Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 16, 2023

Power demand moderates due to lower activities in the industrial sector

S&P Global Commodity Insights has published the Southeast Asia (SEA) power and renewable market briefing for the first quarter of 2023 (Q1 2023). The report discussed the power demand, supply, pricing, and major market events in the quarter, as well as the latest proposed or enacted policies and regulations. The report is now accessible to clients via Connect.

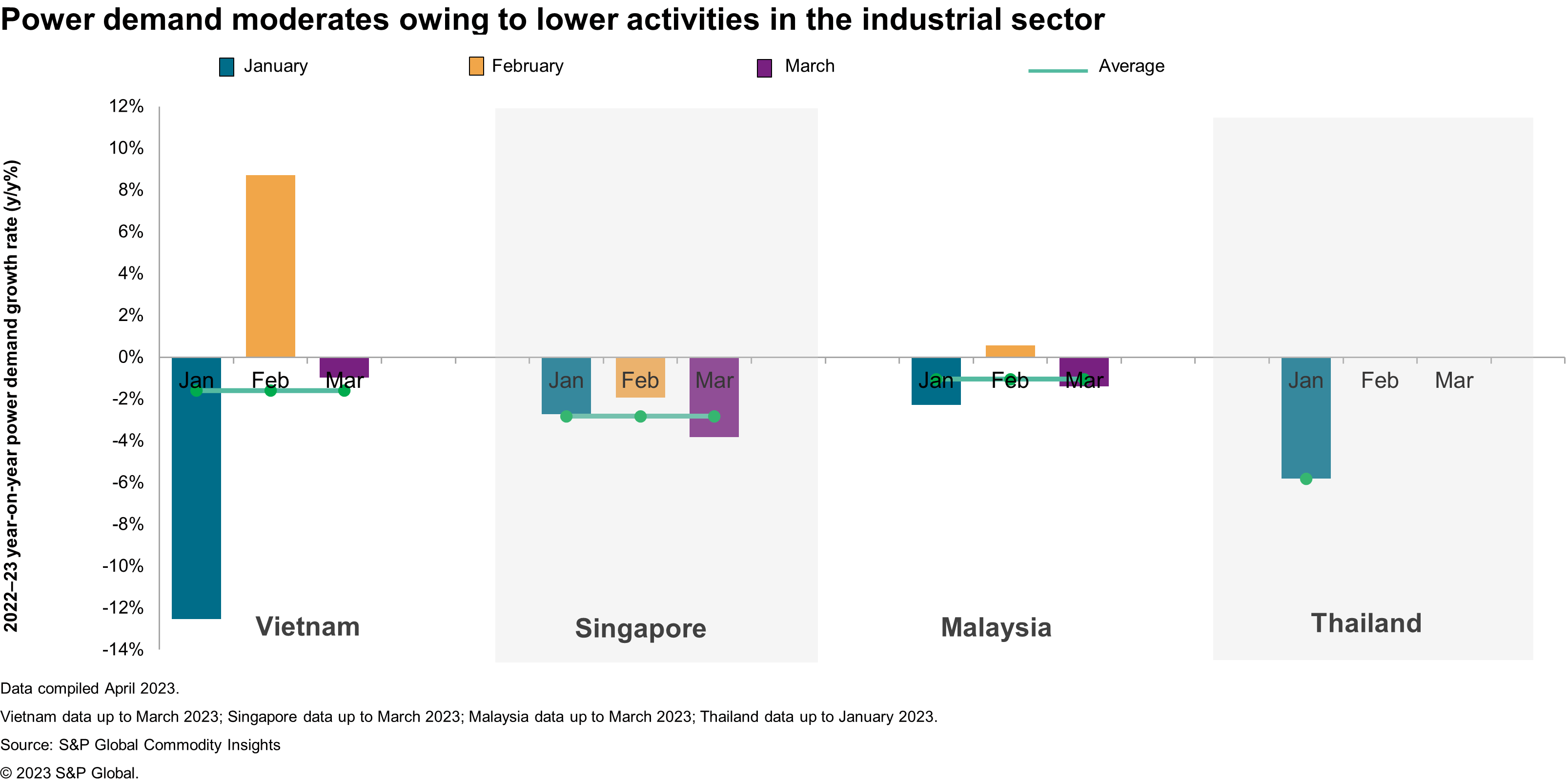

The data from the power market indicates a fluctuation in the year-over-year (y/y) power demand growth in the first quarter of 2023 in Southeast Asian countries, including Vietnam, Thailand, Malaysia, and Singapore, with a range of -1.6 y/y% to -5.8 y/y% compared to the same period in the previous year, reflecting a slowdown in the recovery of power demand. This is mainly attributed to the weakening the industrial activities in the region, as global economic growth slows and global inflation rises.

