Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 05, 2021

Are we entering a decade of offshore decommissioning?

IHS Markit forecasts global offshore decommissioning spending to reach almost USD100 billion for the 2021-30 period, up by over 200% compared to the previous ten-year period.

As multiple oil and gas fields are approaching end of production, and the global economy is pushing toward a low carbon economy and energy transition, a horde of oil and gas platforms and associated infrastructure are going to be obsolete and left without purpose during the next decade.

The United Nations Convention on the Law of the Sea (UNCLOS) obliges member countries to remove any abandoned or disused installations or structure to ensure safety of navigation, considering any generally accepted international standard of the IMO and with due regard to fishing and protection of marine environment (Articles 60(3) and 80).

The North Sea countries have committed itself to the responsible removal and recycling of platforms that are not in use through the Oslo-Paris Convention for the Protection of the Marine Environment of the North-East Atlantic (OSPAR).

Government and offshore regulators across the world are greatly

aware of the forthcoming oil and gas field abandonment and are

enhancing their scrutiny and enforcement to make sure the industry

does not leave the clean-up bill for the taxpayers.

According to IHS Markit's proprietary database Petrodata™ FieldsBase, nearly 2,800 fixed platforms and 160 floating platforms could be decommissioned during the 2021-30 period. That represents 33% of fixed platforms and 43% of floating platforms currently in operation. Additionally, more than 18,500 wellheads, 2,850 subsea trees, and 83,000 km offshore pipelines and umbilicals currently in operation are subject to decommissioning during the same period.

This is a daunting task for the oil and gas industry. A task that

will require strong collaboration with both the service industry

and regulators to make it as safe and cost effective as possible.

Oil and gas operators are better served in the long run to start

decommissioning as early as possible rather than delaying as long

as possible, because the task ahead is formidable and will require

cost-effective solutions and innovation to succeed.

The service industry needs sustained activity and incentives to keep developing new technology and expand its experience to keep pushing down the costs on decommissioning.

Technology development, improving project execution, and creating innovative commercial models are all contributing to push down costs within decommissioning activities. Challenging resources and regions with stricter regulations are also driving the needs for technology-enabled cost reduction, as seen in the decommissioning of Gulf of Mexico (GOM) deepwater assets.

Most new decommissioning technologies and highest cost-saving potential are within plug and abandonment (P&A) of wells, which represent about 50% of total offshore decommissioning spending. But innovation and strong capabilities in other areas including offshore heavy lift, subsea removal, and cutting and dismantling are also vital to achieve further cost-savings, not to mention a competent and qualified workforce.

Other notable findings in the report

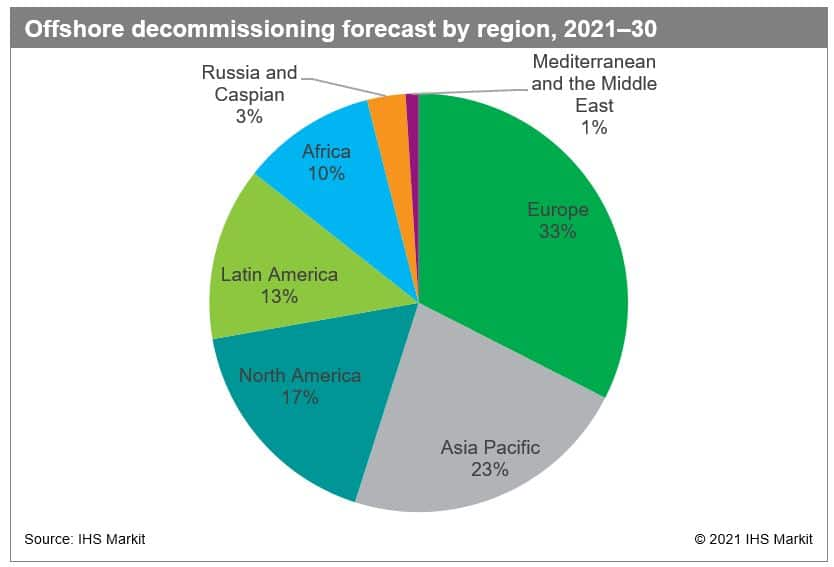

Europe is the largest market with 33% of spending, followed by Asia

Pacific and North America with 23% and 17% respectively.

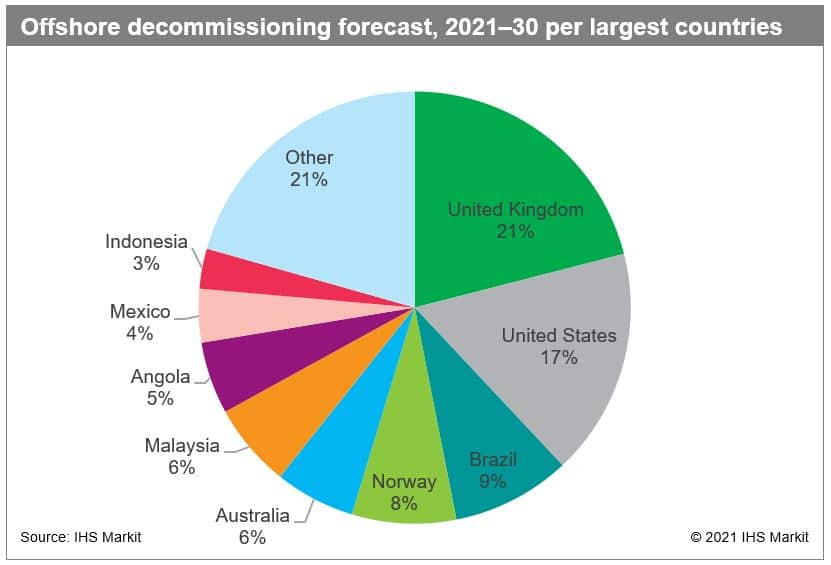

United Kingdom is expected to be the largest decommissioning

spender, followed by USA, Brazil, Norway, Australia.

The 13 largest operators represent 51% of expected global

decommissioning spending.

Decommissioning costs is more expensive in deepwater and harsh

environments.

Decommissioning spending is sensitive for lower oil prices. A

USD45/bbl scenario will have a significant, negative effect on the

economic production period for multiple fields in the tail-end

production phase.

Watch a reply of our recent

offshore decommissioning webinar and listen to our expert Erik

Simonsen discussing factors affecting future demand trends

globally, regionally, and in key markets. For more information

about our Offshore Decommissioning service please contact james.blanchard@ihsmarkit.com.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdecade-of-offshore-decommissioning.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdecade-of-offshore-decommissioning.html&text=Are+we+entering+a+decade+of+offshore+decommissioning%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdecade-of-offshore-decommissioning.html","enabled":true},{"name":"email","url":"?subject=Are we entering a decade of offshore decommissioning? | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdecade-of-offshore-decommissioning.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Are+we+entering+a+decade+of+offshore+decommissioning%3f+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdecade-of-offshore-decommissioning.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}