Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 22, 2021

Overseas financing rises with India’s renewable ambition

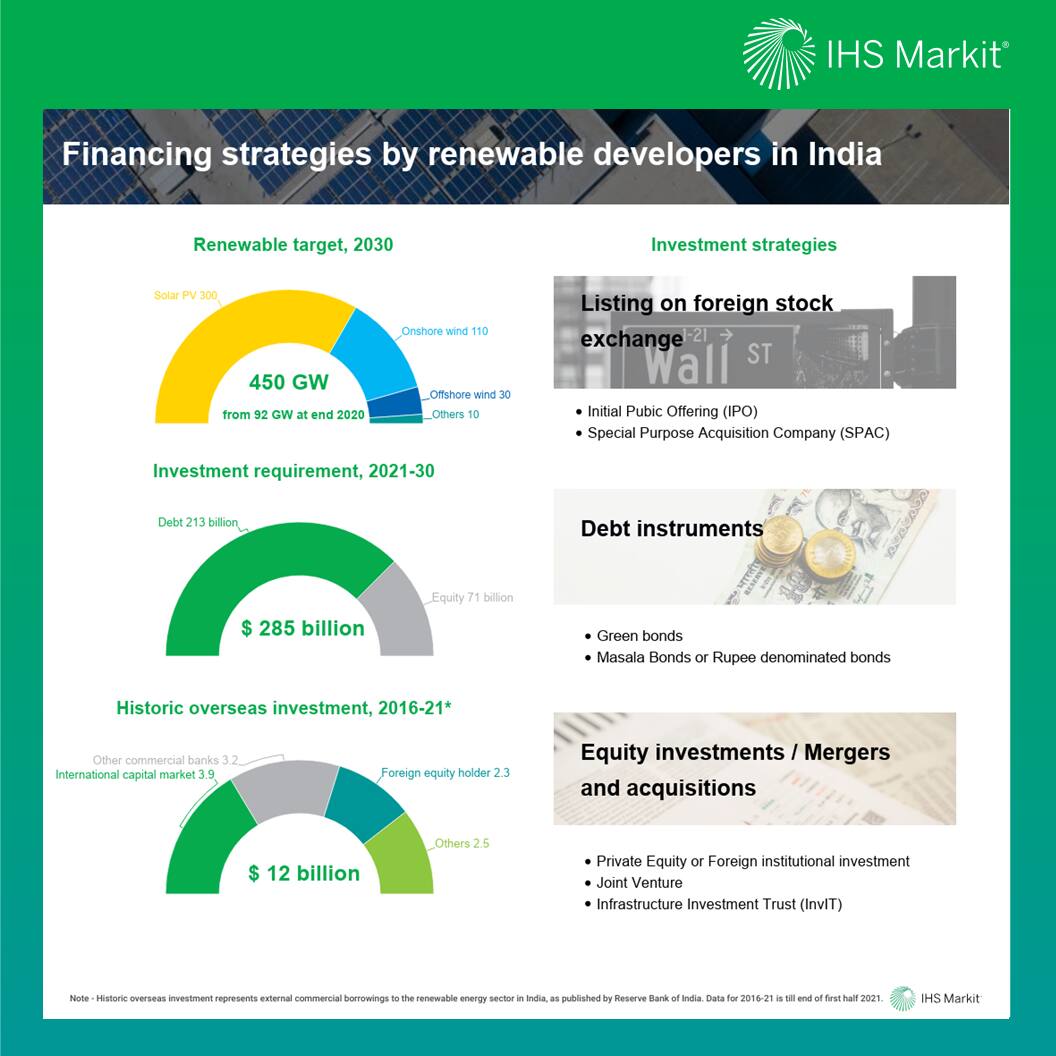

India has set an aggressive target to reach 175 GW renewable capacity by 2022 and 450 GW by 2030 from about 100 GW at present. To meet this target, India will need more than $28 billion of investments annually in the sector. In comparison, India received an estimated investment of roughly $7 billion annually over the past five years. Therefore, India will need to quadruple its renewable investment to be able to reach its target to add more than 350 GW of new renewable capacity during 2021-30.

Debt constitutes 70-75% of the capital requirement for renewable generation projects. This would translate to about $200-215 billion debt financing needs during 2021-30 and the rest in the form of equity investments. In addition, India will need substantial investments for renewable integration through transmission infrastructure augmentation and building storage capacity. For example, the targeted battery storage capacity of 27 GW by 2030 will require an estimated additional $30 billion investment.

While on the one hand local banks reach the regulator capped limits of their exposure to the sector, the share of overseas investments is witnessing a rise in the renewable sector. To overcome the local financing constraints, renewable developers are increasingly looking for alternative modes of financing through foreign banks, bilateral and multilateral financing institutions, and green bonds to both finance new projects and refinance operational assets.

Overall, India's external commercial borrowings (ECBs), including dollar- and rupee-denominated bonds, in the renewable sector have increased from $476 million in 2016 to about $1.6 billion in 2020 as reported by the RBI statistics. In 2021, the ECBs have crossed $3.9 billion in the first six months, about half of which are going toward refinancing rupee loans, and another 45% are toward financing greenfield renewable projects.

Green bonds are emerging as an important financing instrument; however, access is limited to a few large portfolio owners. Green bonds of more than $14 billion have been raised by renewable developers, banking, and nonbanking financial institutions during 2016-21 year to date and are estimated to be about 20% of the total renewable investment during the period. However, only a handful of large renewable IPPs and conglomerates have been able to access finance through this mode.

Leading developers in the country are adopting a mix of strategies to attract investments from international players and grow their renewable portfolio including listing the business on a foreign stock exchange, partnerships with foreign private equity and institutional investors, M&A deals, and infrastructure investment trusts.

To improve access to low-cost international capital and improve financial sustainability of renewable projects, India needs to improve regulatory transparency and introduce a uniform green taxonomy. These measures will help address the concerns of foreign institutional investors with respect to the relatively low credit ratings of renewable projects. Further, offering credit guarantees by underwriting the currency, policy, and offtaker risks through public financing institutions can help enhance the attractiveness of renewable assets.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foverseas-financing-rises-with-indias-renewable-ambition.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foverseas-financing-rises-with-indias-renewable-ambition.html&text=Overseas+financing+rises+with+India%e2%80%99s+renewable+ambition+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foverseas-financing-rises-with-indias-renewable-ambition.html","enabled":true},{"name":"email","url":"?subject=Overseas financing rises with India’s renewable ambition | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foverseas-financing-rises-with-indias-renewable-ambition.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Overseas+financing+rises+with+India%e2%80%99s+renewable+ambition+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foverseas-financing-rises-with-indias-renewable-ambition.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}