Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 03, 2022

Decarbonizing electric power: Key challenges and opportunities after the 2021 global energy crunch and COP26 climate negotiations

The year 2021 saw much of the world undergo an energy supply crunch, with disruptions and record-high prices. It also saw difficulties—and some breakthroughs—in setting the agenda to combat climate change during the 26th United Nations Climate Change Conference of the Parties (COP26) in Glasgow. For the global power sector, affordability, reliability, and sustainability have rarely simultaneously caught global attention as they have this past year.

Looking forward, these multiple requisites placed on the electric power sector while it tries to decarbonize represent both an enormous challenge and an immense opportunity for market participants: 55% of the world's current generation fleet runs on fossil fuels, many clean technology solutions like battery storage and offshore wind are still maturing, the remit of electricity is broadening into areas such as vehicle transport and hydrogen production, and by 2050 the world's overall need for power could be 2-2.5 times higher than today.

Should the power sector indeed lead a full-fledged global energy transition effort, then, according to one of the IHS Markit deep decarbonization scenarios, over 2021-50 the world may need to add about 28,000 GW of clean generation capacity, or 5.5 times more per year than was added annually over the past 10 years. This represents a total future investment of approximately $30-40 trillion.

IHS Markit recently published a report entitled "Decarbonizing electric power: Key challenges amid a global energy crunch and climate negotiations" that discusses four fundamental topics related to power sector decarbonization:

