Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 14, 2023

China’s LNG imports surged early summer 2023 under the impact of extreme weather and declining spot price

According to S&P Global Commodity Insights ship tracking data, in June 2023, China imported 6.3 MMt of LNG, up 8% month over month, 32% year over year and approaching the record for June in 2021. Imports into the southern coast of Guangdong, Guangxi and Hainan were particularly strong at 34% growth month over month and 54% year over year, reaching a new record of 2.64 MMt. LNG imports in July went on to break the monthly record, marking the first time in 2023 when monthly imports exceeded the highs set in 2021.

In addition to declining spot prices and rising term contracted volumes, extreme weather conditions in southern China also contributed to the surging imports. In late May 2023, a strong heat wave in southern China drove up power demand and power peak at the time that the drought in Yunnan curbed hydropower exports to Guangdong, calling for local gas-fired power to ramp up to fill in the gap. Consequently, spot purchases were procured for restocking purposes, with cargoes arriving in June and July. In addition, the planned maintenance at offshore gas fields in the South China Sea in June also required LNG imports to make up the loss of upstream production.

China's demand for gas and LNG is expected to grow in 2023 but still under significant pressure from several factors. The weakness in the domestic real estate market and the exports demand from the international market will constrain economic rebound. The current policy prioritizes economic growth stability and energy supply security with coal and renewable being prioritized. Continued growth in domestic production and ramped-up delivery from Russian pipeline imports will limit the growth of LNG imports.

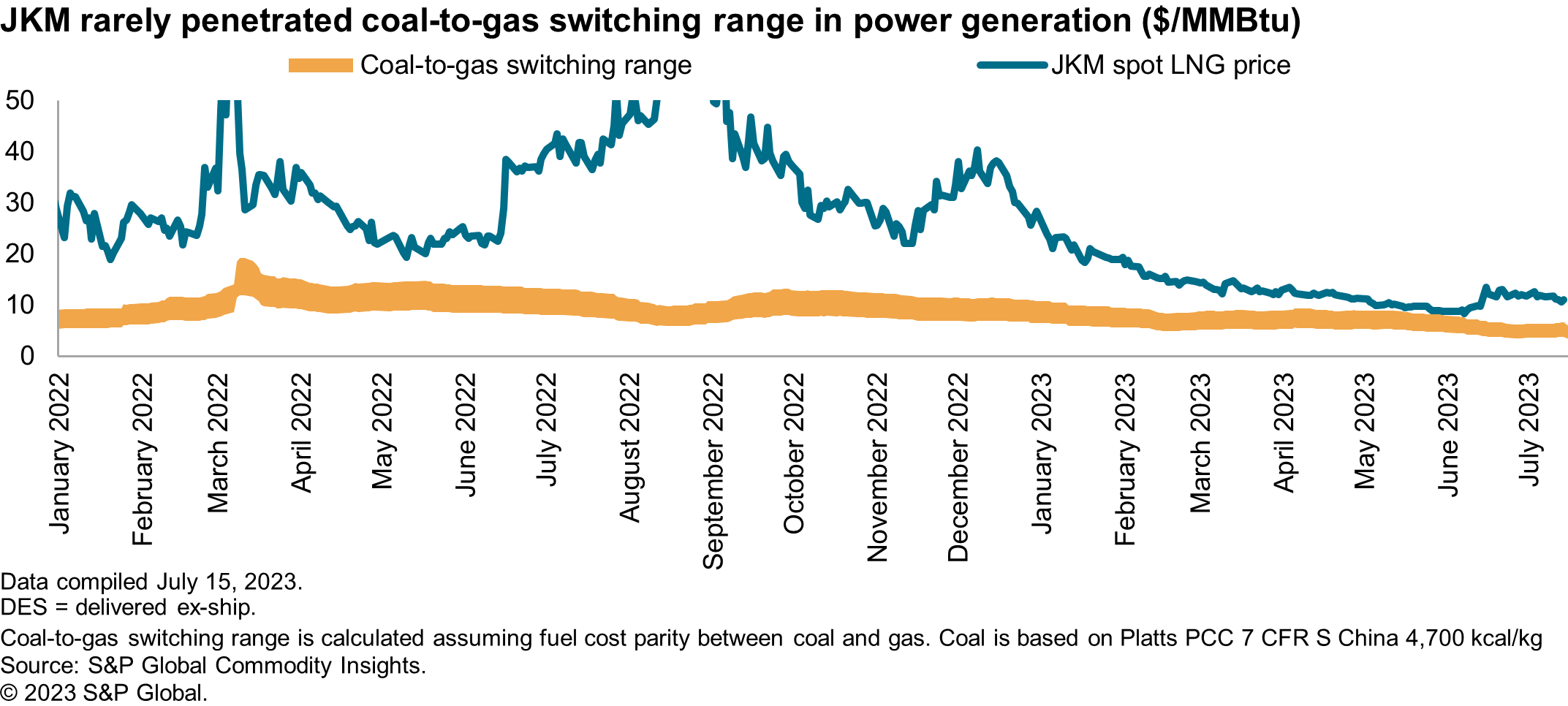

Furthermore, spot LNG lacks cost competitiveness against alternative energy supply sources in downstream market. Taking power generation as an example, current fuel cost differential still favors coal over spot LNG on the short run marginal cost basis. In southern China, the spot LNG price has moved further away from the switching range since mid-June. Outside of Guangdong, the coal-to-gas switching point in power generation could be significantly lower. Negative spark spread in the Guangdong spot power market also implies that the current power balance does not require spot LNG-based generation to be called on to fill the power supply gap. In comparison, spot coal power has an average dark spread of positive 0.09 yuan/kWh in June in Guangdong. Better profitability of coal units than gas has left gas only to serve as the last peaker option.

On the other hand, China's spot purchase decisions depend not only on price but also the domestic energy market balance. With the NOCs being the dominant players, China is more of a cost-conscious market rather than a price-sensitive one. NOCs can purchase some spot cargoes even at high prices to maintain a certain level of supply security, given their ability to absorb expensive costs into their portfolios. Most non-NOCs will need to consider spot price levels, downstream demand, other supply options (mostly from the NOCs) and the relationship with the NOCs when making procurement decisions. Only when their own gas balance is in shortage, they will come to the spot market with firm procurement demand. Some companies are opportunistic players looking for arbitrage windows between the international and domestic markets, but their appetite to take a position is relatively limited.

This report is part of our research series, "Natural gas in Asia Pacific: Balancing supply security and energy transition."

Learn more about our Asia-Pacific energy research.

Xiao Lu is a director covering Greater China's gas and LNG markets.

Posted 14 August 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-lng-imports-surged-early-summer-2023-under-the-impact.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-lng-imports-surged-early-summer-2023-under-the-impact.html&text=China%e2%80%99s+LNG+imports+surged+early+summer+2023+under+the+impact+of+extreme+weather+and+declining+spot+price+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-lng-imports-surged-early-summer-2023-under-the-impact.html","enabled":true},{"name":"email","url":"?subject=China’s LNG imports surged early summer 2023 under the impact of extreme weather and declining spot price | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-lng-imports-surged-early-summer-2023-under-the-impact.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China%e2%80%99s+LNG+imports+surged+early+summer+2023+under+the+impact+of+extreme+weather+and+declining+spot+price+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-lng-imports-surged-early-summer-2023-under-the-impact.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}