Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 05, 2024

Recent Global Power and Renewables Research Highlights: COP28 targets, challenges and the performance of market reforms

This Scheduled Update provides a brief overview of selected reports in the Global Power and Renewables service. To learn more about our Global Power and Renewables Service and the reports featured in this post, click here.

In December 2023, the 28th United Nations Climate Change Conference of the Parties (COP28) was held in Dubai with a top priority of keeping the 1.5-degree C target alive. Plans and targets announced during COP28 will shape the structure of power markets across geographies going forward. Markets are looking at various technologies and frameworks to meet their decarbonization ambitions. S&P Global Commodity Insights monitors progress on existing power market policies and reforms.

COP28: Navigating diverse short- to medium-term challenges to achieve targets

COP28: An in-depth review and COP28: Leaders pledge to triple renewable generation capacity by 2030 highlight the key developments from COP28 while also pointing out areas of interest and progress monitoring indicators for COP29. COP28 introduced the Global Stocktake framework to improve climate mitigation and adaptation efforts. The document highlighted the need to shift from fossil fuels, especially in electricity generation. This was the first official COP document to acknowledge the future of all fossil fuels. It also supports zero-carbon power and energy efficiency, with a goal to triple renewable capacity and double energy efficiency by 2030. Despite disagreements on market-based mechanisms under the Paris Agreement's Article 6, initiatives were launched to enhance voluntary carbon markets and promote cleaner electricity.

Keeping in tandem with COP28 discussions, The Green Case — Energy demand outlook in a fully decarbonized Europe A review of key learning from the 2023 Green Case for energy demand elicits the building blocks for a net-zero Europe. These include minimization of final consumption demand, creation of an effective framework for low-carbon fuels and increased electrification. As per Commodity Insights forecasts, a "Green Case" wherein net-zero can be achieved by 35 countries including the EU27 plus Norway, Switzerland, the United Kingdom, the non-EU Balkans and Iceland by 2050 is subject to various conditionalities. Policies on carbon pricing, focus on energy efficiency, sector-specific mandates and consumer engagement in the form of electric vehicle (EV) and heat pump adoption, price responsive consumption, and deep refurbishment of infrastructure are medium- to long-term steps required for this.

