Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 09, 2023

Can the trend of deepwater plays offshore Gabon be extended further north by Tigre?

China National Offshore Oil Corp (CNOOC) could expand its Gabon deepwater portfolio in the case of a positive result from the recently spud Tigre 1 new field wildcat, targeting the pre-salt Gamba sandstones of Aptian age. Although there have been gas discoveries in the area, CNOOC have clearly indicated that they are targeting an oil prospect. Tigre is a 4-way closure with a recoverable resource potential of up to 1.4 billion barrels according to the operator. The prospect is located within the offshore Block BC9 operated by CNOOC with 100% interest. It is worth mentioning that CNOOC has been looking for partners since early 2022. If successful, the well will prove that the trend of pre-salt targets in the deepwater of the Gabon Coastal basin extends northwards from the 2014 Block BDC10 Leopard discovery.

The well is currently being drilled by the Stena "Ice Max"

drillship at a water depth around 2,000 m. The targeted reservoir

within the pre-salt Gamba and Dentale is expected to be reached at

a depth of approximately 3,000 m. Given the existing offshore

development in the area, it's assumed, development of the field

would involve a floating production, storage and offloading (FPSO)

vessel with offshore loading onto shuttle tankers to export the

crude oil to market.

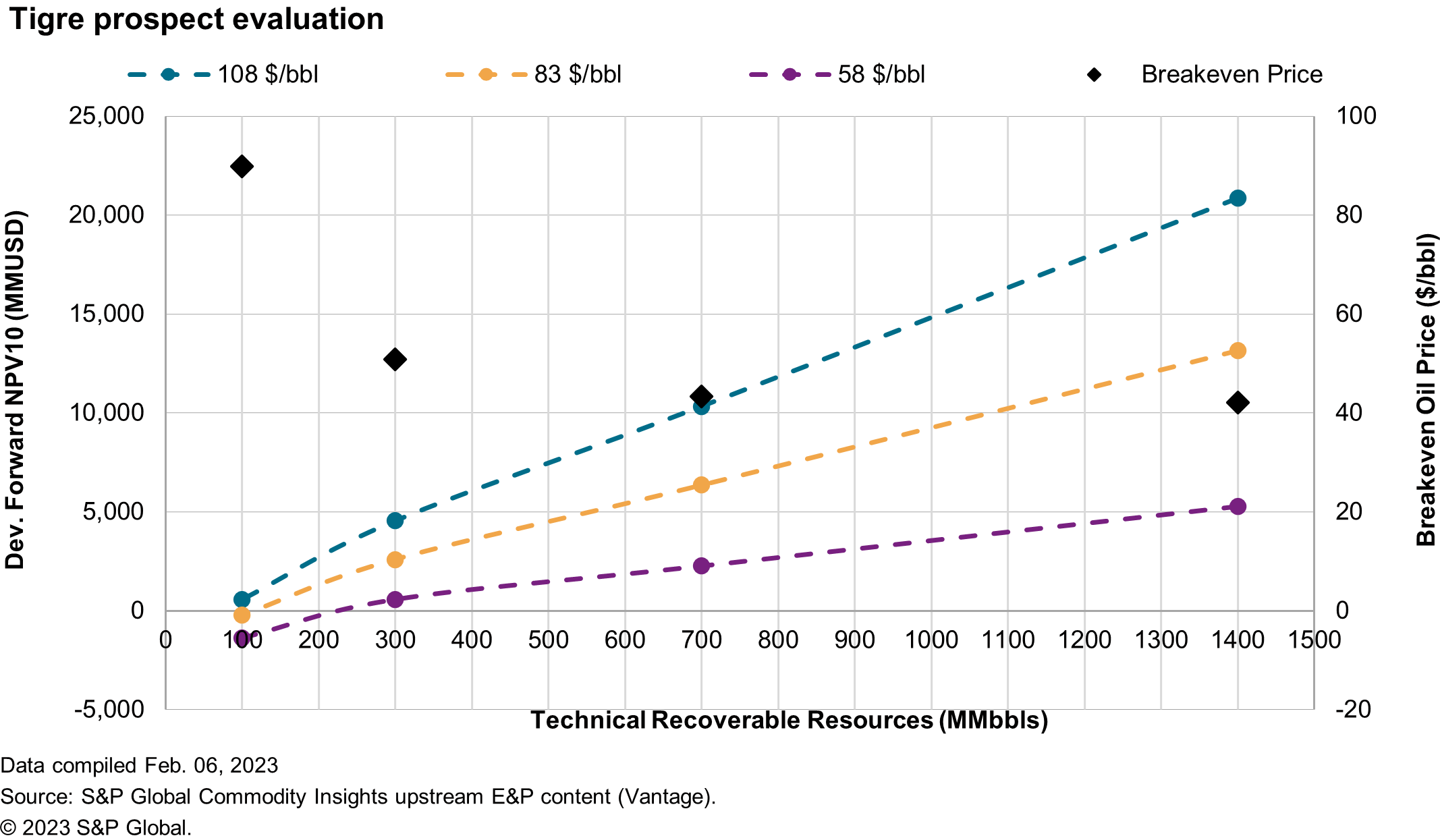

Analysis of the modelled prospect, results in a minimum economic

field size (MEFS) of around 120 million barrels (MMbbls)

recoverable at a Brent oil price scenario of $83/bbl, while a

discovery of 300 MMbbls is expected to have a NPV of over USD 2.6

billion. Above the MEFS, the prospect has an internal rate of

return (IRR) of around 20% and the government take is between 45%

and 50% which is below the average for Africa which is

approximately 60%.

Based on a more conservative Brent oil price scenario of $58/bbl

(which is more appropriate for planning purposes), suggests, CNOOC

is likely targeting at least 300 MMbbls recoverable with a NPV of

USD 0.6 billion as the MEFS is approximately 220 MMbbls. At a brent

crude price of $58/bbl a discovery of 1,400 MMbbl will have a value

in the region of USD 5.3 billion, with IRR of 15%, a government

take of approximately 50% and a break-even price around

