Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 10, 2023

India’s Carbon Credit Trading Scheme notification reflects S&P Global Commodity Insights’ suggestions on enhancing coordination capacity

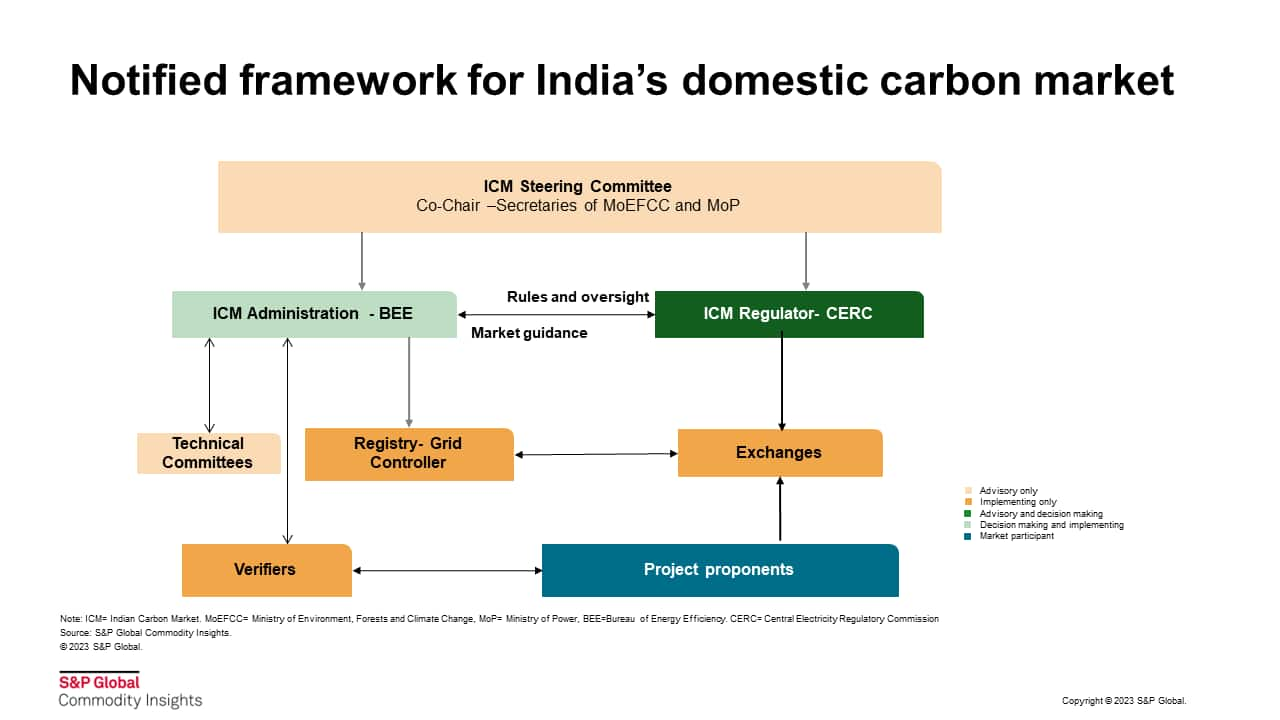

The last week of June 2023 was particularly eventful for India's carbon and environmental markets. India communicated the finalized framework for its Carbon Credit Trading Scheme (CCTS) for the Indian Carbon Market (ICM) via gazette notification on June 28, 2023[1]. The fundamental structure and framework of the ICM is carried forward from the draft stage. However, there are some significant changes compared with the draft CCTS, such as:

- Reduction of powers and enhancement of the membership of the ICM steering committee

- Increase in the powers and purview of the ICM administrator

- Detailed guidance on the compliance market development

- Relegation of the voluntary segment of the ICM to a later stage

In the comments to the draft CCTS scheme submitted to the Power Ministry, Commodity Insights suggested[2]:

- Membership of the Governing Body/ Steering Committee be expanded to include certain other ministries important for India's nationally determined contributions

- State participation in the CCTS is necessary for the success of the ICM through improved center-state coordination

- Engagement with carbon market experts and practitioners to navigate market shocks and unintended outcomes, to achieve ICM objectives

These suggestions are reflected Section 3 (3) of the final CCTS framework pertaining to the composition of the ICM Steering Committee (SC). Additional members from ministries such as agriculture and chemicals and petrochemicals, state officials, and carbon market experts have also been included.