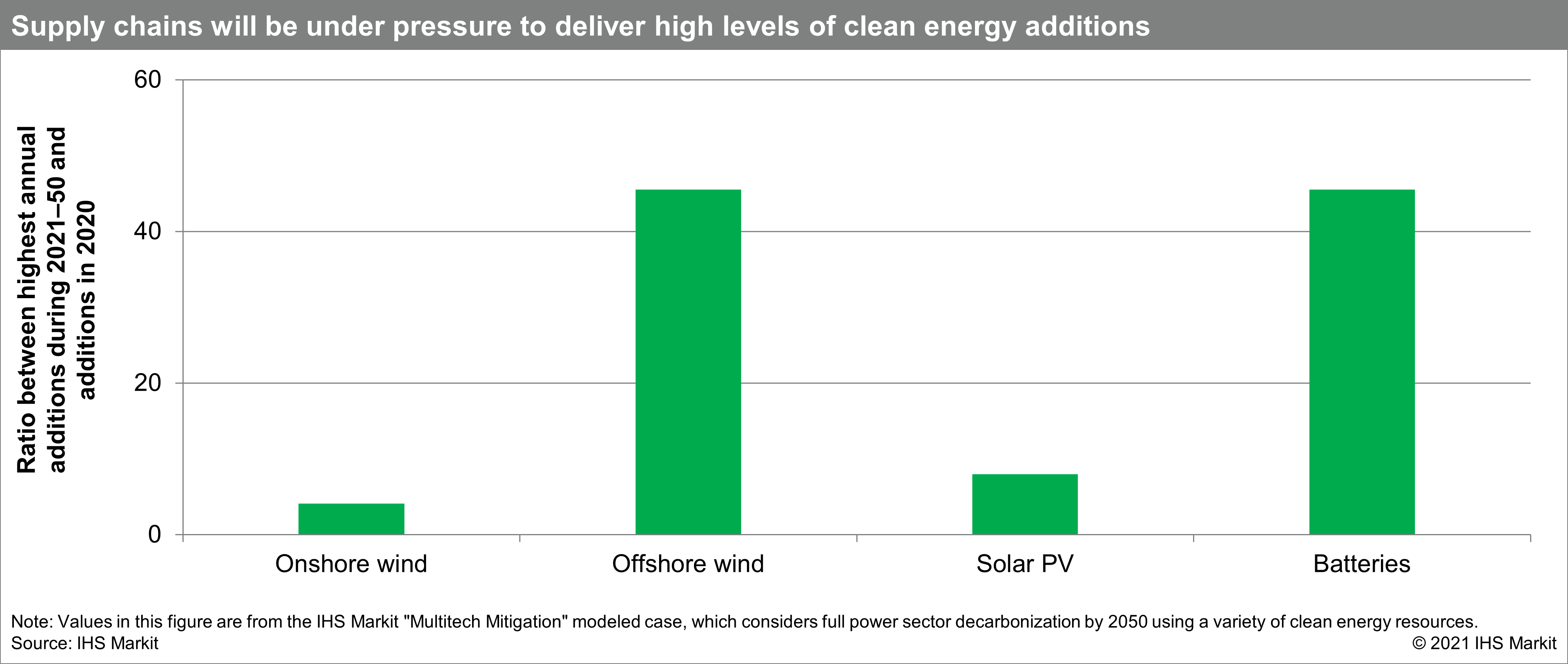

1) Building resilient supply chains for clean energy. Under a full decarbonization scenario, the diverse supply chains for solar, wind, and battery technologies may need to increase 4- to 45-fold relative to today (see Figure 1). This increase is complicated by mineral scarcity, shortages in processing and workforce capacity, and regional bottlenecks, among other matters. As clean energy expands, however, there could be more technology hubs in more markets around the world, helping minimize bottlenecks and boost resilience. Incentivizing demand for clean technologies can create market certainty and drive capital-intensive investments in the supply chain. For example, the European Commission has committed to building 60 GW of offshore wind capacity by 2030 and 300 GW by 2050. Also, recycling in equipment manufacturing can relieve stresses on the mining and processing of raw material. For example, in the United States, several states either implemented or are considering incentives or mandates to promote the sustainable management of materials.

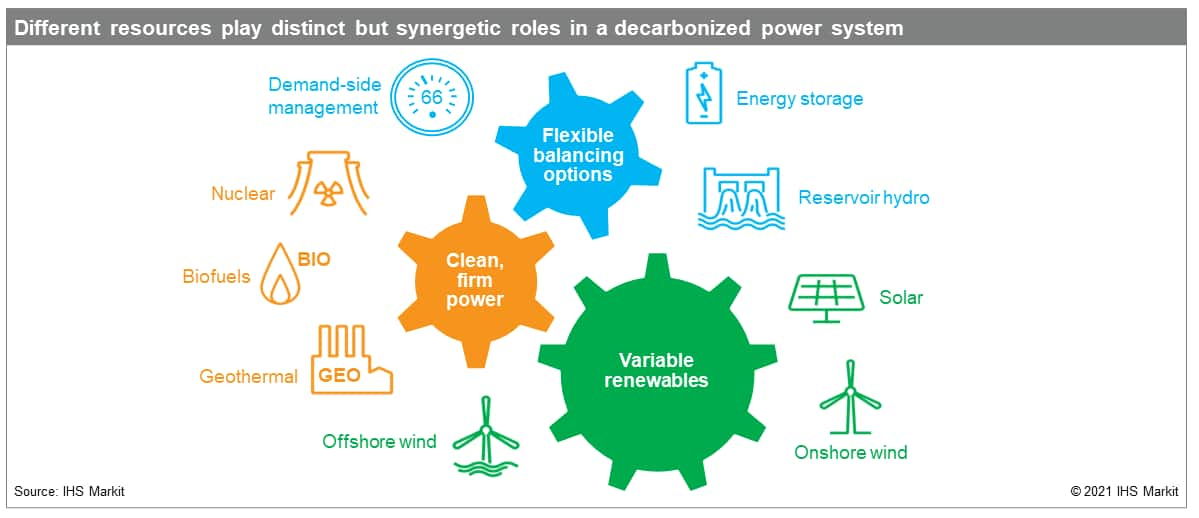

2) Ensuring power supply reliability. Because wind and solar resources are intermittent, high penetration rates for these technologies test the reliability of decarbonized power systems, especially as climate change brings on more extreme weather. Reliability planning is becoming more complex. More investment is needed to make clean reliable technologies low cost, and, until they are, there are benefits to keeping online the dependable low-emitting facilities that exist today. For example, in Japan, new draft energy policy aims to maintain nuclear at 20 to 22% of the generation mix to 2030. Renumeration schemes can evolve to reward carbon-free firm and flexible resources through a variety of different means, including greater locational and temporal price granularity, scarcity pricing mechanisms that accurately reflect system conditions, and the remuneration of ancillary services, demand response, and energy storage (see Figure 2). For instance, India is implementing an ancillary services market and allowing energy storage solutions to participate.

