Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 10, 2023

PTTEP’s exit from Mariana oil sands is no surprise as a sharper portfolio strategy reaches fruition

In January 2023, PTT Exploration and Production (PTTEP) reported in its 2022 year-end results that it is progressing toward exiting its holdings in Canada, and the process to return the Mariana oil sands project to the Canadian government has begun. Repeated delays since 2014 related to sanctioning the Mariana steam-assisted gravity drainage (SAGD) oil sands project in Canada owing to the low oil price environment and PTTEP's realignment of strategy resulted in the national oil company (NOC) to mark its exit from the country.

PTTEP considered the entry into the Canadian oil sands as a 'transformational step'

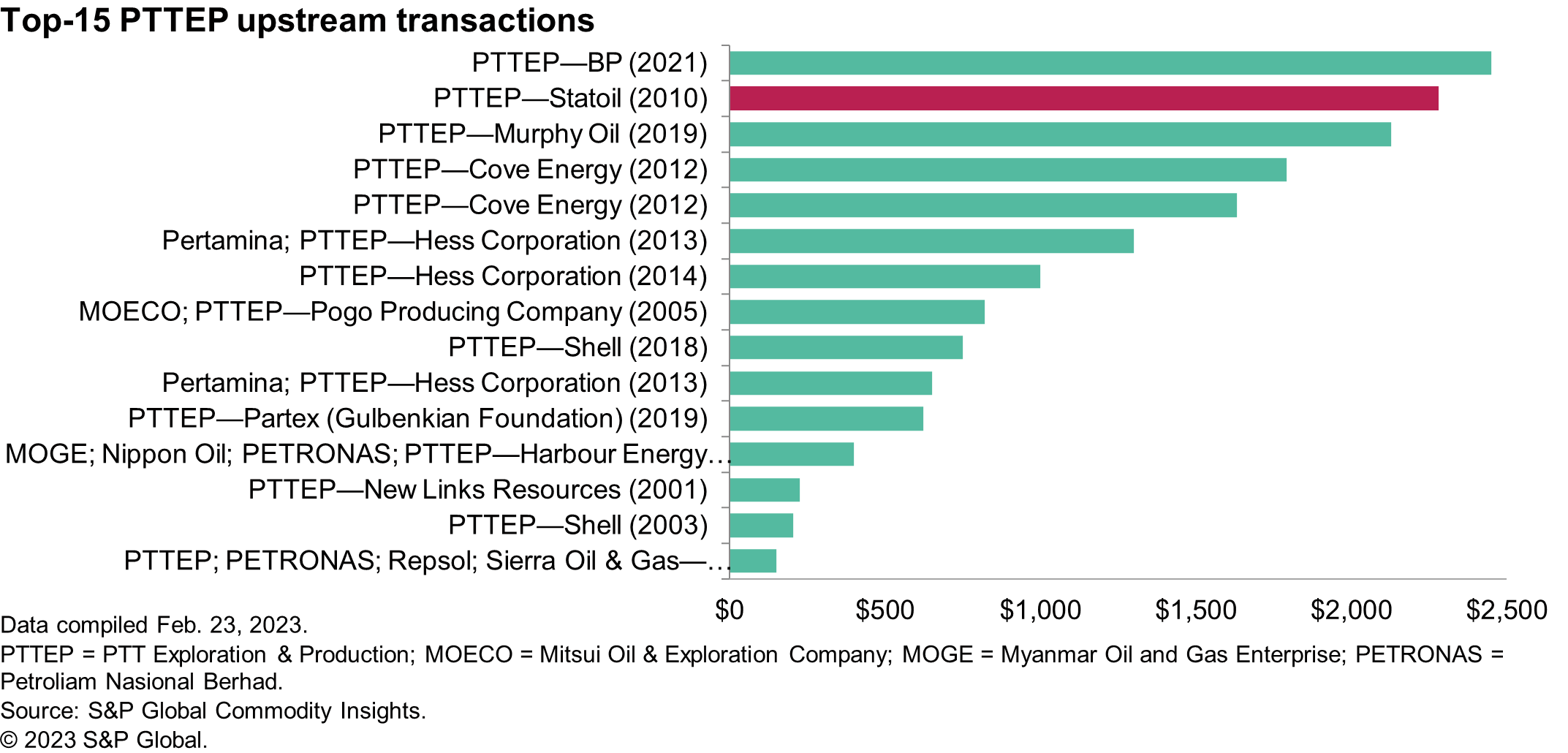

In 2010, PTTEP joined its peer Asian NOCs, chiefly PETRONAS and the Chinese NOCs with the acquisition of a 40% interest in the Kai Kos Dehseh (KKD) project in Alberta from Equinor for $2.3 billion, with Equinor retaining the remaining 60% and operatorship in the project. The acquisition of Equinor's stake was the company's largest single upstream acquisition until 2021 when PTTEP acquired a 20% stake in the Block 61-Khazzan-Makarem gas field from BP in a $2.45 billion transaction.

Partnership Units Redemption Agreement (PURA) with Equinor in 2014 led to an asset swap

In 2014, Equinor and PTTEP completed the agreement to divide their interests in the KKD Alberta oil sands project with PTTEP owning and operating 100% of the Thornbury, Hangingstone, and South Leismer areas (later called the Mariana oil sands project) and Equinor owning 100% and operatorship of the Leismer and Corner development projects.

The assets in Canada became an outlier in PTTEP's portfolio

In 2014, PTTEP-operated Mariana oil sands project was expected to come onstream in 2019. However, with the oil price collapse in 2014, PTTEP deferred investment decision on the project and has put the project on hold in 2015 citing assessment in development plans and seeking to reduce project-related cost. In 2017, PTTEP deferred a sanction decision on the project, with final investment decision (FID) expected in 2019 and first production by 2022. However, after that the NOC did not went ahead with the project as it shifted its focus back to the "core" region.

