Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 02, 2023

Carbon capture/CCUS M&A market 2022: Oil and gas companies dominated the deal activities

The Paris Climate Agreement was signed on 12 December 2015 with an aim to limit global warming to 1.5°C per year. To achieve this goal, countries and companies have been pledging to reduce their emissions and reach net zero by 2050.

Companies are paying increased attention to CCUS as it is considered one of the critical technologies to help reduce emissions and reach net zero goals. Some governments are providing financial incentives and regulatory support to CCUS projects, but additional support will be needed to accelerate the deployment of CCUS technology. The recent Inflation Reduction Act, 2022 is expected to incentivize CCUS deployment in the United States.

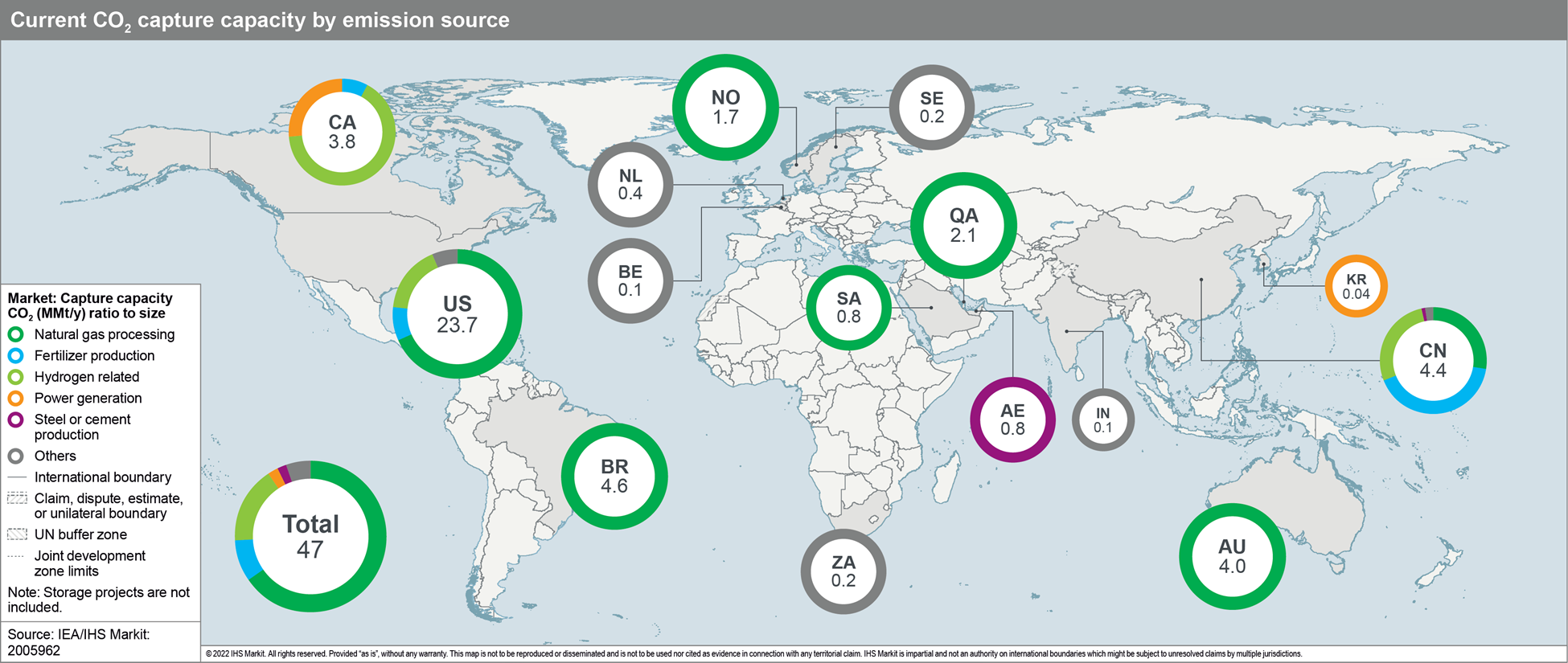

The CCUS industry is still in a nascent state of development; therefore, most of the deals are linked to conducting research and feasibility studies, creating a partnership to share technologies and collaborating to explore the potential of various CCS projects. Various companies, primarily the companies operating in the oil and gas industry, have been forming strategic alliances to research and built a viable and cost-effective way of capturing carbon dioxide at source, transporting, storing, and potentially utilizing it for commercial purposes.

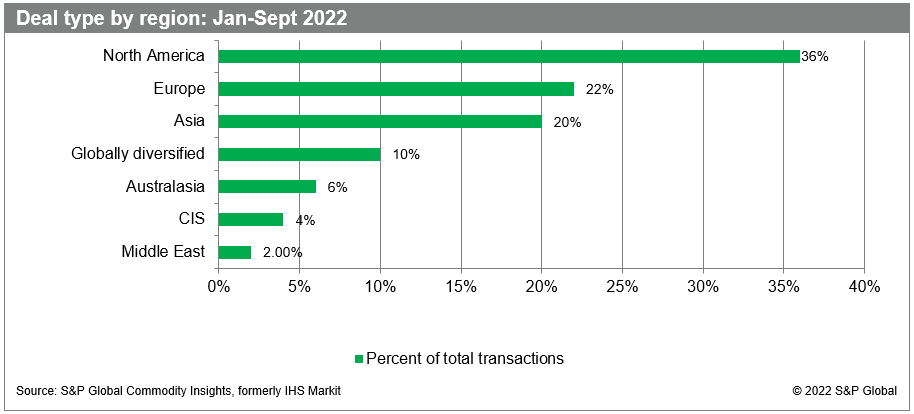

Regarding the M&A activity, North America, mainly the United States, is the most active region, followed by Europe and Asia. The United States holds the highest share in deal flow, followed by Europe and Asia. These three regions together contributed more than two-thirds of the total deal count worldwide.

For successful adoption, CCUS requires certain challenges to be addressed. A robust policy framework and support from policy makers are needed for successful business cases and to accelerate the deployment of carbon capture technologies. Incentives such as tax credits, cash subsidies and support in research and development will attract private investment into the sector.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcarbon-capture-ccus-ma-market-2022-oil-and-gas-companies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcarbon-capture-ccus-ma-market-2022-oil-and-gas-companies.html&text=Carbon+capture%2fCCUS+M%26A+market+2022%3a+Oil+and+gas+companies+dominated+the+deal+activities++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcarbon-capture-ccus-ma-market-2022-oil-and-gas-companies.html","enabled":true},{"name":"email","url":"?subject=Carbon capture/CCUS M&A market 2022: Oil and gas companies dominated the deal activities | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcarbon-capture-ccus-ma-market-2022-oil-and-gas-companies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Carbon+capture%2fCCUS+M%26A+market+2022%3a+Oil+and+gas+companies+dominated+the+deal+activities++%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcarbon-capture-ccus-ma-market-2022-oil-and-gas-companies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}