Impact of plastics recycling on the future of energy transition

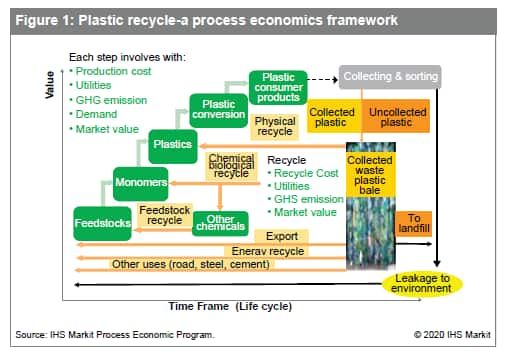

The petrochemical industry is facing mounting environmental pressure to reduce plastic waste through increased recycling. Yet plastics recycling is a complex issue that involves not just plastics producers but also brand owners, consumers, municipalities, waste management companies, and waste recyclers. Industry infrastructure, government regulations, and technology development also play important roles. To delineate the issues and to assess factors that will determine future plastics recycling rates, IHS Markit proposes a process economics framework that enables systematic and quantitative evaluation of plastics recycling (see Figure 1).

In the production of virgin plastic, feedstocks typically cost US $100 to US $500 per ton. Every conversion step requires capital investment and involves operating costs that provide maximum value at a typical consumer product value of US $2,000 per ton. Yet due to lack of effective sorting and collecting infrastructure, most post-consumer plastics end up in landfill or as environmental pollutants. These wasted post-consumer plastics have zero or negative value, which represents a tremendous loss in resource utilization. Because the most urgent issue for plastics recycling is addressing environmental pollution, plastics recycling must also be considered from the standpoint of associated resource utilization and value preservation.

The collected post-consumer plastic materials may be viewed as "the new oil" in the circular economy. There is already a market for waste plastic bales in each geographical region. As recycling activities pick up and markets expand, waste plastic bales will become an important new commodity with prices set by supply and demand. Sorting efficiency, collection costs, and quality will be reflected in the market price, similar to other commodities.

Collected waste plastics can be mechanically recycled into plastics, chemically recycled to monomers, or molecularly recycled to feedstocks. Each recycling route exerts its impact mainly on the supply and demand of virgin plastics, virgin monomers, and virgin feedstocks, respectively. All recycling routes will eventually impact the supply of incumbent feedstocks: crude oil, natural gas liquids (NGL), and even natural gas or coal.

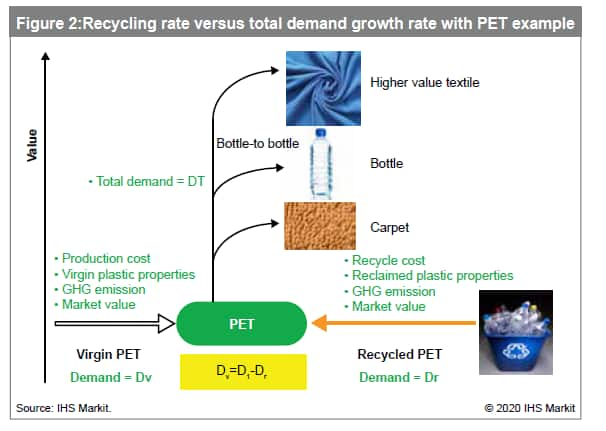

The extent to which recycled materials impact future demand for virgin plastics depends on the future recycling rate versus the total demand growth rate. Figure 2 illustrates this concept using mechanical recycling of polyethylene terephthalate (PET) as an example.

In Figure 2, the total annual demand for a plastic is Dt, which is the sum of demand for virgin plastic Dv and demand for recycled plastic Dr. Thus, Dv = Dt - Dr in any given year. The impact of plastic recycling on future demand for virgin plastic can be determined as follows:

1. Demand balance in year 0 (base year):

Dv0= Dt0- Dr0

Letting R0 =Dr0/Dt0 , where R0 is recycle ratio in year 0:

Dv0= Dt0(1-R0)

2. Demand balance in year n:

Dvn = Dtn- Drn

3. Assuming total annual demand grows at x% and

recycle rate grows at y%:

Dvn = Dt0 (1+x)n * [1-R0(1+y)n ]

The future growth rate of virgin resin thus depends on three factors: the growth rate of total demand (x), the current recycle ratio (R0), and the future growth rate of plastics recycling (y).

