Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 25, 2022

Latin America: E&P to remain resilient amid global volatility

Latin American governments seek to capitalize on upstream resources

Amid persistent geopolitical and energy market volatility, the Latin America and Caribbean region stands out as a resilient upstream investment destination. The region's governments are eager to generate socioeconomic gains from their oil and gas resources by offering numerous upstream assets under competitive investment conditions.

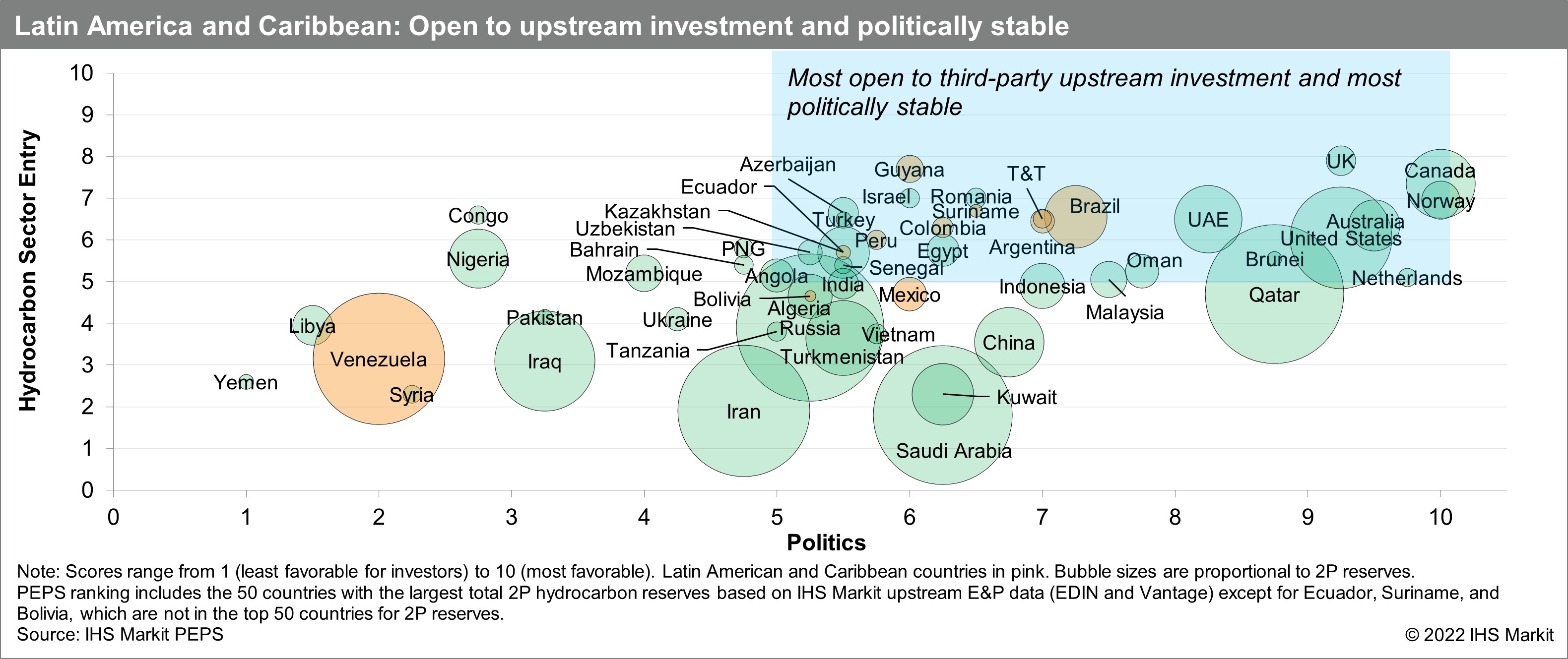

Latin America offers considerable oil and gas resource opportunities under a generally favorable above-ground environment. According to IHS Markit Petroleum Economics and Policy Solutions (PEPS) analysis of above-ground E&P investment conditions, countries in the region rank among the most competitive jurisdictions globally.

The PEPS Oil and Gas Risk Hydrocarbon Sector Entry score provides a direct assessment of how welcoming a host country is to new foreign upstream investment. The chart below plots countries on the metrics of upstream openness and political stability, the latter of which is critical in shaping the durability of investment policy.

Of the 11 countries assessed in the region, 8 place within the quadrant that encompasses the countries that are most open to third-party upstream investment and are the most politically stable (i.e., scoring above 5 on both metrics). Latin American oil-producing and gas-producing countries have enacted, are enacting, or are planning to enact, over 2021-23, a range of policies to attract investment, expedite contractual awards, and accelerate production. Actions encompass fiscal, contractual, and regulatory changes as well as the offering of investment opportunities through upstream licensing.

