Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 04, 2022

Putting a price on the unknown: determining fair valuation in oil and gas exploration

Authors:

James Veron, Executive Director, Business Strategy, S&P Global Commodity Insights

Ian Longley, Director, GIS-pax

The value of an oil and gas asset goes beyond the volume of hydrocarbons in place. Fair valuation incorporates volumes, risk and the value of mapped and future exploration potential in any particular area. In today's market, determining the fair valuation of an asset is more important than ever. Exploration upside is often a differentiator in competitive M&A deals when the producing assets are valued by different companies using the same price decks.

The oil and gas industry is in transition. In most companies, decision makers are focused on rapidly reshaping exploration portfolios into short-cycle and low carbon intensity opportunities, typically via divestment and M&A activity.

As more-demanding shareholders insist that operators exercise fiscal discipline, companies are shifting their focus to core assets and streamlining their portfolios. Portfolio Opportunity Ranker allows you to compare apples and apples and have an entire evaluation of your exploration portfolio within a truly global context.

Predictions beyond known data points

The fair valuation of an oil and gas exploration asset quantifies its risk and future exploration potential. It is determined by calculating the risk of volume and value of all the known and unknown prospects in a certain area or within a company portfolio. This can be done at the country, basin, prospect, license, or block level.

Portfolio Opportunity Ranker incorporates the risked volumes and values for around 30,000 S&P Global Commodity Insights prospects and has a methodology to estimate the yet to be discovered prospects. It uses machine learning driven by exploration history and a measure of exploration efficiency.

Subscribers can use their own prospects, edit all key inputs and re-run calculations to make their own global ranking of opportunities.

All companies struggle with consistent risking of global opportunities, as it is always subject to the influence of local/human bias. This human trait is impossible to eliminate entirely but Portfolio Opportunity Ranker mitigates its impact by using a systematic map and data-based methodology for estimating prospect risking. This methodology incorporates the exploration history of the area together with local aspects of each prospect as detailed in the S&P Global Commodity Insights prospect database. This transparent methodology is applied to 19 stratigraphic play intervals and incorporates many spatial elements such as charge/seepage presence, seismic datasets and local trap type descriptors. It is structured so that companies can modify the base assumptions and match their in-house risking methodologies to the global evaluation.

Economic evaluations are complex at an asset-by-asset level and are controlled by the local fiscal regimes and assumptions regarding commodity prices, production profiles, OPEX, CAPEX and well costs. It is impossible to do this systematically for +/-100,000 features. Portfolio Opportunity Ranker uses a base calibration dataset to establish the volumetric cut-offs for oil fields and gas fields in polygons that have common water depth/elevation ranges, distance to infrastructure and fiscal terms. Value metrics ($/boe) for low, base and high cases for oil fields and gas fields are then stochastically applied to the post cut-off risks and volumetric estimates to calculate risked values (EMVs). When convolved with the well costs and tax factors, a stochastic assessment is made for economic volumes and values.

Standardized datasets for better results

The new Portfolio Opportunity Ranker tool from S&P Global Commodity Insights and GIS PAX provides a standardized, spatial dataset of the value, volume, risk and rank of the entire world's oil and gas prospects, making it easier and faster to calculate fair valuation.

The data product is built solely on S&P Global Commodity Insights' spatial E&P data and is delivered on a GIS database platform with software that enables subscribers to modify key exploration and commercial inputs and then recalculate the volumes and value calculations. The workflow is simple and industry standard and is not a black box.

Make better decisions with fair valuation

A robust estimation of fair valuation allows companies to deploy and use their resources wisely in areas with the most perceived value. These value predictions can be customized to include proprietary data, local knowledge, and range of risk tolerances.

Before investing in an asset or company, E&P's evaluations aim to understand the remaining exploration potential. Comparing and ranking real and predicted future prospects in any set of blocks or basins in a systematic way should quickly identify the best opportunities and provide a consistent estimate of relative value.

Before divesting assets, companies should make sure they are selling the right asset for the right price. Knowing the fair market value for every asset in their portfolio will help determine which assets have potential and are aligned with their risk tolerance. In divestitures and farm-outs, fair valuation allows companies to sell the asset for its true worth.

New from S&P Global Commodity Insights and GIS PAX: Portfolio Opportunity Ranker

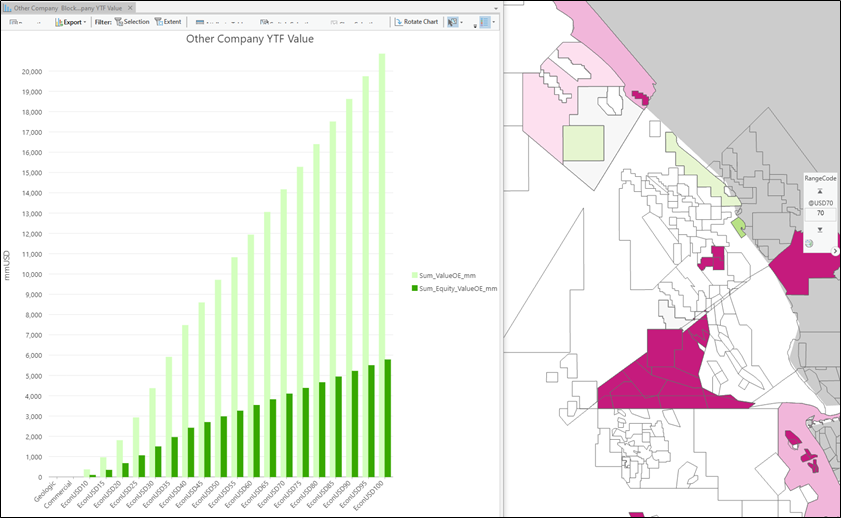

Portfolio Opportunity Ranker uses the world's best E&P data, spatial analytics and machine learning to predict and rank the remaining conventional exploration potential of the entire planet (outside of onshore North America). It risks, values and ranks 30,000 oil and gas prospects, and integrates this with an estimate of missing prospects. These estimates are commercially based and thus provide a meaningful basis on which to plan M&A acquisition and divestment decisions.

The tool is fully customizable, allowing users to incorporate their own data and local expertise. All calculations are editable and auditable.

Key features include:

● Polygons at the country, basin and block levels in a spatial

platform

● YTF volumes values and rankings of the exploration potential in

every proven charge area

● Risk, volume and value estimates of the world's known

prospects

● Spatial predictions of volumes and values for global unidentified

prospects

● Estimates of commercial yet to find volumes and values for all

proven charge areas

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdetermining-fair-valuation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdetermining-fair-valuation.html&text=Putting+a+price+on+the+unknown%3a+determining+fair+valuation+in+oil+and+gas+exploration++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdetermining-fair-valuation.html","enabled":true},{"name":"email","url":"?subject=Putting a price on the unknown: determining fair valuation in oil and gas exploration | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdetermining-fair-valuation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Putting+a+price+on+the+unknown%3a+determining+fair+valuation+in+oil+and+gas+exploration++%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdetermining-fair-valuation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}