Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 19, 2022

Global Power and Renewables Research Highlights, December 2022: Policy responses to the energy crisis, renewable growth, and decarbonization challenges in the power system

The following provides a brief overview of selected reports in the Global Power and Renewables service from November 2022. Learn more about our Global Power and Renewables Service and the reports featured in this post.

The global energy crisis sparked by the Russia-Ukraine war has cast a spotlight on the region's reliance on a single gas source. Policymakers continue to face a balancing act of securing energy supply and mitigating price volatility. Amid the complex set of near-term challenges, renewable penetration grows worldwide, and questions on maintaining grid reliability arise.

The following reports showcase government policy responses to the energy crisis, renewable growth, and the decarbonization challenges in the power system.

Government policy responses to the energy crisis

Winter has arrived in Europe, and the energy crisis has led to a return of European governmental intervention to the forefront of energy markets. Aiming to secure energy supply in the long run, Europe also strives to ensure the supply of energy for this winter and protect consumers from high prices in the short term.

According to our client webinar, European policy responses to the energy crisis, Europe's power and gas demand reduction targets and revenue caps on power conflict with each other to deliver affordable price for consumers, which led to subsidized but rising consumer energy prices. Farther out, Europe looks for a new power market design that disconnects gas and power prices, and the proposal will be made in January 2023. Such market redesign and implementation are likely to span over the next decade, according to A decade of government intervention looms over Europe's power and gas markets.

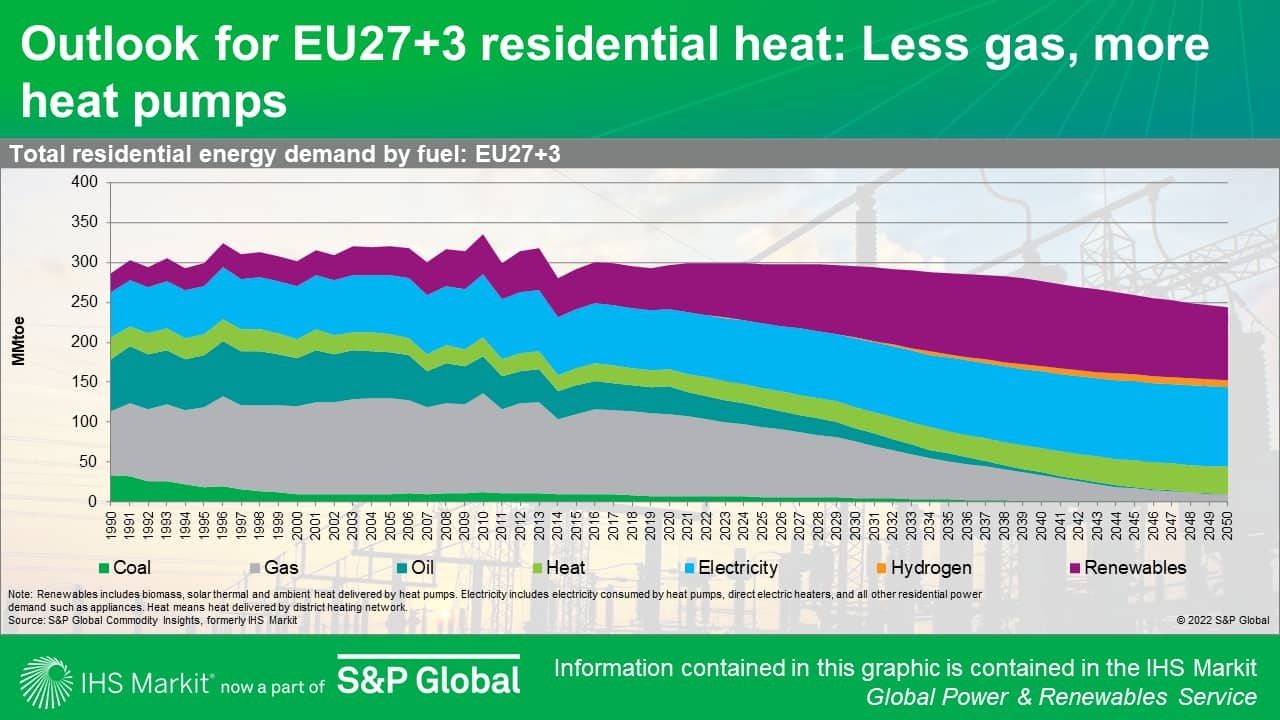

The energy crisis has given a boost to the transformation of the residential heat sector in Europe. According to Heat pumps and gas demand—How fast can Europe decarbonize its buildings heating sector?, growing policy signals and the surge in gas prices are boosting heat pump additions. With a fast transition away from natural gas and accelerated electrification, the share of natural gas in residential heat supply will fall from 40% currently to 28% in 2030 and 5% in 2050 while power demand rises in Europe. Clients can view the detailed discussion here.