IOCs look to Latin America as they seek to high grade upstream portfolios

From a company perspective, the global oil and gas investment environment has become more challenging over the past decade because of multiple price collapses, shareholder pressure, and climate regulations. To tackle these challenges, companies are high grading their portfolios with respect to consideration of profits, returns, and emissions intensity. This trend has led international oil companies (IOCs) to consolidate operations around core countries and to be more selective about future exploration and development opportunities.

The Latin America and Caribbean region continues to attract a range of multi-jurisdiction companies—spanning US-based and Europe-based companies—that otherwise have different approaches to balancing their core upstream portfolio with future decarbonization efforts. The region is home to a raft of recent large-scale discoveries—featuring less carbon-intensive light and medium crude grades—that can be expected to progress to developments with low breakeven prices and will play a core role in these companies' portfolios throughout this decade.

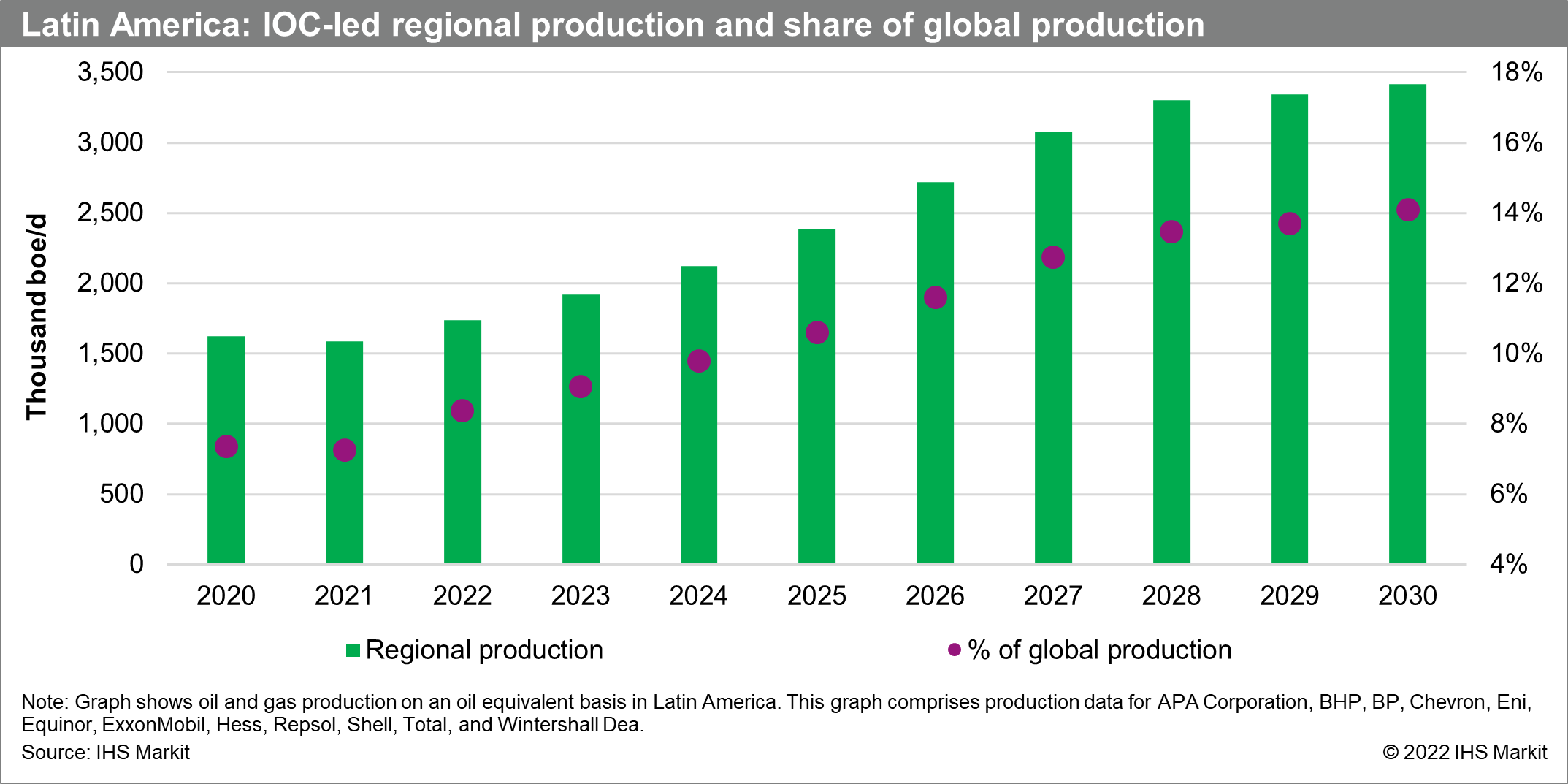

While national oil companies (NOCs) within Latin America are delivering on their mandates to develop domestic resources, IOCs are allocating more resources to the region. This is reflected by forecasts of absolute production growth and the global share of production to come from the region.