Equations (1)- (3) can be extended to any plastic and to multiple end markets, each with a different scenario of demand growth rate, current recycling rate, and future recycling growth. IHS Markit Process Economics Program created an interactive template for quantitative estimation of the impact of future recycling rate on future demand for a virgin plastic, in any region . The template also allows estimation of annual and cumulative leakage to the environment, either as landfills or pollutants. Similar analyses can be applied at monomer and feedstock levels for chemical and molecular recycling, respectively.

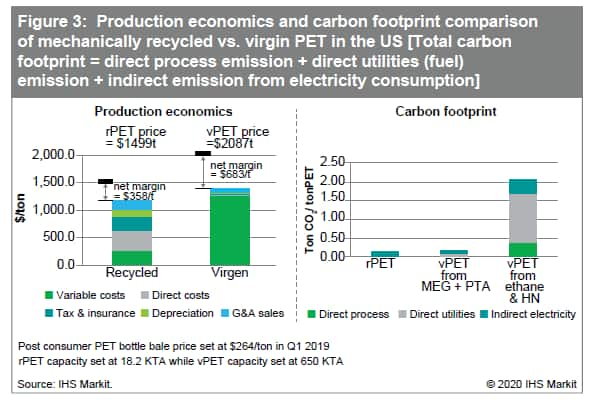

Future recycling growth rate will be determined by the relative production economics and quality of recycled versus virgin material. Figure 3 presents a comparison of production cost structure for mechanically recycled PET (rPET), at 18 KTA capacity, and virgin PET from monoethylene glycol (MEG) and purified terephthalic acid (PTA), at 650 KTA capacity. Also shown is the carbon footprint of each process, to show relative sustainability.

The current scale of mechanical recycling for PET is relatively small, which means that fixed and other costs per ton of rPET are very high compared to production of vPET. However, due to the relatively low price of feedstock (waste PET bales), the total production cost of rPET is lower than that of vPET. rPET also commands a lower price than vPET, due to its generally lower quality, resulting in lower profitability for rPET. To improve the economics and profitability of rPET, its production scale must be increased substantially and its quality must improve to command a higher market price.

From a sustainability viewpoint, rPET has a lower total carbon footprint than vPET produced directly from MEG and PTA. When tracing MEG production to ethylene by ethane steam cracking and PTA production from PX (para-xylene) and heavy naphtha (HN) in an aromatic complex, the sustainability of rPET vs. vPET is even more striking.

Future recycling operations will require multiple solutions. Chemical and feedstock recycling offer the possibility of operating at a larger scale, and they may be right for certain situations. However, these processes require energy to break down larger molecules to smaller molecules, plus additional energy to convert small molecules back to plastics by repeating the long conversion steps as used in production of virgin polymers. The net result is much higher carbon emissions for chemical and feedstock recycling than for mechanical recycling.

From the sustainability, resource utilization, and value preservation viewpoints, the industry's priorities should be mechanical recycling, chemical recycling, and feedstock recycling. Mechanical recycling has challenges that require industry innovations. Sample opportunities include: developing better tagging or tracking of materials to significantly increase sorting and collection of higher-purity post-consumer plastics; providing blend stocks to compensate for somewhat inferior properties of recycled plastics; and developing new, large-volumen markets that decrease use of recycled plastics for short life-cycle applications, such as packaging materials, with use for long life-cycle applications, such as textiles, pipes, or even housing construction materials.

With the emergence of EPR (extended producer responsibility) policy approaches, producers are at least in part operationally and financially responsible for recycling the products they produce. The new regulation is expected to build a more effective infrastructure that will lead to a larger supply of well-sorted, high-quality, post-consumer plastics - which will significantly increase the scale and further improve the economics of mechanical recycling.