Renewables continue to grow

Despite supply chain bottlenecks on module supply and raw materials as well as higher prices owing to the pandemic and policy restrictions, renewables continued to grow in many markets around the world with new technological advancements and policy incentives.

In mainland China, floating solar photovoltaic (FPV) capacity reached 1.67 GW by the end of 2021 with the strong climate ambitions of eastern provinces, where land availability challenges renewable deployment potential, according to Emerging floating solar PV in mainland China: A new effort to boost renewable growth.

In Southeast Asia, the Philippines and Vietnam are looking to grow offshore wind to meet growing power demand and transit away from fossil fuels. According to our webinar Seizing offshore wind investment potential in Southeast Asia, ambitious renewable targets in Southeast Asia signal high upside potential for offshore wind to meet the targets. While the growth potential looms, regulations and policies to facilitate offshore wind development are still lacking. Risk-mitigating instruments like export credit agency (ECA)-covered loans could facilitate access to diversify sources of capital for the proliferation of offshore wind. (The replay of this webinar is publicly available here.)

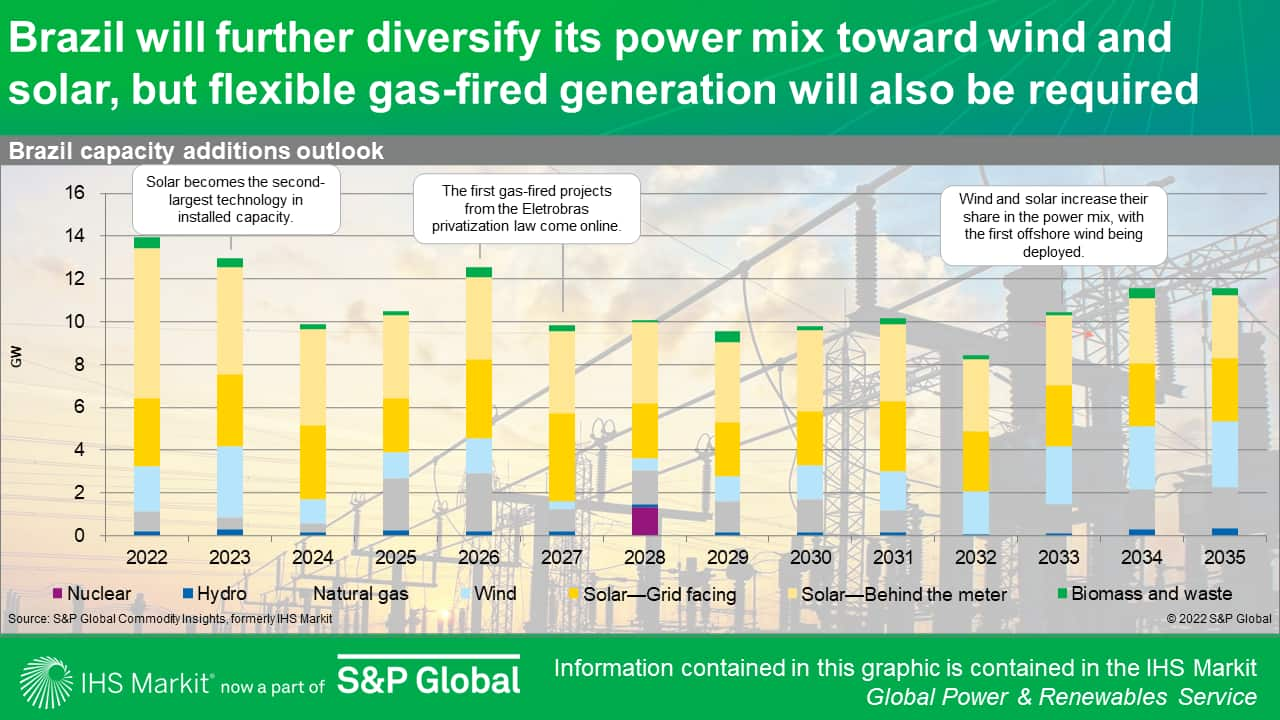

Offshore wind is also becoming a critical element to accelerate energy transition in Brazil with recent regulations approved. According toBrazil braces to deliver on high offshore wind expectations, while offshore wind will become more competitive owing to technology improvement and economies of scale, technology-targeted energy policies are needed to shed light on critical aspects of the offshore wind market. The economics of offshore wind remains challenged.

