Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 01, 2021

Mounting financial challenges for Australia’s utility-scale solar developers

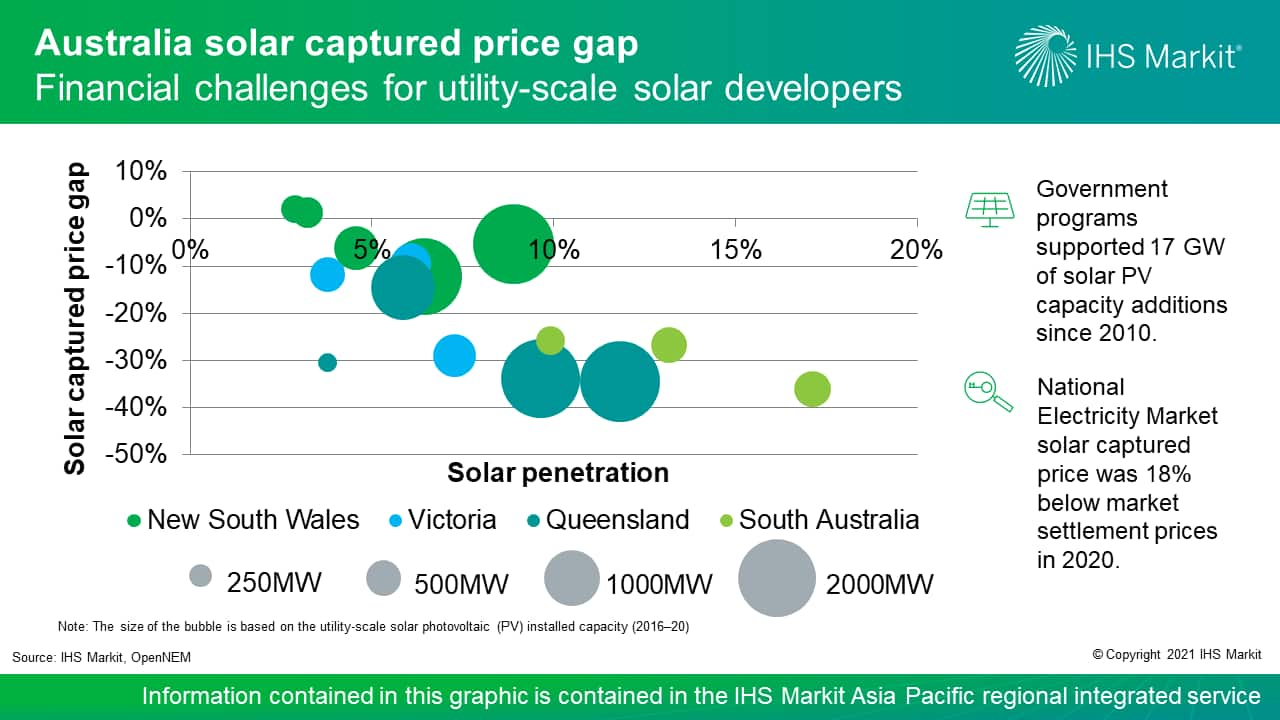

The rapid uptake in solar photovoltaic (PV) capacity in Australia's National Electricity Market (NEM) has created financial challenges for utility-scale solar projects participating in the wholesale market. Prices during peak solar generating hours (10:00 am-3:00 pm) once stood at a premium to average daily market prices but starting in 2017 flipped to a worsening discount as the penetration of solar generating capacity increased. Government programs fueled 17 GW of solar PV capacity additions over the past decade, sending solar captured prices to an average 18% below spot prices in 2020. Solar capacity additions, mainly in the form of rooftop solar, are the principal factor in the widening gap between the settlement price and the solar captured price. In addition, the remote location of solar generating capacity creates higher transmission loss, and in 2020, utility-scale solar revenues were scaled down an average 5% below nonsolar market participants.

Australia's utility-scale solar developers are already facing financial headwinds from increased competition for market share because of a rapid uptake in rooftop solar capacity and the ongoing wave of utility-scale solar capacity additions. In addition, physical curtailment risks have emerged owing to issues with grid constraints, system strength, oscillation problems, and other factors associated with development in weak portions of a long and narrow grid. These mounting financial challenges have reduced revenues and with an expectation of further declines in internal rates of return mean project developers must look to alternative solutions, such as corporate power purchase agreements, to hedge against low prices.

For more about our Asia Pacific energy research and analysis, view our Asia Pacific Regional Integrated Service page.

Logan Reese, is an associate director on the Asia Pacific Regionally Integrated team at IHS Markit, focusing on Australia power and gas markets.

Posted 1 April 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmounting-financial-challenges-for-australias-utilityscale-solar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmounting-financial-challenges-for-australias-utilityscale-solar.html&text=Mounting+financial+challenges+for+Australia%e2%80%99s+utility-scale+solar+developers+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmounting-financial-challenges-for-australias-utilityscale-solar.html","enabled":true},{"name":"email","url":"?subject=Mounting financial challenges for Australia’s utility-scale solar developers | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmounting-financial-challenges-for-australias-utilityscale-solar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mounting+financial+challenges+for+Australia%e2%80%99s+utility-scale+solar+developers+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmounting-financial-challenges-for-australias-utilityscale-solar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}