Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 23, 2021

Pipeline imports: What role will they play in China’s gas supply mix?

Accounting for about half of total imports and a quarter of total supply, pipeline imports play a vital role in maintaining China's gas supply security and diversification. The dynamics between demand and supply options create different roles for pipeline imports in China's regional markets.

In 2020, China's total pipeline imports declined 5% despite the ramp-up Power of Siberia (POS) delivered volumes. This was mainly the result of intensifying the competition between various supply sources, including policy-favored domestic production and cheap term and spot LNG.

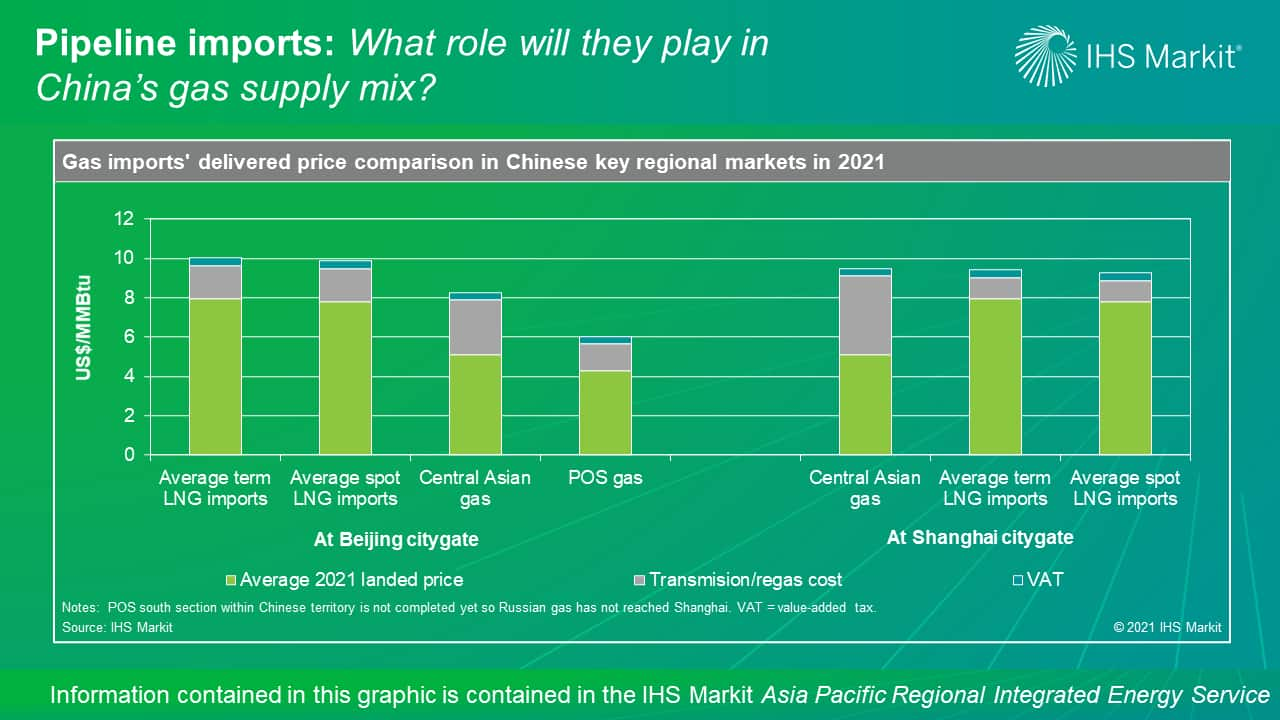

We expect China's pipeline imports to rebound in 2021. Oil price is the pricing linkage for the majority of Chinese pipeline imports and LNG term contracts. LNG contracts typically have a short lag time—about three months—to the oil price and an average slope of about 12-13%. In contrast, regression analysis on the landed prices of pipeline imports against oil prices shows that Chinese pipeline imports have a long lag time, single-digit slope, and high fixed price portion. Central Asian and POS gas imports have a 6-7% slope with a 10-12-month lag time to the oil price. As a result, the 2020 oil price collapse led to declining landed prices of LNG term imports within just a few months but won't be reflected in pipeline import prices until 2021.

Central Asian gas' competitiveness will also improve in 2021. The 2021 average landed price of Central Asian gas import will be $0.3/MMBtu lower than the 2020 average. The landed price of LNG imports, on the other hand, will increase almost $2/MMBtu for term contracts and at least $4/MMBtu for spot purchases on average, given the current oil price and global LNG dynamics. As a result, Central Asian gas imports are expected to recover from the 2020 lows but still remain below the pre-COVID-19 levels at 42 Bcm in 2021.

Beyond 2021, pipeline imports will remain an important supply source to China's regional markets. With the low border prices, Russian pipeline gas imports will represent a major growth area in China's supply mix over the next decade, particularly for northeastern and coastal markets. In addition, Gazprom has been actively promoting the 50 Bcm/y Power of Siberia-2 pipeline to China. Non-Russian gas faces supply stability issues owing to upstream development challenges, export policy, and pricing considerations, but is crucial to regional supply security including for markets along the West-East pipeline system for Central Asian gas and the southwestern region for Myanmar's gas. In the current IHS Markit current outlook, total pipeline imports will reach 88 Bcm in 2025, up from 48 Bcm in 2020.

Learn more about our research in the regional energy markets through the IHS Markit Asia Pacific Regional Integrated Service and Russian and Caspian Energy Service.

Tianshi Huang is an Associate Director covering Greater China's gas and LNG analysis.

Anna Galtsova is a Director of the Russia and Caspian Energy service.

Paulina Mirenkova is a Director of the Russia and Caspian Energy service.

Posted on 23 June 2021.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpipeline-imports-what-role-will-they-play-in-chinas-gas-supply.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpipeline-imports-what-role-will-they-play-in-chinas-gas-supply.html&text=Pipeline+imports%3a+What+role+will+they+play+in+China%e2%80%99s+gas+supply+mix%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpipeline-imports-what-role-will-they-play-in-chinas-gas-supply.html","enabled":true},{"name":"email","url":"?subject=Pipeline imports: What role will they play in China’s gas supply mix? | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpipeline-imports-what-role-will-they-play-in-chinas-gas-supply.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Pipeline+imports%3a+What+role+will+they+play+in+China%e2%80%99s+gas+supply+mix%3f+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpipeline-imports-what-role-will-they-play-in-chinas-gas-supply.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}