3) Expanding and upgrading transmission and distribution networks. Power networks are poorly adapted to variable and distributed renewables: grids in many countries are old, they were designed for large dispatchable generators, new lines often take years to build, and revenue structures are often dissociated from upcoming needs. For this to change, planning policies that build networks concertedly with renewables can substantially reduce the cost of decarbonization. For example, Australia is developing areas called Renewable Energy Zones, with states backing the infrastructure development. Revenue schemes can evolve to address emerging system balancing needs. In China, for instance, tariff reforms are starting to shed light into the often opaque cost structure of the grid companies. Lastly, digitalized grids can better capitalize on the operating characteristics of renewables and distributed energy, including the proximity of distributed generation to demand centers or the ability of renewables to nearly immediately ramp down their output.

4) Harmonizing the renewables industry's relationship with land and the community. Renewables are typically diffuse, so exploiting them on a massive scale will create land use competition with other economic, community and environmental interests. The competition can also engender greenhouse gas emissions from land use changes. Establishing solutions will require multi-level governance that considers the local specificities of land management and community participation. In Chile, for example, communities in energy-dense localities pay lower energy tariffs and gain other social benefits. Meanwhile, India is planning hybrid wind-solar parks in barren, waste, or deserted areas. Policies can target locations where renewables maximize carbon displacement. Also, technologies that increase power production per unit of land, that relocate generation to sea, or that co-locate multiple economic activities can increase resource access. Some population-dense geographies like South Korea and Indonesia are already considering floating PV a third tier along with rooftop and ground-mount installations.

While the electric power sector faces significant challenges ahead for deep decarbonization, the process of overcoming them will also lead to business opportunities for companies along the value chain. Many solutions can emerge from policies that drive companies to develop clean energy projects, in turn increasing equipment manufacturing capacity, decreasing supply chain costs, and accelerating technology improvements, all of which facilitate implementing yet more policies that favor renewables. Together, the governments and companies that promote these types of solutions can create a "virtuous cycle of clean energy development."

***

To read the full report, Decarbonizing electric power: Key challenges and opportunities after the 2021 global energy crunch and COP26 climate negotiations, sign up for complimentary access to the Climate and Sustainability Hub.

Etienne Gabel is a senior director at IHS Markit with the Latin America gas, power, and renewables team who specializes in the analysis of regulatory and market developments in the natural gas and power sectors.

Xizhou Zhou is a vice president in the Climate & Sustainability Group at IHS Markit and leads the company's power and renewables practice globally. He has expertise in power and renewable market fundamentals analysis and forecasting, power market design and policy analysis, renewable energy business models, and company strategies, among other areas.

Posted 3 January 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdecarbonizing-electric-power-key-challenges-and-opportunities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdecarbonizing-electric-power-key-challenges-and-opportunities.html&text=Decarbonizing+electric+power%3a++Key+challenges+and+opportunities+after+the+2021+global+energy+crunch+and+COP26+climate+negotiations+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdecarbonizing-electric-power-key-challenges-and-opportunities.html","enabled":true},{"name":"email","url":"?subject=Decarbonizing electric power: Key challenges and opportunities after the 2021 global energy crunch and COP26 climate negotiations | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdecarbonizing-electric-power-key-challenges-and-opportunities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Decarbonizing+electric+power%3a++Key+challenges+and+opportunities+after+the+2021+global+energy+crunch+and+COP26+climate+negotiations+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdecarbonizing-electric-power-key-challenges-and-opportunities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}