The new world of mobility—and what it means for Middle Eastern demand

For the first time in more than 100 years, the automotive ecosystem faces a convergence of technological, political, and economic forces that are fundamentally altering how cars are sold,used, and powered. Driverless technology, electric vehicles, new mobility services, and public policy are prime disruptive forces. This change is under way; the only question is how quickly it will occur and how transformative it will prove. This shift is affecting not only the automotive industry, but also the energy and chemical industries since they are inextricably linked. The implications for the Middle East-especially major oil-producing countries-are profound.

IHS Markit addresses these disruptive forces in our Mobility and Energy Future subscription service, which builds on our 2017 study, Reinventing the wheel: the future of cars, oil, chemicals, and electric power. Our team of mobility experts-drawn from the IHS Markit Automotive, Energy, and Chemical teams-established an entirely new modeling approach, which quantifies fuel demand and vehicle miles traveled (VMT) by powertrain and mobility channel (ride hailing, car sharing, personal use). We model the penetration of new mobility services and powertrains, including electric vehicles, under two long-term scenarios for both light vehicles and trucks.

A key element of our analysis is the clear impact on global oil demand-and what changes in the mobility signal about the possibility of a peak in world oil demand in the next 20 years. For the Middle Eastern oil industry, there are both existential threats as well as fresh opportunities related to changes in mobility.

Demand for mobility via the car: Up 90%

A key insight of our work is that mobility via the car will be higher in the coming years and decades owing to the growth of mobility as a service-such as Uber and Didi ride-hailing services. Indeed, at a time when many prognosticators debate the timing of a peak in oil demand, we expect global VMT to increase 90% from 2018 to 2050. However, will these "new" miles driven come from oil-powered or electric-powered cars? There is no single global answer-and even if oil demand plateaus in the late 2030s, there is still significant demand growth before then. In any case, changes in mobility will be different around the world. For example, in some markets-such as India-oil demand may rise because of increasing demand for mobility via the car. In others, such as California, demand may decrease. Understanding regional variation in mobility changes is key for Middle Eastern oil producers to align with marketing and downstream strategies. Several other key headlines emerge from our ongoing mobility analysis:

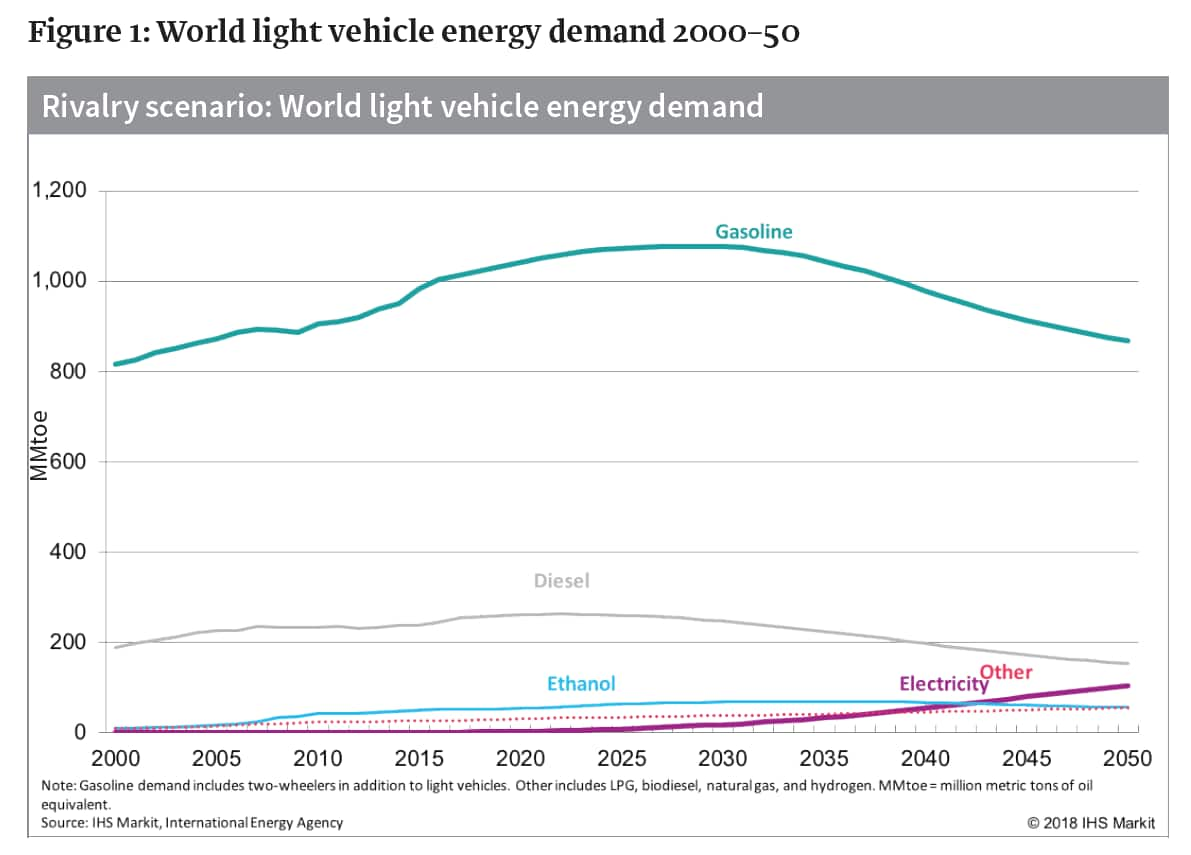

Declining sales of internal combustion engine (ICE) light vehicles lead to weakening demandfor gasoline and diesel in the 2020s. Globally, conventional gasoline light vehicle sales are expected to peak by the early 2020s; diesel in particular will be squeezed drastically beyond 2025, owing to many EU city access restrictions to address local air quality concerns. In addition, the hybridization of powertrains picks up pace after 2020 when mild hybrid electric vehicle technology effectively starts to displace conventional gasoline engines. As battery costs continue to decline and zero-emission vehicle mandates are made effective, hybrid sales will lose ground to greater sales of battery electric vehicles and plug-in hybrid vehicles. Even as light vehicle ICE sales decline, we expect electric vehicle sales to rise from 2% of global vehicle sales in 2018 to 15% by 2030 in our base case Rivalry scenario. The combination of this switching away from ICE vehicles and tightening fuel economy regulations will lead to a peak in global light vehicle gasoline and diesel demand by 2030 in our base case Rivalry scenario (see Figure 1).

Penetration of alternative powertrains is expected in medium and heavy vehicles. Medium and heavy vehicles currently account for approximately 50% of global gasoil demand. Our Reinventing the Truck study shows that although diesel is expected to remain the dominant fuel in key markets such as China, Europe, the United States, and Japan, a long-term decline in diesel demand for trucking is expected, beginning by 2030. By 2040, our base case analysis shows that 15% of medium and heavy vehicle sales will be trucks with alternative powertrains, particularly in urban applications where sales of battery electric medium-duty vehicles will expand. In addition, increasing efficiency and tighter fuel economy standards contribute to this decline in diesel demand even for long-haul trucking.

There are headwinds for long-term global oil demand. A plateau in world oil demand in the 2030s is in our base case, the Rivalry scenario. However, if changes in mobility are more revolutionary- propelled by advances in the commercialization of driverless technology-a demand peak could occur as early as the 2020s, as in our Autonomy scenario. Much of the Middle East's oil production is at the lower end of the global oil supply cost curve, which means the region is well positioned for a highly competitive oil market. However, keeping an up-todate understanding of a rapidly changing automotive ecosystem is essential to avoid unpleasant surprises and stranded assets.

The increase in electrification and automation creates opportunities for companies outside ofthe traditional automotive supply chain. The opportunities for new entrants are in areas such as machine learning, software development, data collection and analysis, and sensing and automation technology. "Auto-tech" companies will emerge as a result of both competition and partnership between incumbent companies and new entrants. Interdependencies will emerge because of growth in ride hailing and the increasing automation and electrification of cars. New entrants will need the manufacturing knowledge of incumbents. Incumbents will need the technology innovations from new entrants. In addition, the energy companies are investing in these new ventures, inserting themselves in businesses ranging from electric vehicle charging to the digitalization of mobility services.

Cascading into chemical feedstocks

The decreased use of liquid transportation fuels, as the automotive industry moves vehicle powertrains away from ICEs, will have rippling effects throughout the energy and chemical sectors. Some changes will be noticeable in the near term, but most of the changes are expected in 2030-40. Demand for gasoline and diesel used in light-duty vehicles will weaken; as a result, more refinery cuts will be available to serve as chemical feedstock. Also, lower oil and natural gas demand in the Autonomy case reduces energy production and prices. As oil prices decline in the long term, prices for related products such as naphtha and NGLs will decline with them, reducing feedstock costs for petrochemicals. Lower crude prices could potentially force naphtha values downward to the point where they become the long-term favorable feedstocks for steam crackers. Such a shift in favorability would encourage investment in naphtha crackers in the growing Asian demand centers, such as China and India, and in the low-cost naphtha regions.

Materials shift

Changes in the volume of cars built and sold, as well as trends in miles traveled, will impact the materials used by the automotive industry. One of the many significant impacts from the move away from ICEs is the elimination of fuel tanks, which will hurt high-density polyethylene demand in the automotive sector. The move will also result in reduced demand for engineering plastics used in under-the-hood applications, which require high-temperature and chemical resistance.

There will also be "gainers," which will have increased use because of design changes, including increased use of polyurethane foams in sound-deadening applications, as well as increased use in thermal insulation to minimize the need for battery power consumed by air conditioning. Polymers used in wire and cable insulation and connectors will become increasingly important to meet the demands of higher voltage and higher amperage power distribution in electricity-based cars. Although plastics will continue to play a role in the lightweighting of automobiles, the use of highstrength metals and alloys, as well as composites, will take on a more prominent role in this trend. Lightweighting will remain a key trend given its importance to maximizing the miles per charge of electric vehicle batteries.

Jim Burkhard, Vice President, Oil Markets, Energy & Mobility, IHS Markit | Kate Hardin, Vice President, Energy and Mobility, IHS Markit | Anthony Palmer, Vice President, Consulting, IHS Markit