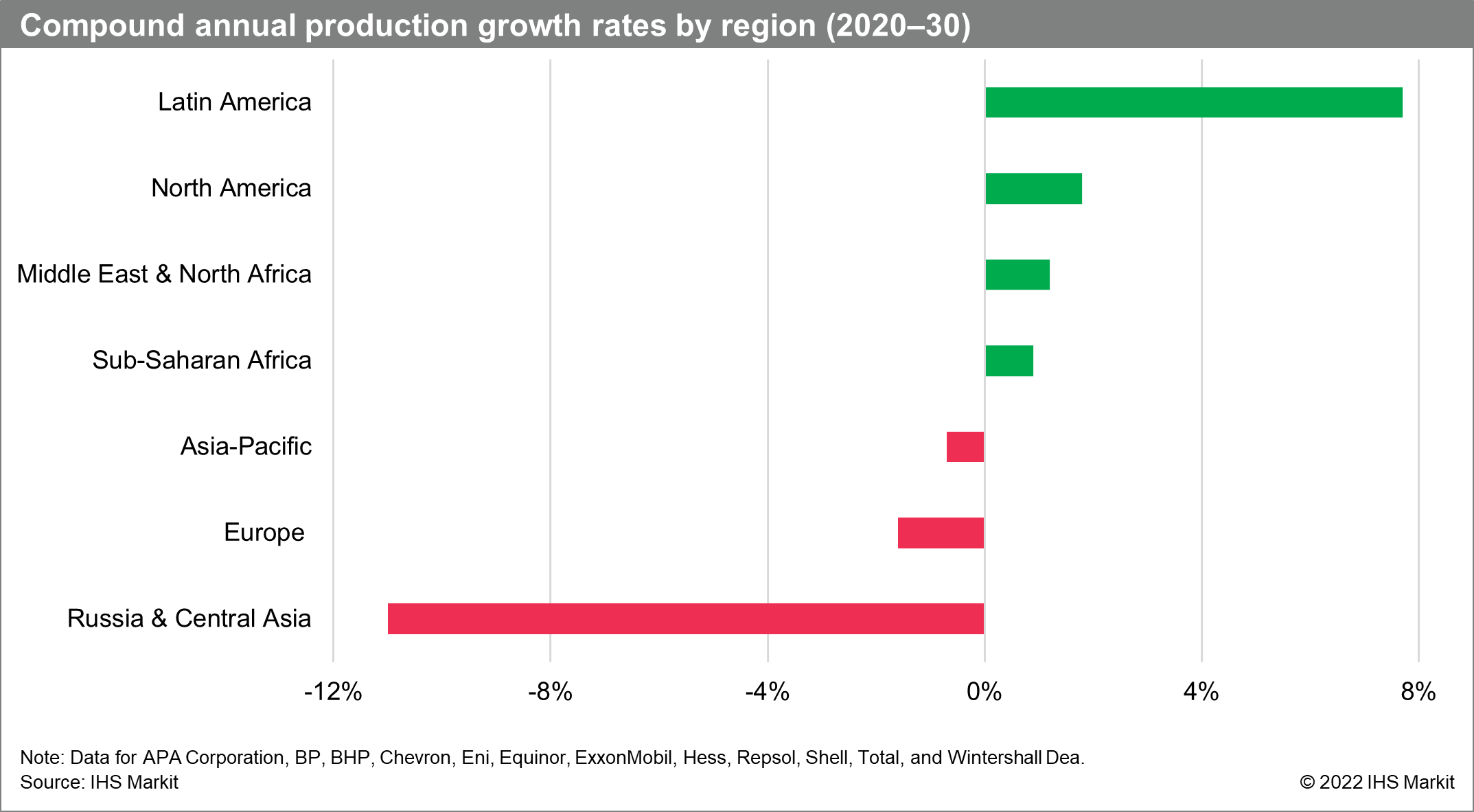

Compared with other regions, Latin America is leading in terms of production growth. For the IOCs assessed in this report, Latin American production is expected to increase at a 7.8% compound annual rate from 2020-30 compared to a median of 0.9% across all regions (after taking the effects of the Russia-Ukraine conflict into account). Based on production data for 12 IOCs covered in this report, their collective Latin American oil and gas output is forecast to surge from 1.6 MMboe/d in 2020 (7.4% of global output) to 3.4 MMboe/d in 2030 (14% of global output).

