Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 08, 2022

North American service cost increases expected against an uncertain global backdrop.

COVID-19 counts are down and restrictions in North America are

being lifted. From a public health perspective this is excellent

news, but this improvement is exacerbating pain points from an

economic perspective. Supply chains that were already stressed will

continue to be so; rising oil prices that could be further impacted

by the recent geopolitical events will contribute to inflationary

pressures in the broader economy, which will then be felt at the

wellhead.

These acute, momentous events are occurring at the same time that

operators and service companies are attempting to navigate the

energy transition. This momentum has the potential to alter supply

chains further as well service companies adapt to new client

demands by adding new services and perhaps dropping existing

ones.

In the meantime, after a year spent speculating about well services

cost increases, with some hindsight it is possible to affirm that

operators will have to get used to seeing increases: the North

American Unconventional Onshore index is projected to increase at a

double-digit rate in 2022.

PLEASE NOTE: This report was prepared prior to the

invasion of Ukraine. Given how starkly this has affected the

markets, the findings in this

publication do not reflect the present state of affairs and do

not fully cover our long-term view of North American operations.

Future publications of this report will account for our latest

findings based on the geopolitical ramifications of current

events.

After the appearance in late 2021 of the Omicron COVID-19 variant,

the world braced itself for the effects of this more contagious

virus. While Omicron continues to affect people, case counts are

now down and restrictions in North America are being lifted. From a

public health perspective, this is excellent news, though perhaps

paradoxically, this improvement is going to exacerbate pain points

from an economic perspective.

Supply chains that were already stressed will continue to be so.

Rising oil prices that could be further impacted by the recent

geopolitical events will contribute to inflationary pressures in

the broader economy, which will then be felt at the wellhead.

Turning now to more specific upstream findings for this

quarter:

• These acute, momentous events are occurring at the same time that

operators and service companies are attempting to navigate the

energy transition. Momentum that picked up in 2020 continued

through 2021, with about 65% of the IHS Markit

Company Research Large and Midsize North American E&P peer

group establishing greenhouse gas emissions targets for 2024-30

that were more specific than before. This momentum has the

potential to alter supply chains further as well service companies

adapt to new client demands by adding new services and perhaps

dropping existing ones.

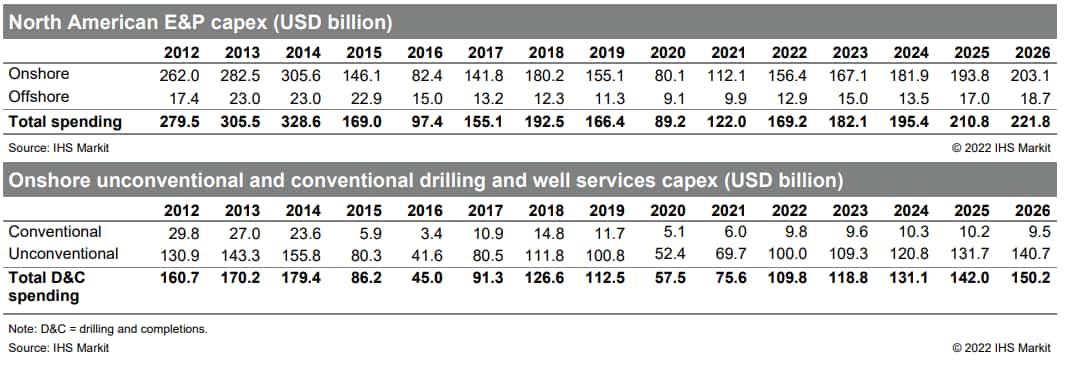

• From a spending point of view, high oil prices and demand that is

well above pandemic lows have contributed to an upstream spending

forecast that is projected to increase materially over the next few

years. Indeed, North American E&P capex is projected to

increase every year through 2026, from USD122 billion in 2021 to

USD221.8 billion in 2026.

• After a year spent speculating about well services cost

increases, with some hindsight it is possible to affirm that

operators will have to get used to seeing increases: the North

American Unconventional Onshore index increased just over 7.5% in

2021 and is projected to increase at a double-digit rate in

2022.

• While operators are expected to have less buyer power going

forward, they should be able to mitigate this by reaping the

rewards of the work they have put in constantly to improve their

operational efficiencies. While it would be reasonable to assume

that gains stopped years ago, given how long operators have been

present in all the major US plays, in fact, rig efficiencies increased between

10% and 25% over 2020 and 2021 for many of these plays.

Furthermore, producers in the Delaware Basin and Appalachia

increased productivity by 10-15% by drilling longer laterals.

The 'North American Upstream

Spending' full report is available to our Connect

subscribers.

For details on our research offerings visit Upstream Costs & Expenditures.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-service-cost-increases-expected.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-service-cost-increases-expected.html&text=North+American+service+cost+increases+expected+against+an+uncertain+global+backdrop.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-service-cost-increases-expected.html","enabled":true},{"name":"email","url":"?subject=North American service cost increases expected against an uncertain global backdrop. | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-service-cost-increases-expected.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=North+American+service+cost+increases+expected+against+an+uncertain+global+backdrop.+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-service-cost-increases-expected.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}