Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 12, 2023

Is US natural gas generation set to peak in 2023?

Current market conditions could lead to natural gas's best year on record followed by a steady decline

To date, natural gas has generated 1,311 TWh of electricity in 2023. This represents an 8% increase over the same time period in 2022. This is particularly notable when considering that 2022 holds the title for the strongest gas-fired year on record despite the fact that power demand overall in 2023 is down roughly 2%. If current trends hold true, 2023 is expected to see more gas-fired generation than any year on record.

When examining whether 2023 will be gas's peak year, it helps to contextualize the situation with a few questions.

- What has spurred natural gas's rise to becoming the US's primary generating resource?

- What about 2023 separates it from other years?

- What drives the decline from "peak gas"?

The short answer to the first question is the shift away from coal. Environmental regulations have made new natural gas construction increasingly preferrable relative to coal and at the same time, have driven the retirement of many older coal-fired assets. Additionally, lower capital costs have made gas-fired generation preferrable to other conventional power sources, including coal, nuclear and hydroelectric.

In 2008, coal accounted for 49% of all US power generation. In 2022, this figure dropped to just over 20%. While renewables have filled some of the void left behind, gas-fired generation during the same period has nearly doubled from 20% to 39% of the total resource mix. As of 2022, the coal fleet accounted for 198 GW of capacity, significantly down from its 2008 levels of 288 GW. With so much coal having exited the market, natural gas has stepped in to displace such significant generation losses.

So, what makes 2023 different from surrounding years? The key driver is the current suppressed natural gas market relative to surrounding years. 2022 was a high-price year for gas; from January 2022 to September 2022, gas prices at the Henry Hub averaged $6.65 per MMBtu. During the same period this year, Henry Hub prices are down more than 60%, averaging just under $2.50/MMBtu. In several key coal markets such as PJM and SERC, gas prices have been cheaper than delivered coal on a $ per MMBtu basis. As a result of these more favorable prices, we've seen an uptick in gas generation.

There are numerous factors that have contributed to 2023's natural gas price environment. The market has been well-supplied owing to a mild winter, export demand is down as a result of reduced LNG exports owing to an extended outage at the Freeport LNG facility in Texas, and overall robust production.

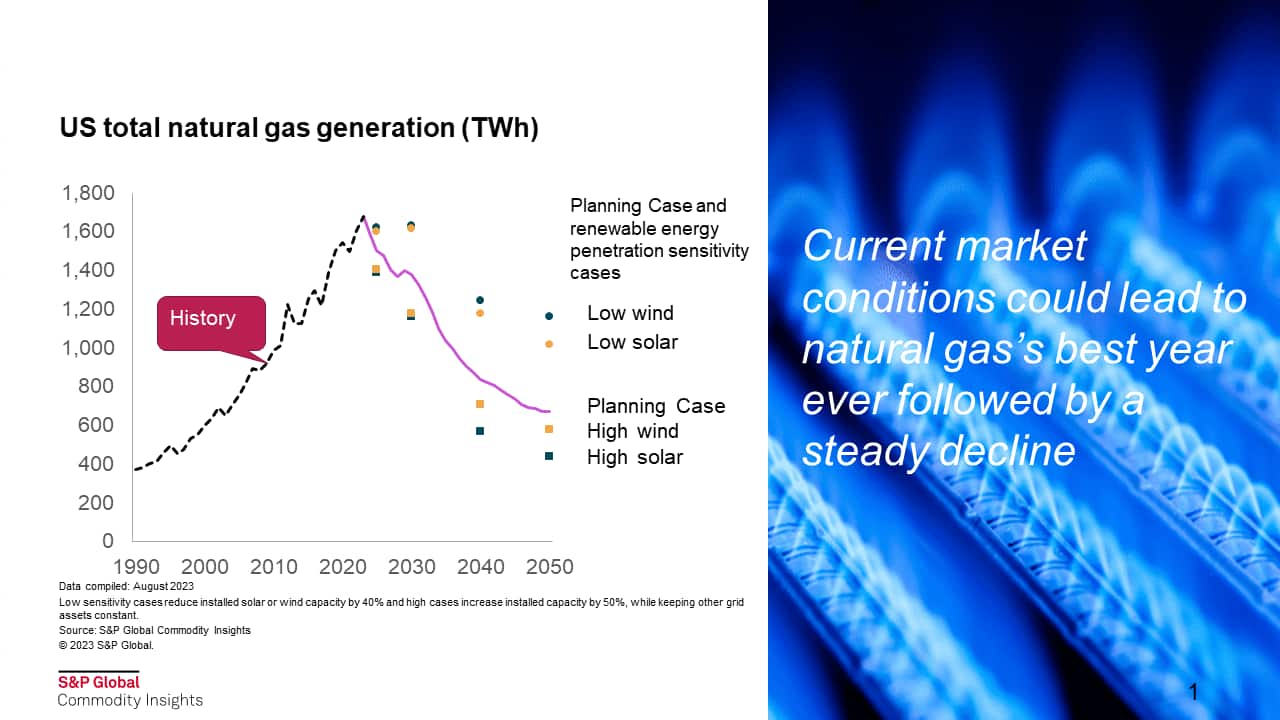

Why the decline? While we do expect gas-fired generation to remain relatively strong through 2030 as shown in the chart below, we might not get the same confluence of factors that have propped gas-fired generation up as we've seen in 2023. In the short-term, we expect gas prices to bounce back in 2024 and beyond. Natural gas prices are expected to exceed $4/MMBtu by 2025 owing to sharply growing LNG feedgas demand beginning in the third quarter of 2024. This additional demand is expected to exhaust storage surpluses and, thus, tighten the market through the end of 2025.

Beyond the short-term gas price increases, increased production from wind and solar facilities is expected to have an increasingly material role in the overall composition of the power supply mix. While total power supply demand is expected to grow in response to the electrification of transportation and other energy end uses, and coal generation will continue to decline as more coal-fired power plants retire, gains in wind and solar generation will more than offset those trends and serve to suppress the need for natural gas-fired generation. The chart below illustrates both S&P Global Commodity Insights' Planning Case outlook for US gas-fired power generation and the uncertainty around that outlook depending on the magnitude of future wind and solar development.

Overall, the larger story is not so much about 2023 itself, but rather the multiple trends driving the longer-term decline in gas-fired generation. "Peak gas" is likely to happen fairly soon, and with that the need for natural gas-fired generation declining as the energy transition ensues. Regardless of when peak gas occurs, natural gas-fired capacity will continue to be a fundamental piece of the US power system as a key source of baseload generation, firm capacity, and as a dispatchable long duration resource when renewables cannot adequately meet demand.

This content is published by the S&P Global Commodity Insights North America Regional Integrated Service team. To find out more about the gas and power coverage within this service, please click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fis-us-natural-gas-generation-set-to-peak-in-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fis-us-natural-gas-generation-set-to-peak-in-2023.html&text=Is+US+natural+gas+generation+set+to+peak+in+2023%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fis-us-natural-gas-generation-set-to-peak-in-2023.html","enabled":true},{"name":"email","url":"?subject=Is US natural gas generation set to peak in 2023? | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fis-us-natural-gas-generation-set-to-peak-in-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Is+US+natural+gas+generation+set+to+peak+in+2023%3f+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fis-us-natural-gas-generation-set-to-peak-in-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}