Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 21, 2022

Government funds provide tailwind to CCUS growth outlook

Carbon capture, utilization, and storage (CCUS) may prove to be a critical component of the net zero tool kit, and interest in the technology has arguably never been higher, notably among oil-producing countries and in hard-to-abate industries. Strong policy support in select localities will be a key determinant of whether the sector's growth trajectory remains slow and steady or kicks into higher gear from 2030.

Funding announcements in the past 18 months show that a handful of governments are collectively investing more than $14 billion into developing the carbon capture and utilization sector, with allocations to be doled out along varying timelines. From the private sector side, a peer group of eight large integrated oil and gas firms is allocating just under $10 billion for the 2021-2025 period for both CCUS and carbon offsets.

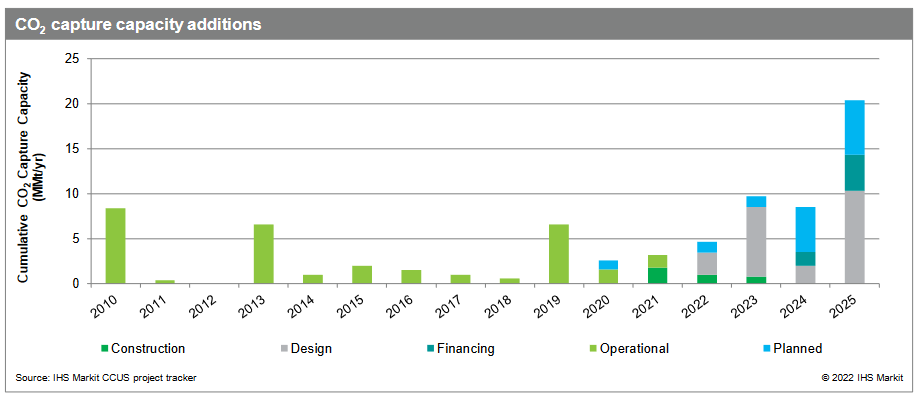

This influx of new and targeted funding has the potential to shift the sector's growth trajectory into a higher gear after two decades that have seen capacity additions largely in fits and starts. A global trend towards more ambitious climate goals is driving ongoing activity in the CCUS market. The active pipeline for large-scale CCUS projects - those at the construction, design, financing, and planned stages -increased by 26% in 2021. If projects in the pipeline are successful, capture capacity will more than double by 2026. Although enhanced oil recovery remains the primary use for captured carbon dioxide, the active project pipeline suggests that sequestration, much of that for hydrogen-related and power generation, will be the primary destination for captured CO2 by 2026.

Figure 1: CO2 capture capacity additions

The outlook for capacity growth in the sector from 2021 onward will depend in large part on policy, both to incentivize CCUS buildout and penalize unabated carbon dioxide emissions. Absent regulatory frameworks that combine incentives, penalties, and a means of enabling captured emissions to bring in substantial revenues, CCUS remains a cost driver. Even in the most promising CCUS markets, government support will be critical to move into the financing phase.

Ask Conway a question, or schedule a 1-1 meeting.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fgovernment-funds-provide-tailwind-to-ccus-growth-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fgovernment-funds-provide-tailwind-to-ccus-growth-outlook.html&text=Government+funds+provide+tailwind+to+CCUS+growth+outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fgovernment-funds-provide-tailwind-to-ccus-growth-outlook.html","enabled":true},{"name":"email","url":"?subject=Government funds provide tailwind to CCUS growth outlook | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fgovernment-funds-provide-tailwind-to-ccus-growth-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Government+funds+provide+tailwind+to+CCUS+growth+outlook+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fgovernment-funds-provide-tailwind-to-ccus-growth-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}