Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 07, 2022

Building an advantaged portfolio—Ranking international basins based on profit and emissions

As the energy industry moves toward a low-carbon future, performance metrics must go beyond dollars and barrels and begin to include emissions.

More and more energy companies are beginning to show interest in incorporating emissions and emissions reduction into their overall strategy.

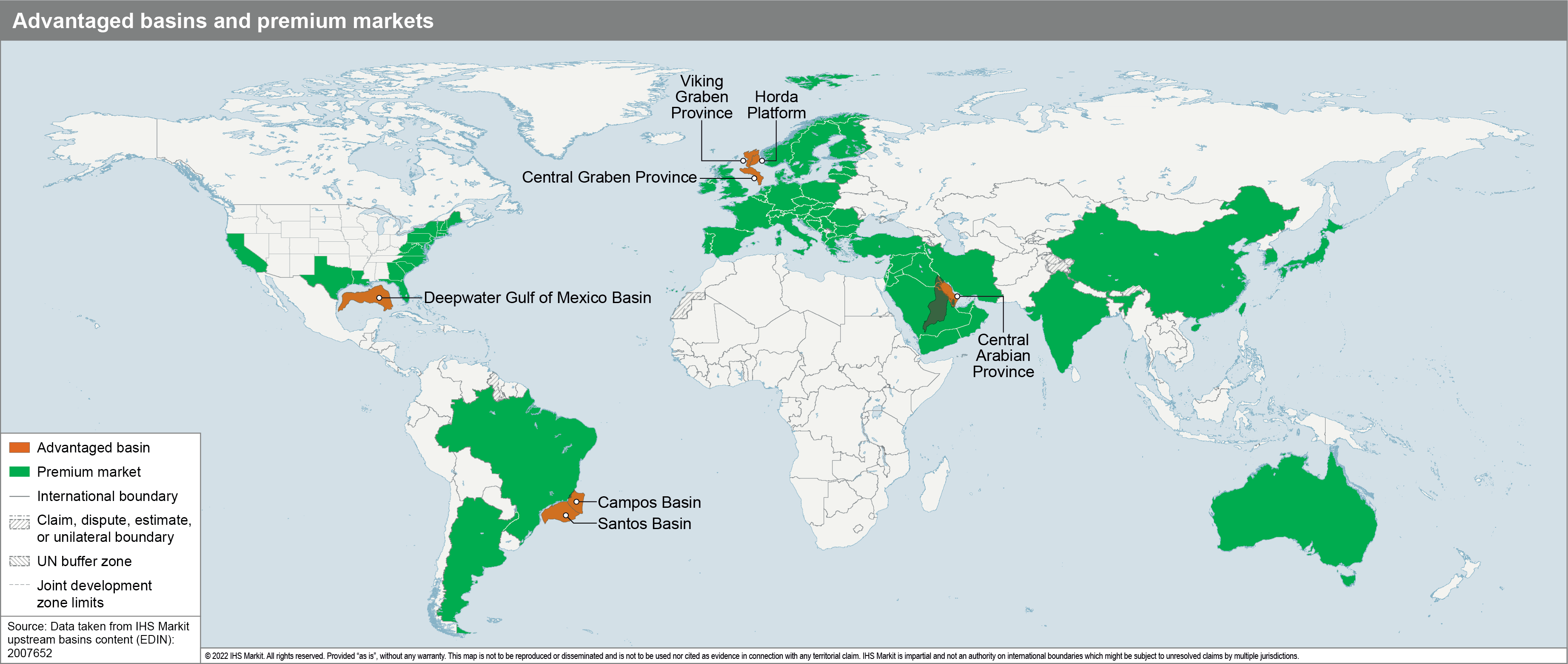

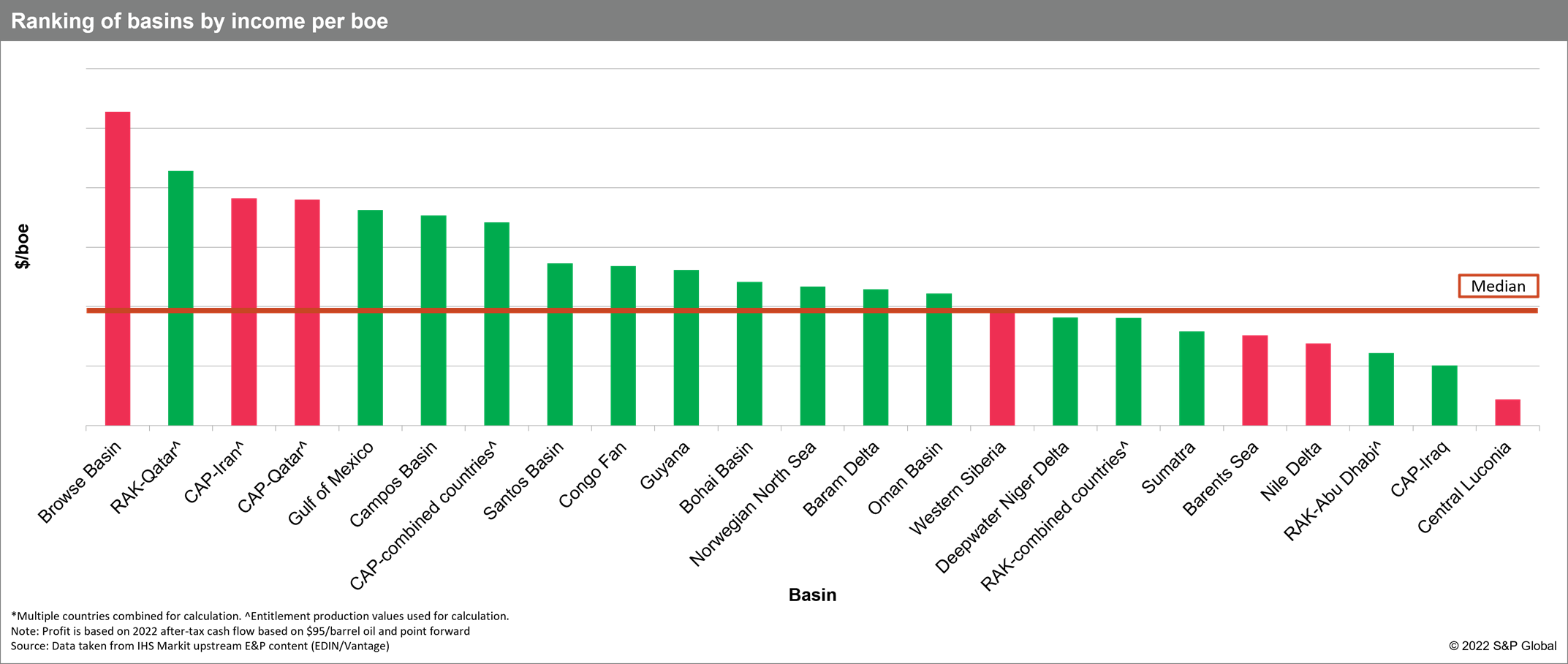

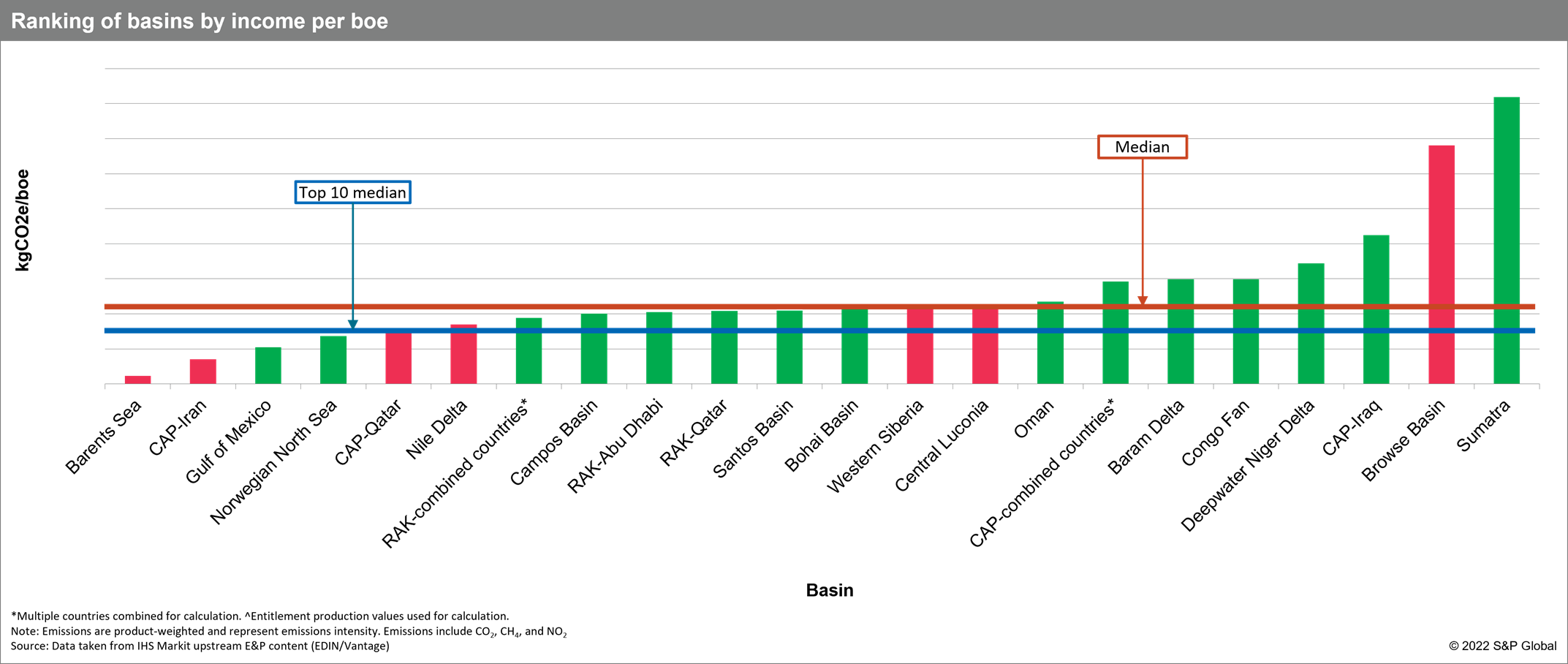

The basin of the future excels at the intersection of scale, profit, and emissions. It is critical that the products from these basins are near premium long-term markets. This study evaluates 25 global basins and examines which basins have a combination of low emissions intensity and high after-tax cash flow for every barrel of oil equivalent (boe) produced. These results demonstrate which basins are currently strong performers, and which basins might benefit from investment.

This blog is an extract from the study and the full report is available for S&P Global Commodity Insights Connect platform Commercial Plays and Basins subscribers only.

For more information regarding basin scale commercial and strategic insights, please refer to Plays and Basins

Want to learn more on this topic and access similar reports? Try free access to the Upstream Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdirector-energy-insights-product-manager.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdirector-energy-insights-product-manager.html&text=Building+an+advantaged+portfolio%e2%80%94Ranking+international+basins+based+on+profit+and+emissions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdirector-energy-insights-product-manager.html","enabled":true},{"name":"email","url":"?subject=Building an advantaged portfolio—Ranking international basins based on profit and emissions | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdirector-energy-insights-product-manager.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Building+an+advantaged+portfolio%e2%80%94Ranking+international+basins+based+on+profit+and+emissions+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdirector-energy-insights-product-manager.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}