Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 01, 2020

Government Response to E&P Industry Headwinds

The outbreak of the coronavirus 2019 (COVID-19) pandemic and the subsequent major decline in oil prices has wreaked havoc on exploration and production (E&P) investment, with multi-jurisdiction International Oil Companies providing guidance that capital spending will be reduced by around 30% in 2020 and is expected to stay at that reduced level through 2021. With many oil companies indicating longer-term plans to constrain E&P capital investment, particularly in exploration, host governments face increasing competition to attract private investment in the Upstream sector while simultaneously addressing the economic and health crises triggered by the pandemic.

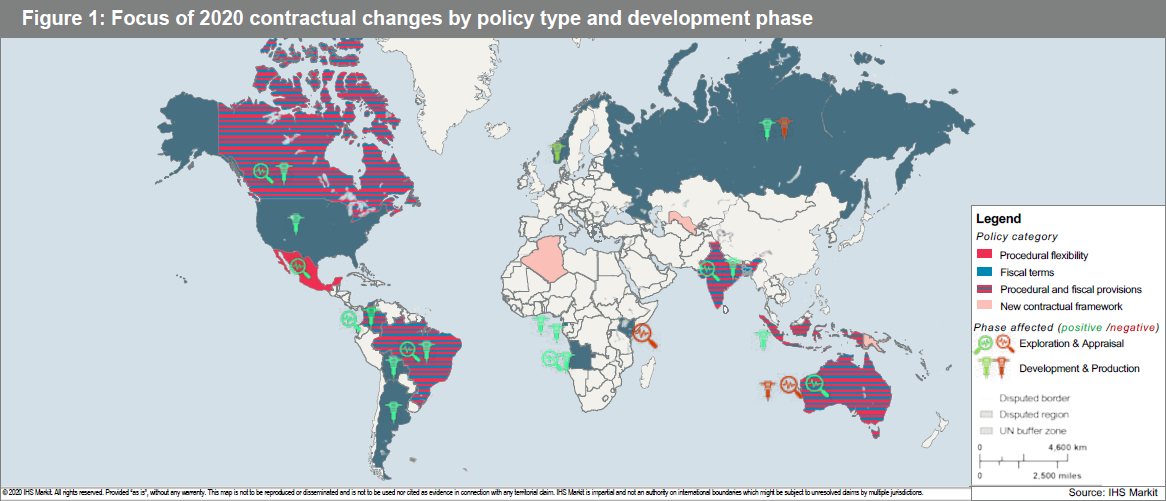

Since mid-March, many hydrocarbon-producing states have adjusted elements of their contractual terms, primarily to the benefit of E&P investors. Most of these modifications are temporary and focused on maintaining exploration engagement, preserving industry cash flow, and safeguarding production capacity. These include procedural adjustments such as flexibility on work program timing and commitments (largely focused on the exploration phase) and fiscal changes that defer or limit payments to the state (primarily affecting the development and production phases).

In general, the adjustments have been measures that are relatively easy to approve, were made by industry regulators, and did not require the drafting and passing of new industry legislation. Several countries with independent regulatory agencies and/or state level regulators have made multiple modifications to alleviate the operational and fiscal burdens on E&P investors (e.g., Australia, Brazil, Canada, Colombia, Indonesia and the United States).

Our expectation is that reduced hydrocarbon demand growth and constrained spending will drive some countries to make further, more structural shifts to E&P policy. However, host governments vary in their desire to make adjustments, perceptions of the need for doing so, and ability to execute changes. Government motivation to modify E&P investment terms incorporates IHS Markit assessments of:

- The country's reliance and support for foreign and private investment in the E&P sector. This depends on the country's openness to foreign and private investment, the share of the oil & gas held by a domestic national oil company (NOC), as well as the NOC's operational capability to exploit the country's different resource types.

- The country's economic reliance on the hydrocarbon industry and overall health of the E&P industry. This includes factors such as recent E&P drilling rates and production history, the five-year outlook for national production growth, the reliance on project final investment decisions for production, and oil & gas exports as a share of total exports combined with the size of the current account balance relative to GDP.

- The government's climate ambitions. These were characterized by the country's unconditional and conditional nationally-determine commitments to reduce greenhouse gas emissions under the 2015 Paris Agreement. The rationale for utilizing this metric is that significant GHG reduction plans will tend to impinge on support for the domestic E&P industry.

