Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 15, 2022

Frontier deepwater Andaman holds early promise – would preliminary success at Timpan light the way for a new development area in the region?

With challenges to frontier exploration in Asia Pacific, Harbour Energy's recent success in the deepwater Andaman Sea in Indonesia is welcome, positive news that may help rejuvenate interest in under-explored deepwater basins. This well is critical for Indonesia, as the government has set high domestic production targets to achieve by 2030. These targets cannot be met purely through the development of discovered undeveloped resources.

What was found by Timpan and is there further upside resource in the block?

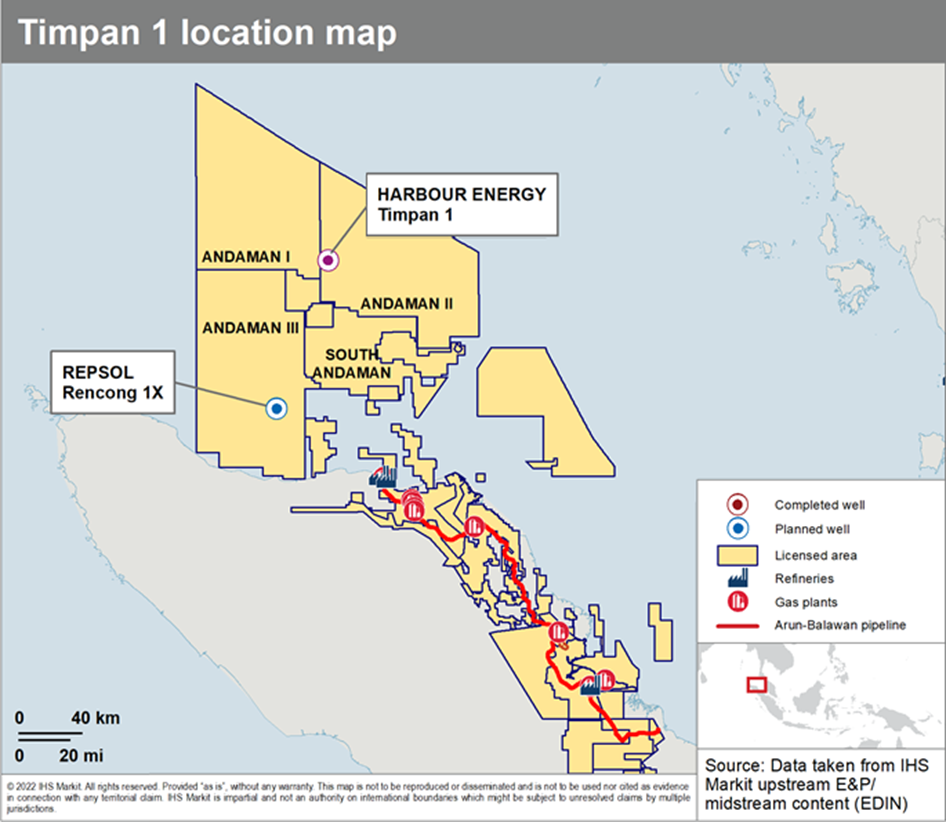

Harbour Energy drilled the Timpan 1 wildcat to a total depth of 4,212 m in the Andaman II PSC at a water depth of close to 1,300 m. It targeted Oligocene syn-rift clastics in a large 4-way dip closure, confirmed by a bright flat spot from the 3D seismic data acquired in 2019. The wildcat penetrated a ~119 m of gas column with reservoir permeability between 1-10 millidarcy (mD). The operator then conducted a series of tests including wireline logging and a drill stem test (DST) which had flow rates of 27 million cubic feet per day of gas (MMcfg/d) and 1,884 barrels per day of condensate (bc/d) (API 58 degree) through a 56/64" choke.

Frontier deepwater Andaman holds early promise - would preliminary success at Timpan light the way for a new development area in the region?

Harbour has likewise identified the Canai Timur and Canai Barat structures in the block, with similar play targets, based on pre-existing 2D seismic lines. These prospects could be future drilling targets for the company. The estimated potential gas resource in the block is more than 6 trillion cubic feet (Tcf).

What could be the development path and challenges for Timpan?

With the operator still at the early stages of evaluating the resource size for this discovery, we have conducted a quick analysis to see what development options are available. There are two main options to commercialize the gas:

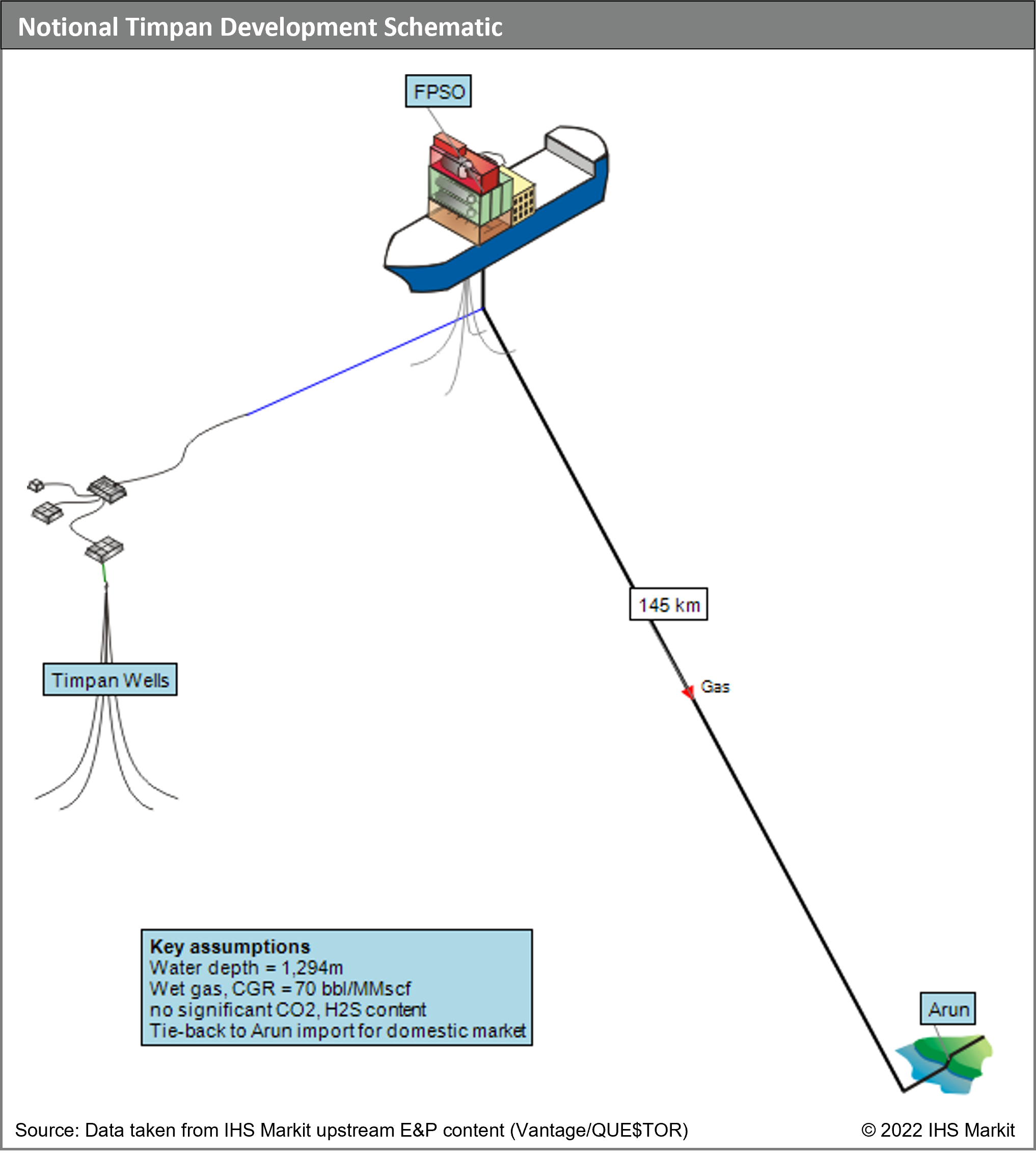

1. Domestic Market: The first would be to sell the gas into the domestic market through the existing pipeline infrastructure. For this option, the gas would be exported through the Arun-Belawan gas pipeline to Medan, with the tie-in point likely to be the Arun LNG import terminal. Should the discovery size be 1 Tcf or less, this can be easily absorbed by the domestic market demand with imported LNG being displaced. A reliable source of domestic gas could also lead to induced demand from local industries and power sector. Additionally, development of the Dumai-Sei Mangkei pipeline could allow gas to flow further and access markets in the central and southern part of Sumatra.

2. LNG Export: The second option would be to sell the gas as LNG into international markets. This would require that the Arun terminal be converted back to an LNG liquefaction plant and export terminal. Alternatively, a new LNG liquefaction plant or even FLNG could be considered.

The Indonesian government will look to prioritize the domestic market, however, should significant volumes be found both in other prospects on the block as well as in the nearby Andaman III Block which hosts the Rencong 1X high impact well, then targeting both the domestic market and LNG exports could start to look more feasible.

What would be the minimum economic field size for Timpan to be developed?

Our base assumption is for Timpan to be tied-in to existing onshore facilities and pipelines to supply the domestic market. Timpan gas could potentially displace existing LNG imports of approximately 100 MMcfg/d.

The Timpan discovery is characterized by a higher condensate to gas ratio and, according to industry sources, the gas has no significant volumes of CO2 or H2S. Our minimum economic field size (MEFS) analysis considered NPV under different gas price scenarios and reserves using a Discounted Cash Flow analysis.

At a gas price of $5/MMBTU, Timpan will only require around 580 Bcf of recoverable gas for the project to be economical.

While gas prices are negotiated bilaterally, they are still subject to regulatory approval. Beginning in 2020, the government has introduced a gas price cap of US$6 per million British thermal units (mmbtu) for selected downstream end users. This is likely to serve as a de facto price cap for upstream gas producers.

What's next in this frontier area?

Upcoming planned wells by Repsol and Mubadala in adjacent blocks would be key wells to watch. Success could speed up development in this region and could fundamentally change the gas supply outlook.

More details on the analysis made on Timpan 1 is available via IHS Markit's Upstream Intelligence and Global Gas solutions.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffrontier-deepwater-andaman-holds-early-promise.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffrontier-deepwater-andaman-holds-early-promise.html&text=Frontier+deepwater+Andaman+holds+early+promise+%e2%80%93+would+preliminary+success+at+Timpan+light+the+way+for+a+new+development+area+in+the+region%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffrontier-deepwater-andaman-holds-early-promise.html","enabled":true},{"name":"email","url":"?subject=Frontier deepwater Andaman holds early promise – would preliminary success at Timpan light the way for a new development area in the region? | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffrontier-deepwater-andaman-holds-early-promise.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Frontier+deepwater+Andaman+holds+early+promise+%e2%80%93+would+preliminary+success+at+Timpan+light+the+way+for+a+new+development+area+in+the+region%3f+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffrontier-deepwater-andaman-holds-early-promise.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}