$42/bbl.

The contract for Block BC9 was signed in 2007 and therefore

benefits from the earlier fiscal terms in Gabon before they were

tightened in subsequent years. As a result, the calculated NPV from

running the analysis is approximately 20% higher using these fiscal

terms compared to the current fiscal terms.

The Gabon Production Sharing Agreement (PSA) of 2007 terms include

details on the allocation of profits and risks between the

government and the companies. The legislation's main term includes

a profit share. The Tigre profit share is a production-based

sliding scale tied to water depth. As the water depth and

production increase the profit share decreases. For ultradeep water

projects like Tigre, the profit share decreases in tranches of 5%.

Tigre prospect will be subject to a profit share of 45%-60% linked

to the production rate.

Currently Gabon produces around 200 thousand barrels per day

(Mbbls/d) of oil, and the expected in-place magnitude of the Tigre

prospect would mean that it could potentially be a significant

player and double Gabon's oil production once the field was put

fully on production.

Should Tigre 1 be a success, it has the potential to further

de-risk prospects in the deepwater Gabon Coastal Basin and play a

key role in future deepwater exploration offshore Gabon.

***

Want to access more upstream content? Visit S&P EDIN & Vantage.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-the-trend-of-deepwater-plays-offshore-gabon-be-extended-fu.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-the-trend-of-deepwater-plays-offshore-gabon-be-extended-fu.html&text=Can+the+trend+of+deepwater+plays+offshore+Gabon+be+extended+further+north+by+Tigre%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-the-trend-of-deepwater-plays-offshore-gabon-be-extended-fu.html","enabled":true},{"name":"email","url":"?subject=Can the trend of deepwater plays offshore Gabon be extended further north by Tigre? | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-the-trend-of-deepwater-plays-offshore-gabon-be-extended-fu.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Can+the+trend+of+deepwater+plays+offshore+Gabon+be+extended+further+north+by+Tigre%3f+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcan-the-trend-of-deepwater-plays-offshore-gabon-be-extended-fu.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}