Even where there are strong economic and resources pressures to significantly change E&P policy, governments vary in their administrative capacity to effectively respond and in their political legitimacy, critical for following through on measures that may arouse opposition. In general, wealthy petrostates, with effective bureaucracies, limited civil society opposition, and relatively high legitimacy, are best placed to implement new policies. Producing states with diversified economies (e.g., United States, Norway, Brazil, Colombia) tend to have strong institutions and political legitimacy, but face resistance from civil society (e.g., opposition to unconventional drilling). Frontier and early-stage producers also tend to score poorly on their ability to implement improved investor terms: many have limited institutional capacity and sector expertise, not least as a result of the recent nature of hydrocarbon discoveries.

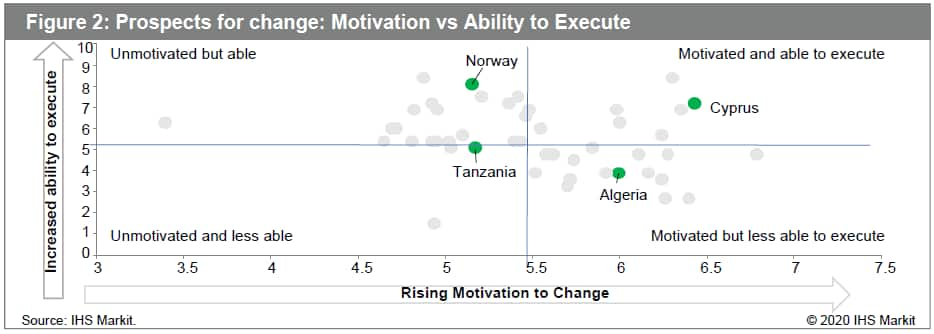

Figure 2 shows an assessment of the motivation to improve E&P terms for investors and the ability to execute the changes for 46 different countries, based on the quantitative metrics detailed above. Only 15% of the countries fall within the quadrant of motivated and able - and only half of these rate highly on both dimensions. The largest group of countries (about 35% of the 46) have sufficient economic incentive and reliance on foreign and private E&P investment to be motivated to improve investment terms, but lack the necessary institutional capacity and political legitimacy to overcome hurdles to executing structural improvements that bolster their E&P investment attractiveness.

The four highlighted countries provide a clear contrast in the likelihood of delivering structural improvements to investment terms in the next 2-3 years. Starting in the upper-right quadrant, Cyprus has had considerable success in capturing exploration investment, but its lack of an experienced domestic NOC means that the country is 100% reliant on external capital and expertise to monetize discoveries and conduct further exploration. The lack of export infrastructure and regional tensions remain a major hurdle towards monetization. Absent state involvement in building new export infrastructure, the government will have to continue to make concessions to E&P investors if it is to realize the value of modest gas discoveries. The risk of failing to capitalize on the opportunity is stark for frontiers like Cyprus, with stranded assets a very real prospect in the current environment.

Algeria is also positioned amongst producers that are strongly motivated to deliver improved terms in order to bolster faltering E&P production, which makes up 90% of exports. Although, the interim government passed significant improvements to fiscal and contractual terms at end-2019, political weakness and the country's history of resource nationalism and cumbersome regulatory processes will likely limit realized policy improvements despite the strong rationale to do so.

The monetization of Tanzania's significant deepwater gas resources has been stalled by challenging economics, and more recently by the increasingly nationalistic resource policies of President John Magufuli. Unattractive fiscal terms, combined with the government's ongoing contract reviews under 2017 laws intended to redress "unconscionable terms", have put off investors. Even if the administration surprisingly reverses policy after its recent re-election victory, marginal state capacity would hamper the country's ability to deliver improved terms.

Finally, Norway, with high state capacity and political legitimacy, could deliver improved terms. Indeed, its high level of administrative capacity has been highly evident with the implementation of short-term procedural and fiscal adjustments that will help investors in the immediate pandemic context. However, broad support for environmental priorities, a track record of fiscal stability, and a solid five-year oil production growth outlook result in limited motivation to make major structural changes.

This analysis was generated by our Petroleum Economics and Policy Solutions (PEPS) team. PEPS is a complete and integrated package of information and tools that enable in-depth understanding and holistic cross-country comparison of E&P activity and results, upstream investment terms, and petroleum sector risk. Learn more about how IHS Markit can help you screen E&P prospects with speed and accuracy.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fgovernment-response-to-ep-industry-headwinds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fgovernment-response-to-ep-industry-headwinds.html&text=Government+Response+to+E%26P+Industry+Headwinds+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fgovernment-response-to-ep-industry-headwinds.html","enabled":true},{"name":"email","url":"?subject=Government Response to E&P Industry Headwinds | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fgovernment-response-to-ep-industry-headwinds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Government+Response+to+E%26P+Industry+Headwinds+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fgovernment-response-to-ep-industry-headwinds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}