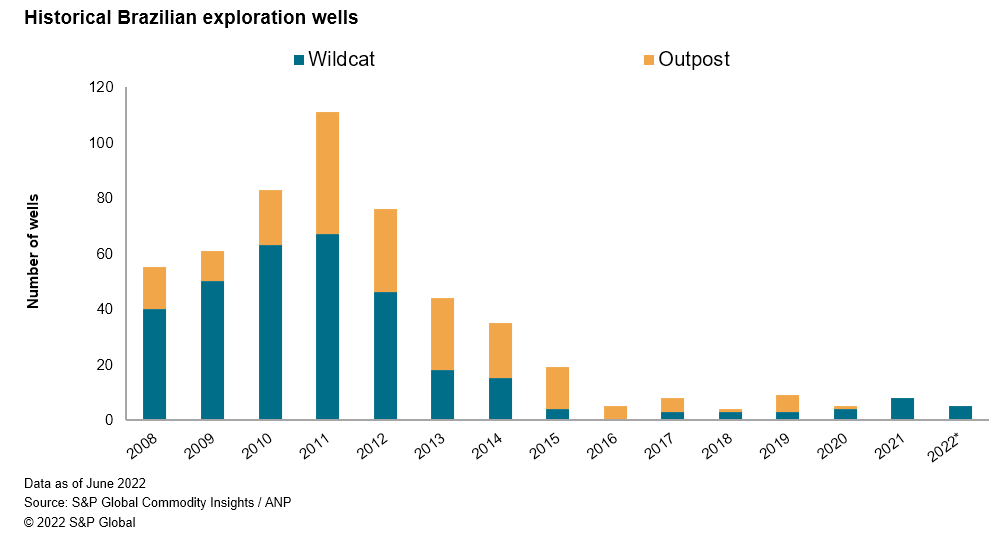

On the exploration side, there is a steep decline in the number of offshore exploration wells drilled in the country since 2011. There are several factors behind this trend, both external and internal, such as the global oil and gas industry 2014-downturn and the relatively long hiatus in local offshore bidding rounds from 2009-13. Campos and Santos keep their prominence around local exploration efforts and they both account for over 85% of offshore new field wildcats drilled since 2016, mostly in the pre-salt polygon. Noteworthy exploration activities and discoveries in 2022 include Alto de Cabo Frio Central and the NFW Bob-1 drilled by Shell in the Campos basin. A highly anticipated exploratory campaign is Petrobras' plans for the Equatorial Margin, particularly the Morpho-1 wildcat expected to be spudded in the Foz do Amazonas basin between the end of 2022 and the beginning of 2023. Development wells commonly account for most wells drilled, but it's also worth noticing that key factors such as the high productivity of the pre-salt wells combined with technological advancements contributed to the reduction observed in the total number of development wells built since 2014 without compromising the country's production output.

The local offshore rig market is dominated by a few local players with substantial contracts held by major international drilling contractors as well. The common ground shared by active local players is the fact they own and operate modern units capable of working in water depths of over 2,000 m and featuring state-of-the-art equipment and technology. However, a key aspect commonly held by drilling contractors operating in Brazil is the ability to cope with strict local regulatory requirements, some of which are unique to the Brazilian reality and usually require minor equipment modification and upgrades, which are also set forth by the customers in tenders and contracts.

All in all, the local offshore drilling market is set to grow under ambitious development programs planned for the next years despite uncertainties around changes to the existing oil and gas local policies combined with possible changes to Petrobras' strategy that could be implemented by the new government of the recently elected president Lula. For more details, we invite the reader to access our full report "Brazil offshore drilling market -Issue 02: The upcycle gains momentum".

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Oil and Gas Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbrazil-offshore-drilling-market-the-upcycle-gains-momentum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbrazil-offshore-drilling-market-the-upcycle-gains-momentum.html&text=Brazil+offshore+drilling+market+-+The+upcycle+gains+momentum+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbrazil-offshore-drilling-market-the-upcycle-gains-momentum.html","enabled":true},{"name":"email","url":"?subject=Brazil offshore drilling market - The upcycle gains momentum | S&P Global&body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbrazil-offshore-drilling-market-the-upcycle-gains-momentum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazil+offshore+drilling+market+-+The+upcycle+gains+momentum+%7c+S%26P+Global http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbrazil-offshore-drilling-market-the-upcycle-gains-momentum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}