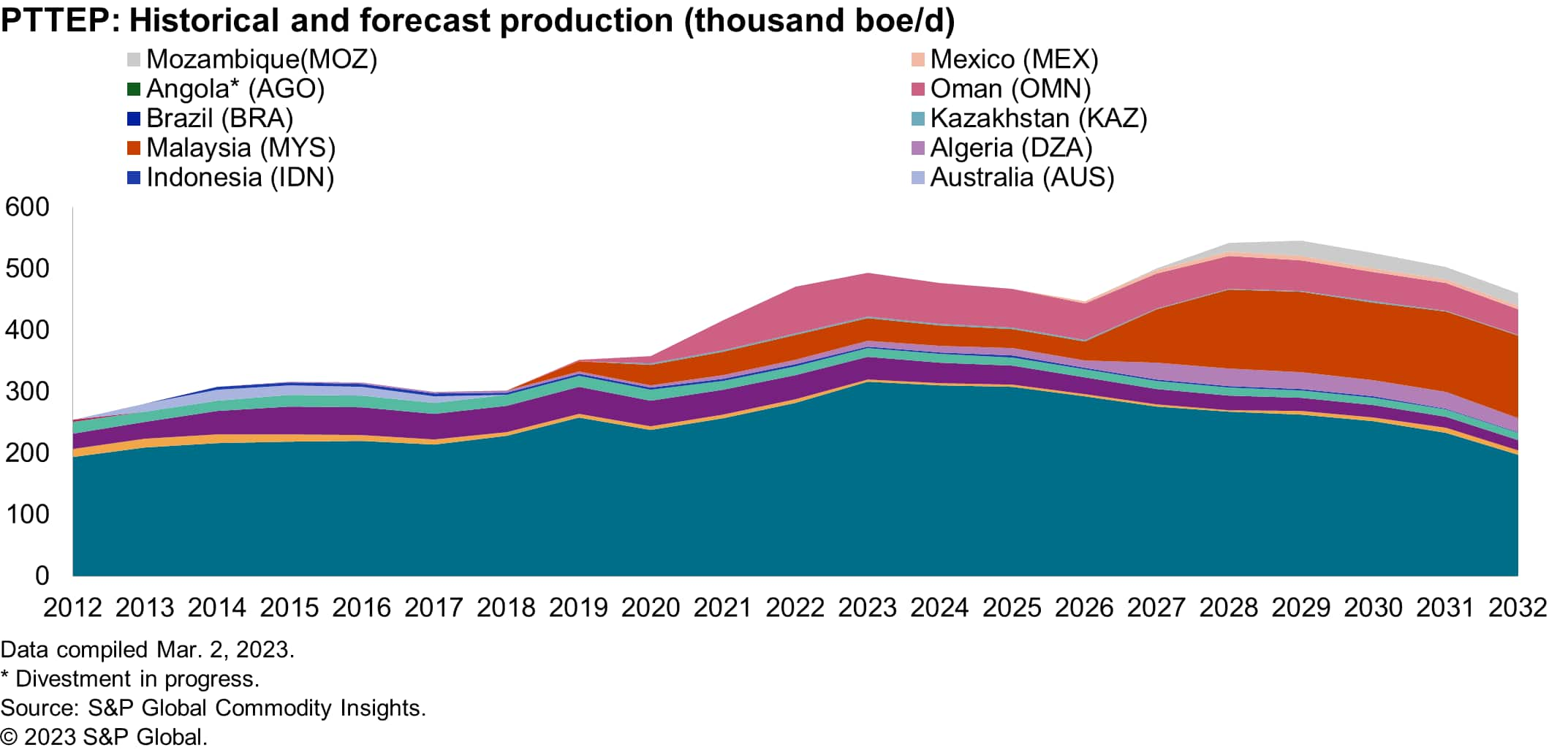

Restructured international footprint establishes a sharper upstream strategy and will boost output

In 2022, PTTEP's global production was around 470,000 boe/d of oil and gas, with more than 85% of volumes sourced from Thailand, Oman, Myanmar, and Malaysia. PTTEP is targeting a production of around 510,000 boe/d in 2024 and 550,000 boe/d in 2027 from its global operations. S&P Global Commodity Insights analysis of PTTEP's currently producing, sanctioned, and unsanctioned assets forecasts that the NOC will produce between 477,000 boe/d and 500,000 boe/d during 2023-27.

***

This blog is an extract from the study and the full report is

available for S&P Global Commodity Insights Connect platform

Companies and Transactions subscribers only.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fptteps-exit-from-mariana-oil-sands-is-no-surprise-as-a-sharper.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fptteps-exit-from-mariana-oil-sands-is-no-surprise-as-a-sharper.html&text=PTTEP%e2%80%99s+exit+from+Mariana+oil+sands+is+no+surprise+as+a+sharper+portfolio+strategy+reaches+fruition+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fptteps-exit-from-mariana-oil-sands-is-no-surprise-as-a-sharper.html","enabled":true},{"name":"email","url":"?subject=PTTEP’s exit from Mariana oil sands is no surprise as a sharper portfolio strategy reaches fruition | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fptteps-exit-from-mariana-oil-sands-is-no-surprise-as-a-sharper.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PTTEP%e2%80%99s+exit+from+Mariana+oil+sands+is+no+surprise+as+a+sharper+portfolio+strategy+reaches+fruition+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fptteps-exit-from-mariana-oil-sands-is-no-surprise-as-a-sharper.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}