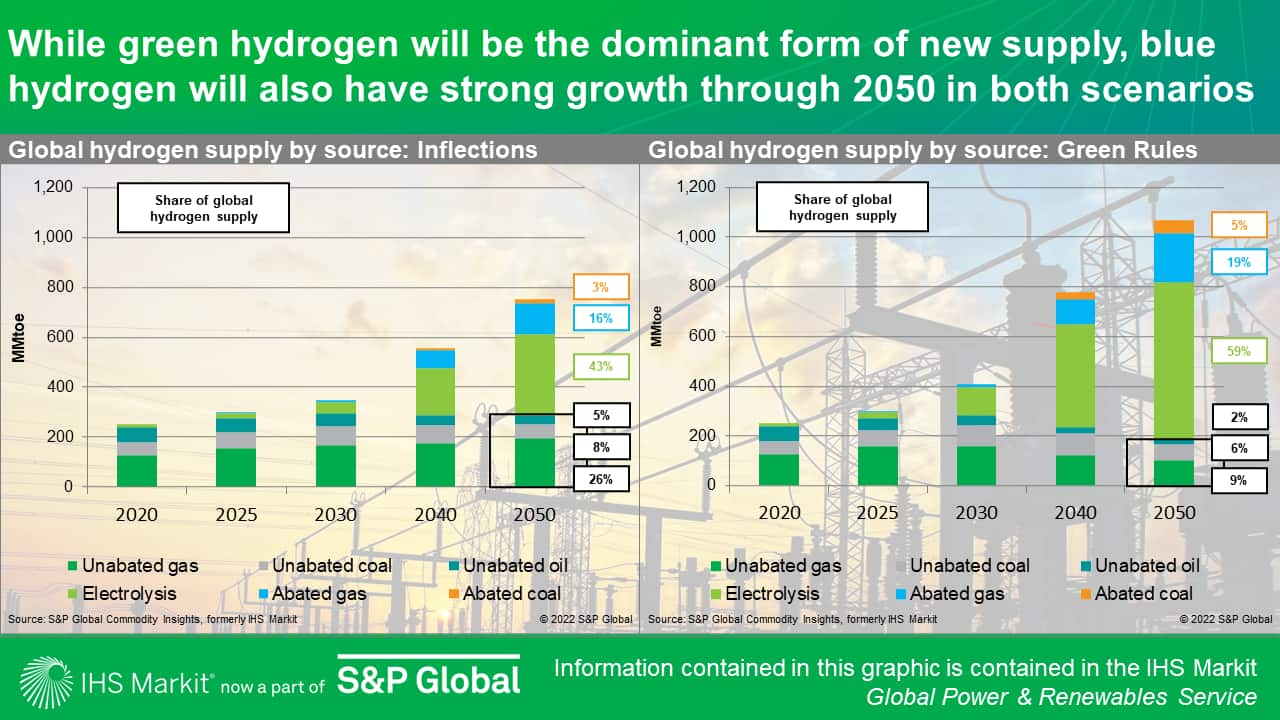

Hydrogen has grown strongly globally in the past year. According to our client webinar Global hydrogen balance—Outlook to 2050, hydrogen is expected to account for at least 5% of total final energy globally by 2050 with green hydrogen being the dominant form of supply. Notably, low-carbon hydrogen accelerated over the past year with 97 GW of new electrolysis capacity additions in the pipeline since the end of 2021. The high gas prices in many regions have also made it possible for new green hydrogen production to displace natural gas production sources. Clients can view the detailed discussion here.

In Spain, renewable deployment is projected to grow with a new 2050 carbon neutrality target. According to Spain Power, Gas, and Renewables Market Profile, Spain aims for 74% renewables in power and to phase out coal by 2030. Spain's renewable policies have promoted renewable energy in many ways, including Royal Decree-Law 6/2022 simplifying the environmental approval procedure for wind and solar projects, and the government plans to launch a tender for grid injection capacity for renewable and battery.

