Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 01, 2022

China’s energy markets during latest Covid-19 lockdown: Coal and gas plummeting while renewables flourishing

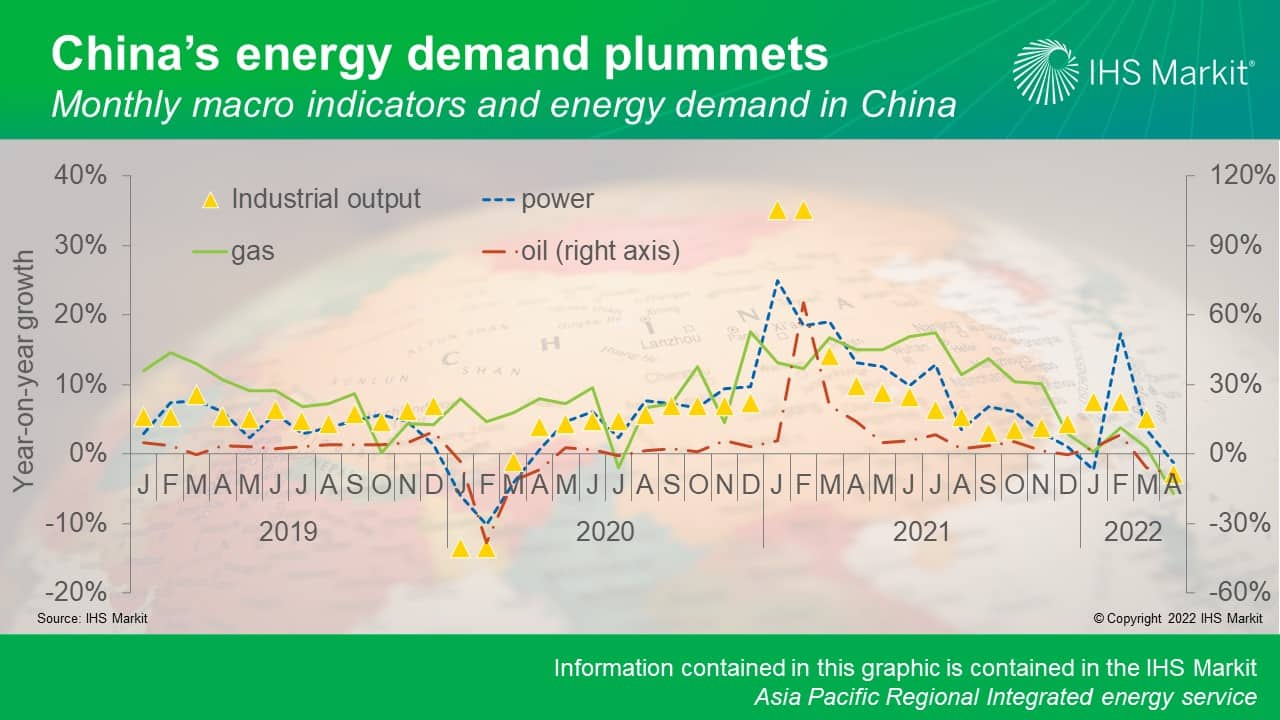

The Omicron outbreak in China since the beginning of 2022 has led to stringent restriction measures that severely disrupted economic activities and energy demand. However, our analysis of the latest data show that the scale of the demand impact did not match that of early 2020 at the onset of COVID-19. The weakness in fossil fuel demand is in contrast with the continued robust growth of renewables.

Power demand declined by 1.3% year on year (y/y) in April, bringing full-year growth in 2022 down to 4.1%, compared with 3.1% in 2020. Both the services and manufacturing sectors contributed significantly to the power demand drop in April. The industrial sector is expected to lead the rebound in the rest of 2022, but a rapid recovery in 2020-21 is unlikely to reemerge.

Coal and gas are impacted the most in power generation due to demand weakness as well as tight fuel markets while renewables continued booming. Generation from coal and gas plants declined by 11% and 29% in April, respectively. Meanwhile, wind and solar generation were up 25% and 15% respectively, with record capacity additions expected this year -- as a result of high coal and gas prices as well as strengthened climate policies.

Almost-flat demand growth is expected in the oil market in 2022. In April, China's oil demand decreased by 9.14% y/y amid weak traffic volumes and supply chain disruptions associated with movement restrictions on people and goods. We expect the oil demand to rebound slightly in May as lockdown measures are marginally eased, although downside risks remain in place with new sporadic cases being reported.

On the other hand, Chinese gas demand growth in 2022 will be much weaker than the 2020 levels. Apparent demand dropped 5.8% in April, the largest decline since May 2015. Full-year demand growth is expected to be 4.1%, just half of the December 2021 outlook. We expect high prices to curb gas demand growth rest of 2022 and in 2023.

Learn more about our Asia Pacific energy research.

Lara Dong is a senior director on the Gas, Power, and Climate Solutions team at S&P Global Commodity Insights, based in Beijing, China.

Jenny Nguyen Yang is a senior director, leads the S&P Global Commodity Insights Greater China natural gas analysis and is a member of the research and consulting team in Asia.

Fenglei Shi is an associate director for the Chinese oil market from the Oil Markets, Midstream and Downstream (OMD) Insights group at S&P Global Commodity Insights.

Posted on 1 June 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-energy-markets-during-latest-covid19-lockdown-coal.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-energy-markets-during-latest-covid19-lockdown-coal.html&text=China%e2%80%99s+energy+markets+during+latest+Covid-19+lockdown%3a+Coal+and+gas+plummeting+while+renewables+flourishing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-energy-markets-during-latest-covid19-lockdown-coal.html","enabled":true},{"name":"email","url":"?subject=China’s energy markets during latest Covid-19 lockdown: Coal and gas plummeting while renewables flourishing | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-energy-markets-during-latest-covid19-lockdown-coal.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China%e2%80%99s+energy+markets+during+latest+Covid-19+lockdown%3a+Coal+and+gas+plummeting+while+renewables+flourishing+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-energy-markets-during-latest-covid19-lockdown-coal.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}