Vietnam's total power demand in the first quarter of 2023 was down 1.6% y/y compared to the same period in 2022. This was largely contributed by the Tet (Vietnamese Lunar New Year) holidays from January 20 to January 26, when businesses and factories halted operations, leading to a 12.5% sharp fall of demand in January 2023 compared to last year. Nonetheless, Vietnam's power demand has seen a recovery after the Tet holidays as operations resumed. While the country's total and peak power demand in 2022 has rebounded to pre-pandemic levels of robust growth, it remains uncertain whether this momentum will carry over into 2023 owing to rising global economic uncertainties.

Singapore's power demand continued to decline in Q1 2023 at 2.8 y/y%, as a result of slower economic trade activities and weaker global demand. Latest statistics from Singapore's Economic Development Board (EDB) also shows weakening manufacturing output in February 2023 which declined by 8.9% y/y and by 11.7% month-over-month (m/m), contributing to the slowdown in power consumption. Nonetheless, the annual power demand growth at 2.1 y/y% in 2022 indicated that Singaporean economy has recovered from the aftermath of the COVID-19 pandemic. Moving forward, significant FDI inflows into the manufacturing sector are expected to partially offset the impact of slow global economic growth.

Similar to Singapore, Malaysia's power demand decreased in Q1 2023 at 1.1 y/y%. Although the Malaysian economy appears to have recovered from the slowdown caused by the COVID-19, as demonstrated by the annual increase in power demand of 4.4 y/y% in 2022, there are several uncertainties that continue to pose downside risks to the recovery of the power market. The uncertainties include rising fuel costs amid tight supply, the Russia-Ukraine crisis that have disrupted the global supply chain, and reduction in trade volumes.

Despite showing continuous growth in power demand in 2022, Thailand's January demand observed a 5.8% decrease compared to January last year, owing to global economic slowdown, phase-out of COVID-19 relief measures and rising inflation. While global economic uncertainty continues to pose downside risks, foreign direct investment (FDI) inflows are expected to boost the country's economy and consequently the power demand growth in the forthcoming future. As announced by the Prime Minister Prayut Chan-o-cha's that FDI in Thai businesses shot up 305% in the first two months of 2023.

The power demand growth in SEA during the first quarter of 2023 overall is facing a slowdown due to weak global demand and slackening in the industrial sector. Although the Southeast Asian countries are showing signs of improvement in the ongoing pandemic and the governments are stepping up efforts to combat the stalling economies, the region is still facing a gloomy and uncertain outlook, owing to supply chain disruptions, soaring global commodity prices, and unexpected events that are causing mounting price pressures.

Are you interested in learning more about our research into the Southeast Asia power sector? Check out our recent research series, "Decarbonizing while growing: Energy Transition in Southeast Asia's power sector."

Cecillia Zheng, associate director, is a key member of the Gas, Power, and Climate Solutions research and consulting team for Asia Pacific at S&P Global Commodity Insights. She leads Southeast Asian power market research and has a deep understanding of the gas and power markets.

Posted on 16 May 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpower-demand-moderates-due-to-lower-activities-in-the-industri.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpower-demand-moderates-due-to-lower-activities-in-the-industri.html&text=Power+demand+moderates+due+to+lower+activities+in+the+industrial+sector++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpower-demand-moderates-due-to-lower-activities-in-the-industri.html","enabled":true},{"name":"email","url":"?subject=Power demand moderates due to lower activities in the industrial sector | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpower-demand-moderates-due-to-lower-activities-in-the-industri.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Power+demand+moderates+due+to+lower+activities+in+the+industrial+sector++%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpower-demand-moderates-due-to-lower-activities-in-the-industri.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}