In New York, the 70% renewable by 2030 Renewable Energy Standard (RES) requires a rapid acceleration of renewable development. According to the client-only insight New York Renewable Energy Credit (REC) Market Outlook, November 2022, this renewable target translates into demand of 60 million Tier 1 RECs (60 TWh of supply) in addition to the baseline renewables and new supply. S&P Global Commodity Insights expects the Tier 1 REC markets to remain tight throughout the 2020s. It will be challenging for the New York State Energy Research and Development Authority (NYSERDA) to procure enough supply to keep up with rapidly increasing demand owing to permitting and transmission challenges. In order to meet annually escalating targets, long-term contracts must be followed by on-time project completion.

Decarbonization challenges in power systems

The energy transition has become imperative. During the Glasgow negotiations in 2021 and the Egypt climate summit this year, many countries across the globe put forth or updated their decarbonization targets, and many are now looking to accelerate clean energy deployments in the face of ongoing tight fuel markets and rising commodity prices, exacerbated by the Russia-Ukraine crisis.

At the same time, significant challenges to decarbonization persist. According to our Beijing Energy Briefing 2022: Are Southeast Asian power systems ready for the rise of renewables? (a blog on the same topic can be accessed here), all countries in the region will require grid enhancements to accommodate more wind and solar capacity, although Vietnam and Indonesia will face the toughest challenge to accommodate more renewables. Incremental power demand will be met partially by conventional fossil fuel generation, raising questions about the adequacy of gas-fired power generation and prospects for emerging technologies, such as battery energy storage and carbon capture and storage (CCS), according to Southeast Asia's continued reliance on fossil fuel generation: Is carbon capture the solution?. As renewables will need to meet an increasing share of load growth, concerns remain about the power system's readiness to accommodate more intermittent generation sources. Against this backdrop, governments will be faced with a balancing act between the energy transition and keeping the grid reliable.

In Southeast Asia, the impact of a shift from internal combustion engine (ICE) vehicles to electric vehicles also fueled a discussion on grid readiness. The electric vehicle revolution: The impact on power systems in Southeast Asia outlines key incentives that are needed to be in place to flatten load profile and upgrade grid infrastructure to embrace vehicle electrification in the region. (Public article available here.)

Mainland China is also facing a delicate balance between addressing the growing power demand and the decarbonization of the power system. According to insight from the client event Beijing Energy Briefing 2022: China's wholesale power price outlook, as mainland China's energy system takes on increasingly diverse generation sources, the cost of balancing services will grow fivefold. Despite short-term volatilities, with the power market liberalization, Chinese developers and power users are able to obtain lower systemwide levelized cost of electricity (LCOE) and wholesale power prices in the long run as more low-cost zero-carbon sources come online.

In Latin America, following a presidential election, Brazil will further diversify its power mix toward wind and solar in the power market reform. In the near term, Brazil will see increasing baseload thermals approved in the Eletrobras privatization, according to Brazil's Eletrobras privatization: A bumpy road ahead for capacity auctions. Despite the thermal projects in the pipeline, over the long term, renewables will occupy more than 50% of the power matrix with offshore wind becoming economically feasible in a decade, according to our client-only webinar, A new chapter in Brazil's gas and power markets. With such a fast-growing renewable penetration, flexible gas-fired generation is required in line-with renewable expansion, calling for more mechanisms incentivizing the development of intermittent thermal projects to ensure grid reliability.

Learn more about our global power and renewables research.

Qingyang Liu is a research analyst for the Global Power and Renewables team at S&P Global Commodity Insights.

Posted on 19 December 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-power-and-renewables-research-highlights-december-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-power-and-renewables-research-highlights-december-2022.html&text=Global+Power+and+Renewables+Research+Highlights%2c+December+2022%3a+Policy+responses+to+the+energy+crisis%2c+renewable+growth%2c+and+decarbonization+challenges+in+the+power+system+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-power-and-renewables-research-highlights-december-2022.html","enabled":true},{"name":"email","url":"?subject=Global Power and Renewables Research Highlights, December 2022: Policy responses to the energy crisis, renewable growth, and decarbonization challenges in the power system | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-power-and-renewables-research-highlights-december-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Power+and+Renewables+Research+Highlights%2c+December+2022%3a+Policy+responses+to+the+energy+crisis%2c+renewable+growth%2c+and+decarbonization+challenges+in+the+power+system+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-power-and-renewables-research-highlights-december-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}