Recent M&A underlines relative attractiveness of Latin American upstream opportunities

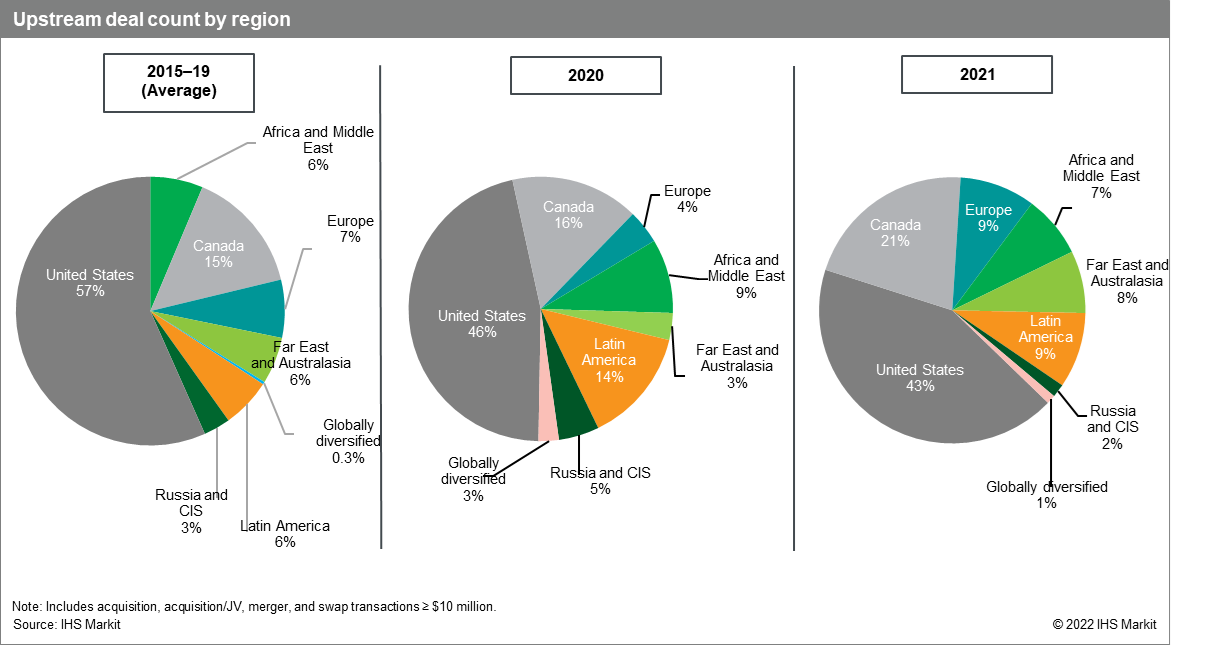

Upstream mergers and acquisitions (M&A) activity in Latin America has remained strong in recent years relative to global trends, and the region will continue to play a prominent and growing role in both organic and inorganic company strategies. The global IOCs and large international independents are—and will remain—prominent players in Latin America, especially in deepwater opportunities across Brazil, Guyana, Suriname, Colombia, and Mexico, where they can capitalize on lower-cost, high-productivity, and relatively lower carbon-emitting "advantaged barrels".

