Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 07, 2022

Installation rush in 2021 propels China to become the largest offshore wind market globally

The National Energy Administration (NEA) announced that China's offshore wind annual installations soared to 16.9 GW in 2021, accounting for over 80% of global total additions that year and quintupling China's domestic additions level from the previous year in 2020. Following the record-setting growth, China surpassed United Kingdom and Germany to become the largest offshore wind market globally.

Compared with the official figure of 16.9 GW, IHS Markit estimates close to 15.0 GW of grid-connected project additions in 2021. In our view, some of the projects may not have fully commissioned in 2021 despite registering as grid-connected to meet the subsidy deadline. Nonetheless, even with IHS Markit estimate, by end-2021, China still holds more offshore wind capacity than any other market in the world.

The boom in installations resulted from a rush to meet the cut-off point for subsidy at the end of 2021. Developers missing the deadline would suffer serious economic penalties—offshore wind power tariff would be halved following the subsidy removal.

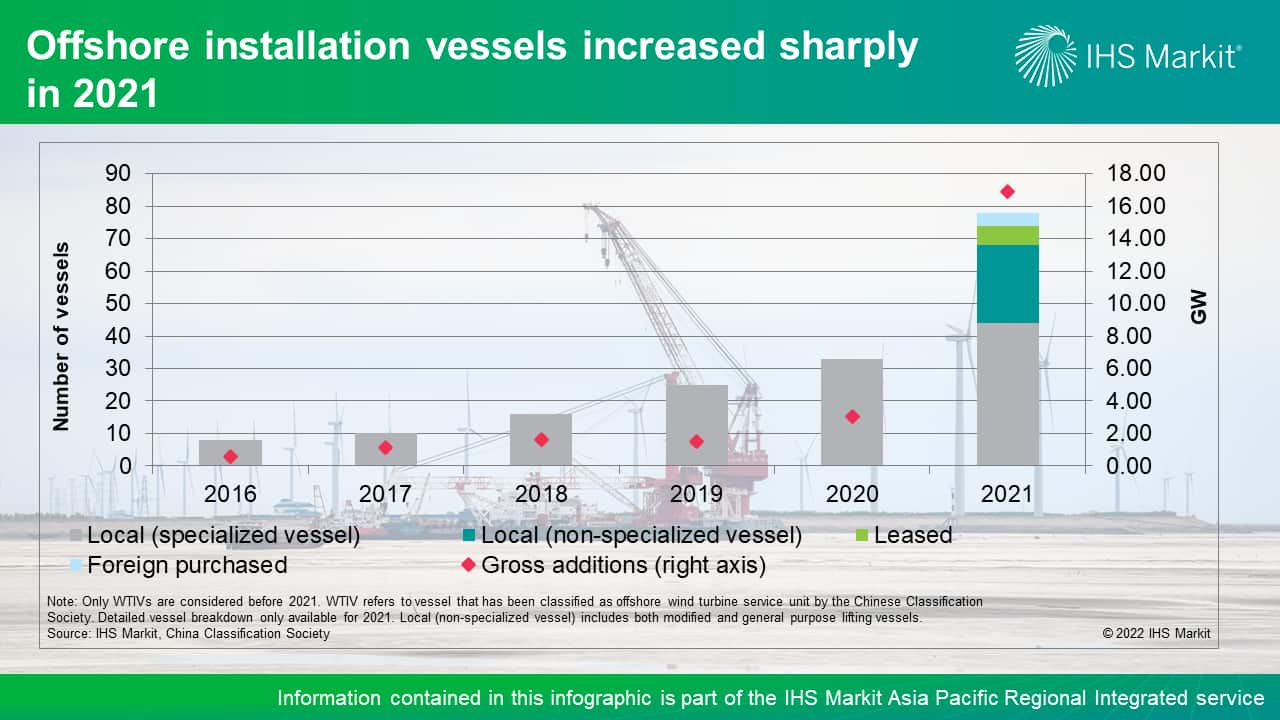

For years, the availability of construction vessel has been the key bottleneck in China's supply chain capabilities for offshore wind installation. However, the number of offshore construction vessels increased sharply in 2021, thanks to the developers' great efforts in building, purchasing, leasing, or modifying existing vessels to cope with the installation rush.

More project development experience, longer working hours, and favorable weather also contributed to the unprecedented additions in 2021. However, safety and quality risks increased resulting in an uptick in accidents, demonstrating that such all-out installation rush in 2021 is not sustainable.

Record level offshore additions will not reoccur in 2022, but the strong momentum will continue during the 14th Five-Year Planning (FYP) period. Cost reduction from declining turbine price, shared transmission lines as well as policy incentives will support the subsidy-free project pipeline. China's state-owned enterprises will continue being the main drivers for offshore wind project development, with strong support from provincial governments.

Learn more about our coverage of the Asia Pacific gas and power market through our Asia-Pacific Regional Integrated Service.

Bing Han is a Senior Research Analyst covering Greater China's power and renewable market.

Choon Kiat William Chia is a Research Analyst covering Greater China's power and renewable market.

Lara Dong is a Senior Director covering Greater China power and renewable market.

Posted on 7 April 2022.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2finstallation-rush-in-2021-propels-china-to-become-the-largest.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2finstallation-rush-in-2021-propels-china-to-become-the-largest.html&text=Installation+rush+in+2021+propels+China+to+become+the+largest+offshore+wind+market+globally+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2finstallation-rush-in-2021-propels-china-to-become-the-largest.html","enabled":true},{"name":"email","url":"?subject=Installation rush in 2021 propels China to become the largest offshore wind market globally | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2finstallation-rush-in-2021-propels-china-to-become-the-largest.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Installation+rush+in+2021+propels+China+to+become+the+largest+offshore+wind+market+globally+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2finstallation-rush-in-2021-propels-china-to-become-the-largest.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}