Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 25, 2023

Could Niamou-1 help replace Congo’s maturing reserves?

The deepwater Niamou-1 well, in the Marine XX block offshore Congo, expected to be drilled before the end of the year will target approximately 1,400 million barrels (MMbbls) of oil or more than 2.7 trillion cubic feet (Tcf) of gas recoverable resources. The well's main two risks are reservoir quality and fluid type, but if successful, could assist in stabilizing Congo's declining production.

The likely development plan for the field would involve a floating production, storage and offloading (FPSO) vessel with offshore loading onto shuttle tankers to export the crude oil to market.

In July 2022, Petronas farmed-in to the block, bringing with them a wealth of data from its recent deepwater wells offshore Gabon. This knowledge can improve the chances of success of the Niamou-1 exploration well.

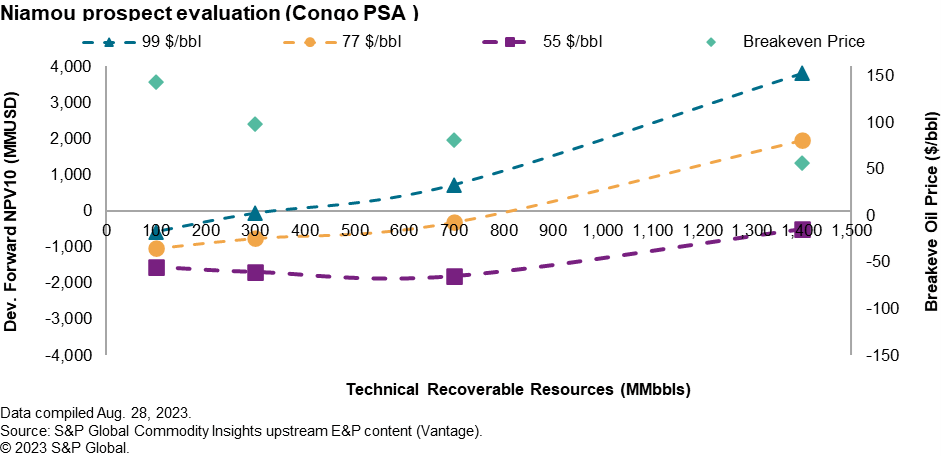

Analysis of the modelled prospect, results in a minimum economic field size (MEFS) of around 800 MMbbls recoverable at a Brent oil price scenario of $77/bbl, while a discovery of 1,400 MMbbls is expected to have an NPV of around USD 2 billion. Above the MEFS, the prospect has an internal rate of return (IRR) of around 15% and a relatively high government take of around 80% which is well over the Africa average of approximately 60%. The MEFS is higher than what is generally seen in Africa and is due to a combination of high costs and fiscal terms. The development will require a large number of deepwater wells due to the water depth and reservoir quality which result in high capital costs. The fiscal terms of Congo do not favour the contractor with a high government take and a low cost recovery cap.

The Congo Production Sharing Agreement (PSA) based on the Hydrocarbon Code of 2016 terms include royalty, cost recovery, profit share and Corporate Income Tax (CIT). The royalty is 15% for oil developments and 5% for gas. The cost recovery is capped at 50% and the profit share is a cumulative production-based sliding scale. A 33% CIT rate is applied to the contractor's share. Congo generally has a petroleum-based economy, and the government heavily depends on the revenue from the petroleum sector.

Should the Niamou-1 exploration well be successful, it would add significantly to the oil production of the country and assist in maintaining the plateau or even increase production for a number of years. The commerciality of the project is challenging and requires several factors coming together to justify developing the prospect, including the magnitude of the recoverable resources, fluid type and reservoir quality. Given the experience of the partners involved in the drilling campaign, the Niamou-1 well is poised to be given the best possible chance of achieving all these necessary factors.

***

Want to access more upstream content? Visit S&P EDIN & Vantage.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcould-niamou1-help-replace-congos-maturing-reserves.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcould-niamou1-help-replace-congos-maturing-reserves.html&text=Could+Niamou-1+help+replace+Congo%e2%80%99s+maturing+reserves%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcould-niamou1-help-replace-congos-maturing-reserves.html","enabled":true},{"name":"email","url":"?subject=Could Niamou-1 help replace Congo’s maturing reserves? | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcould-niamou1-help-replace-congos-maturing-reserves.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Could+Niamou-1+help+replace+Congo%e2%80%99s+maturing+reserves%3f+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcould-niamou1-help-replace-congos-maturing-reserves.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}