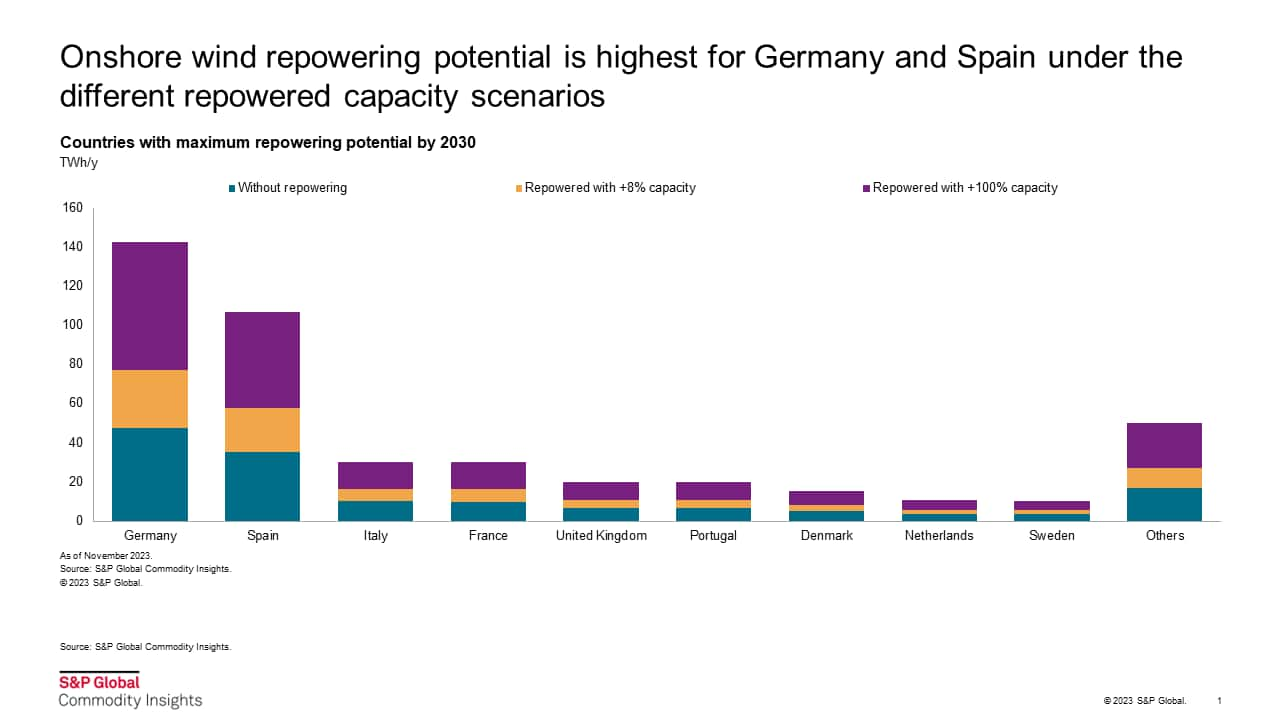

From breeze to gale: Spain kickstarts repowering of onshore wind explains how wind plant repowering can impact capacities and efficiency. Energy efficiency was also an aspect addressed by COP28. Europe's aging wind energy projects offer a chance for repowering, which can boost renewable energy production and is often more accepted than developing projects at new sites. There has so far been slow progress in this regard because of a lack of incentives, low power prices during the pandemic and high power prices in 2022. However, Spain's new legislation and financial support are making repowering more feasible. The recent auction under Spain's "Circular Repowering" program showed significant interest: 1,205 old turbines will be replaced with 167 new ones across 34 project sites, thus increasing capacity by 8% to 800 MW and doubling energy production. By 2030, a total of 83 GW of onshore wind capacity will be more than 20 years old across Europe. The success in Spain suggests that repowering could enhance capacity across Europe as shown below.

The podcast episode on Emerging battery technologies discusses the importance of energy storage technologies in light of growing demand for firm and round-the-clock non-fossil origin power. The analysts talk about the short and long term storage cost outlooks, while also discussing the challenges in adopting lithium and nonlithium storage technologies. Comprehensive explorations of these themes can be found in Li-ion supply chain volatility puts alternative technologies in focus — Scale, cost and market access will determine success and Four key trends shaping energy storage markets in Europe.

Tracking progress in regional energy market reforms

China power market design tracker: Is China on track for a national unified power market by 2030? states that China is looking to establish a national unified power market preliminarily by 2025 and at a basic level by 2030. China's power market reforms have leaped forward since late 2021 with all coal-fired power entering marketing trading, abolishment of regulated retail tariff for commercial and industrial (C&I) power users, start of pilot trading of green power contracts, and liberalization of ancillary services.

Renewable megabase development in China: 2 years after kickoff tracks progress on China's national renewable megabase initiative. Two years after China's initiative to develop 100 GW of wind and solar megabases, 65.3 GW are expected to be grid-commissioned within two years, contributing 148 TWh of zero-carbon energy from 2024 onward. Transmission capacity and land-use issues have delayed over 18 GW of projects. Despite higher capital investments, megabase wind and solar projects can deliver clean energy at lower costs compared with local renewables and operating coal, making them a viable option for China's power mix decarbonization. With experience gained from initial projects and larger gigawatt-level developments in subsequent batches, cost savings and efficiency improvements are anticipated for China's renewable megabase initiative.

Japan's Hydrogen Strategy: Strategy overview and the latest on support schemes details developments in Japan's approach to the growth of hydrogen technology. Japan's Hydrogen Strategy, published in June 2023, shifts the focus from domestic consumption to industrial strategy through exporting hydrogen-related technologies. The strategy identifies nine areas where the global market size is significant, and Japan has a technological advantage. A portion of the ¥20-trillion ($133--billion) Green Transformation bond will reward first-movers who supply hydrogen. An interim draft for the support schemes discussed in December 2023 clarified scope, eligibility, timeline and assessment criteria. The total package size was not revealed.

New England Renewable Energy Credit (REC) Market Outlook, December 2023 observes that New England's tier 1 REC spot prices are expected to stay high through the 2020s owing to a tight market where demand is roughly equal to supply. In 2029-31, the market is expected to return to a rough balance, with some individual utilities short on RECs and relying on alternative compliance payments (ACPs). Although long-term REC demand will increase significantly, supply is poised to increase even faster, putting downward pressure on spot REC prices. A host of policies that complement renewable portfolio standards (RPS) — most notably those directing procurement of offshore wind — are key drivers of the expected supply surge. However, the pace of offshore wind project completion is among the key uncertainties to this fructifying.

The recent global trends mentioned above show how rapidly the perspectives on the global power sector's future can evolve. Commodity Insights continuously updates its power demand, supply and price outlooks. In December, regional power teams updated their outlooks for several markets and metrics:

- European Power Long-Term Supply and Demand Projections — Planning Case

- European Long-Term Wholesale Power Price and Spreads Outlook — Planning case

- North American power market hourly prices outlook data tables

- North American Power Market Outlook data tables

- South Korea Electric Power Data Tables

- India Power Price Outlook, 2023-50

To learn more about our Global Power and Renewables Service and the reports featured in this post, click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-power-and-renewables-research-highlights-december-2023-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-power-and-renewables-research-highlights-december-2023-.html&text=Recent+Global+Power+and+Renewables+Research+Highlights%3a+COP28+targets%2c+challenges+and+the+performance+of+market+reforms+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-power-and-renewables-research-highlights-december-2023-.html","enabled":true},{"name":"email","url":"?subject=Recent Global Power and Renewables Research Highlights: COP28 targets, challenges and the performance of market reforms | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-power-and-renewables-research-highlights-december-2023-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Recent+Global+Power+and+Renewables+Research+Highlights%3a+COP28+targets%2c+challenges+and+the+performance+of+market+reforms+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-power-and-renewables-research-highlights-december-2023-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}