Enhancing the SC composition will make it more inclusive, reflecting diversity of interests and opinions. This will ultimately help the SC discharge its mandates more effectively. Its eclectic constitution also helps balance the top-down changes introduced in the finalized CCTS framework. Since the central government has reserved the approval powers on several matters, the SC will play a critical role in representing the feedback from diverse stakeholders.

The CCTS notification followed the publication of draft rules for a separate Green Credit Programme (GCP) on June 26, whereby green credits could come from such activities as sustainable agriculture, forestry, waste management, building construction and water management practices. GCP projects with mitigation co-benefits can also register and trade in the ICM. Meanwhile, India retains a sizable credit supply contribution to global voluntary markets, despite the headwinds seen this year. The GCP will harness the mitigation and credit export potential of relatively untapped sectors.

S&P Global Commodity Insights expects these policy developments to steer the carbon and co-benefit markets in a positive direction:

- Prioritization of the compliance segment in the CCTS will lead to a focused and orderly market development.

- Allowing GCP projects to register in the ICM will stimulate credit supply from target sectors.

- The CCTS remains nimble to adapt to any outcomes in climate negotiations that may impact the viability of exporting the ICM's voluntary segment credits.

Customers can read the full report here or log on to our Connect platform to view our full range of offerings on India's carbon market and related topics.

Reports in this series on Indian carbon market include:

- How can India improve on its draft carbon market framework to build stakeholder confidence?

- India finalizes list of Paris Agreement Article 6.2-eligible projects, revises implementation plan for national emissions trading scheme

- India prepares national carbon market under Energy Conservation (Amendment) Act to deliver on NDC goal; future carbon price rise limited by plans to increase supply

- Impact of carbon credit export restrictions on India's global carbon trading revenues

- Webinar: Navigating the trade-offs and implementing the learnings for India's future carbon market

- In the race to global net zero, what are the lessons for India's carbon market?

For more information on this research and its related service offering, please visit the Asia Pacific Regional Integrated Service page.

Mohd. Sahil Ali is a senior sustainability analyst with the Gas, Power, and Climate Solutions group at S&P Global Commodity Insights and covers cross-cutting issues in power and energy for South Asian markets.

Posted 10 August 2023

[1] A draft CCTS outlining the governance framework and roles and responsibilities of participating entities was released in March 2023. An analysis of the same as well as our recommendations to the government are available here.

[2] Readers not subscribed to the Asia Pacific Regional Integrated Service can view the report summary here

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-carbon-credit-trading-scheme-notification-reflects-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-carbon-credit-trading-scheme-notification-reflects-.html&text=India%e2%80%99s+Carbon+Credit+Trading+Scheme+notification+reflects+S%26P+Global+Commodity+Insights%e2%80%99+suggestions+on+enhancing+coordination+capacity+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-carbon-credit-trading-scheme-notification-reflects-.html","enabled":true},{"name":"email","url":"?subject=India’s Carbon Credit Trading Scheme notification reflects S&P Global Commodity Insights’ suggestions on enhancing coordination capacity | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-carbon-credit-trading-scheme-notification-reflects-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=India%e2%80%99s+Carbon+Credit+Trading+Scheme+notification+reflects+S%26P+Global+Commodity+Insights%e2%80%99+suggestions+on+enhancing+coordination+capacity+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-carbon-credit-trading-scheme-notification-reflects-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}