Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 05, 2024

OECD Asia Power and Renewables Market Briefing, Q4 2023

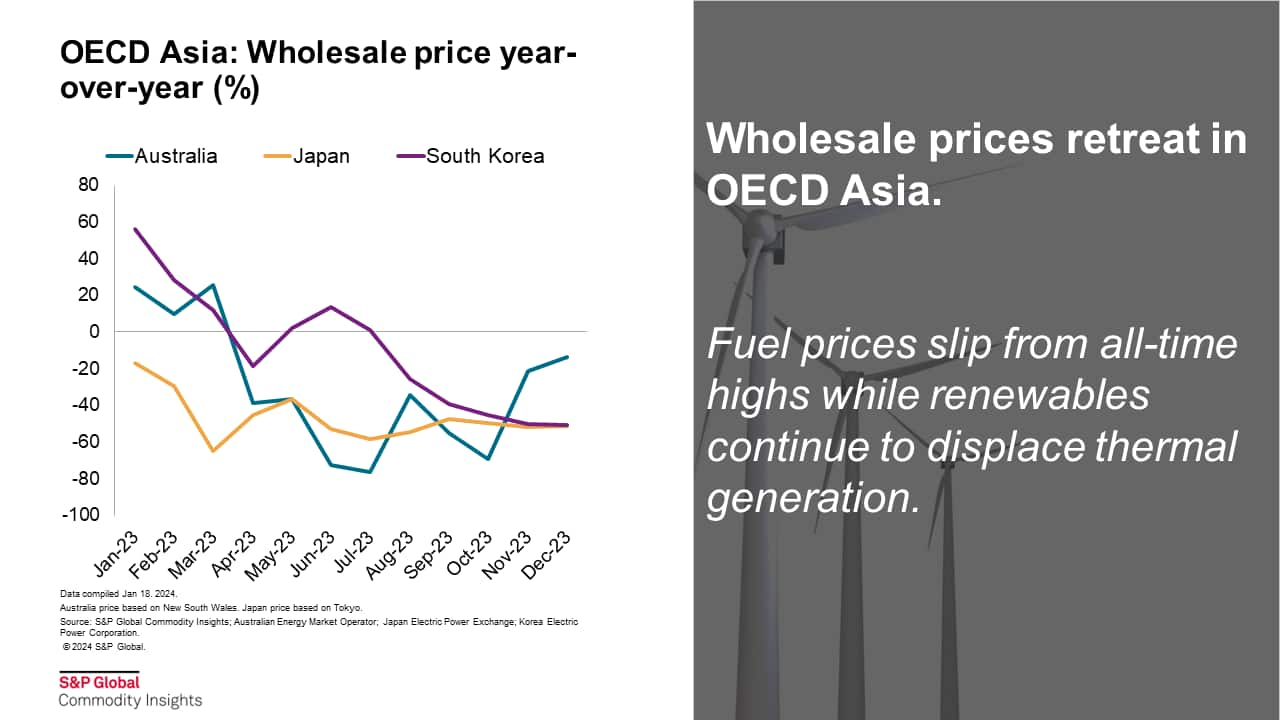

Wholesale power prices declined year-on-year in all 3 markets within OECD Asia (Australia, Japan, South Korea). In South Korea, the wholesale power price contracted by 49% in the fourth quarter of 2023 thanks to lower fuel prices for LNG and coal, down 44% and 38% year-on-year, respectively. Similarly, lower LNG prices helped cut Japan wholesale power prices in half in the fourth quarter 2023 compared to the year prior. Meanwhile, Australia experienced lower gas prices that when combined with sustained growth in behind-the-meter solar generation contributed to a 40% year-on-year decline in wholesale power prices in the fourth quarter 2023.

Our short-term forecast indicates modest growth in power demand in Japan and South Korea. South Korea is largely driven by the government's estimate of 8.5% growth in exports for 2024, compared with a decline of 7.4% in 2023. The increase in exports will likely be "spearheaded" by semiconductors, as mentioned on Jan. 11 by the Ministry of Trade, Industry and Energy (MOTIE). In Japan, any growth in power demand is expected to be met in part by an expected increase in nuclear generation with two announced reactor restarts, and a possible third unit at the very end of the year. However, the earliest restart will take in place in May, so most of the increase in nuclear generation will take place during the second part of 2024. As the units come online, the thermal gap will shrink, and there will be lower output from both coal- and gas-fired power generation; just as observed during 2023.

In this quarter, several new announcements and developments have been observed;

Australia

- In October 2023, the state of Victoria revived the State Electricity Commission (SEC) as a government-owned renewable electricity investment enterprise. From 1972 until privatization in the 1990s, the SEC was the sole agency in the state responsible for generation, transmission, distribution and electricity supply. The revived SEC will prioritize accelerating the energy transition by investing an initial A$1 billion toward 4.5 GW of additional renewable generationand storage capacity (2.6 GW by 2028) and the electrification of households. In addition to the new capacity, the SEC will assume control of the 1.2 GW Victorian Renewable Energy Target contracts (VRET 1 and 2 and Bulgana Green Power Hub) by 2025 to help meet renewable targets for government operations and provide renewable energy products to commercial and industrial customers.

Japan

- The government will begin its review of the Seventh Strategic Energy Plan during 2024. The strategic energy plan is Japan's principal energy policy, and the review process is required to start within three years of the previous enactment (the current Sixth Strategic Energy Plan was enacted in October 2021). The upcoming review is expected to look at changes in the energy landscape, including demand outlooks from emerging sectors such as IT (data centers), and is also likely to add an interim outlook for 2035. The upcoming review period will coincide with Japan's requirement to submit a new nationally determined contribution (NDC) ahead of the UN Framework Convention on Climate Change, or COP30, in November 2025 in Brazil. It is expected that the energy mix laid out after the review will form the basis of that NDC. More details will become available as the evaluation proceeds this year.

South Korea

- On Dec. 20, 2023, the Korea Energy Agency (KEA) announced the results of the solar renewable energy certificate (REC) tenders for the second half of 2023. A total of 59.65 MW was awarded from 175 projects. This represents a mere 6% of total tender capacity, far short of the 1,000 MW target capacity. The low participation rate is mainly attributed to unattractive economic return in the tender relative to merchant sales. Solar merchant projects with 1 MW capacity would have received more than 200 South Korean won/kWh from selling SMP and unbundled RECs, while only 153 won/kWh could be earned from the REC tender. Against the unattractive REC tender market, developers with utility-scale solar projects are pivoting toward the corporate power purchase agreement market as more industrial consumers are adopting direct renewable procurement to raise their climate credential while hedging against rising electricity prices. In 2023, a total of 975 MW corporate PPA deals have been signed, up from 97 MW in 2022.

If you are interested in learning more about our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foecd-asia-power-and-renewables-market-briefing-q4-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foecd-asia-power-and-renewables-market-briefing-q4-2023.html&text=OECD+Asia+Power+and+Renewables+Market+Briefing%2c+Q4+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foecd-asia-power-and-renewables-market-briefing-q4-2023.html","enabled":true},{"name":"email","url":"?subject=OECD Asia Power and Renewables Market Briefing, Q4 2023 | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foecd-asia-power-and-renewables-market-briefing-q4-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=OECD+Asia+Power+and+Renewables+Market+Briefing%2c+Q4+2023+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foecd-asia-power-and-renewables-market-briefing-q4-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}