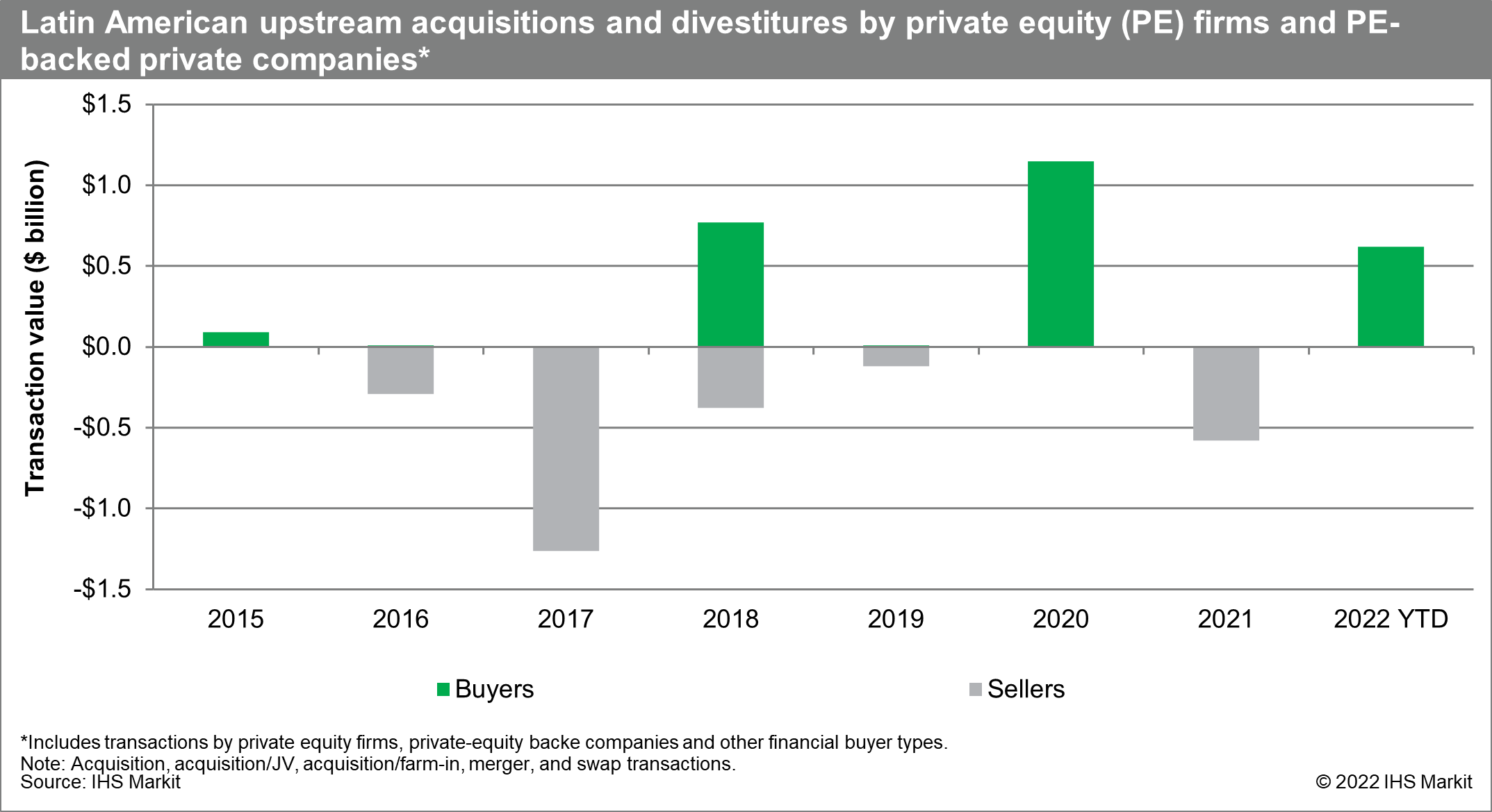

The competitive landscape in the region, however, will likely continue to broaden. Regional independents and private equity players have been gaining significant market share in Latin America in recent years, finding ample inorganic opportunities for growth and expansion. In fact, since 2020, this new class of investors has become the most active buyers of upstream assets in Latin America. Most recent buyers of assets in Latin America have been local E&P companies, many of which are backed by private equity capital, but in some cases are private equity firms themselves.

Over the past two decades, private equity capital apportioned to the upstream industry has largely been concentrated on the United States. But as this trend has reversed course somewhat since 2015, with these firms now having become net sellers of upstream assets in the United States, many of these same firms have redeployed their capital to other areas of the world, including the Latin America upstream. Indeed, upstream M&A investment on the part of private equity firms has been growing in Latin America, with this group of companies now, on average, net buyers in the region - in particular since 2018.

***

Subscribers to the S&P Global Commodity Insights Connect platform can read the full report on our E&P Terms and Above-Ground Risk and Companies & Transactions pages.

Want to learn more on this topic and access similar reports? Try free access to the Upstream Oil & Gas Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flatin-america-exploration-and-production-to-remain-resilient.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flatin-america-exploration-and-production-to-remain-resilient.html&text=Latin+America%3a+E%26P+to+remain+resilient+amid+global+volatility+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flatin-america-exploration-and-production-to-remain-resilient.html","enabled":true},{"name":"email","url":"?subject=Latin America: E&P to remain resilient amid global volatility | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flatin-america-exploration-and-production-to-remain-resilient.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Latin+America%3a+E%26P+to+remain+resilient+amid+global+volatility+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flatin-america-exploration-and-production-to-remain-resilient.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}