Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 27, 2023

Reforms reshape the Australian gas market

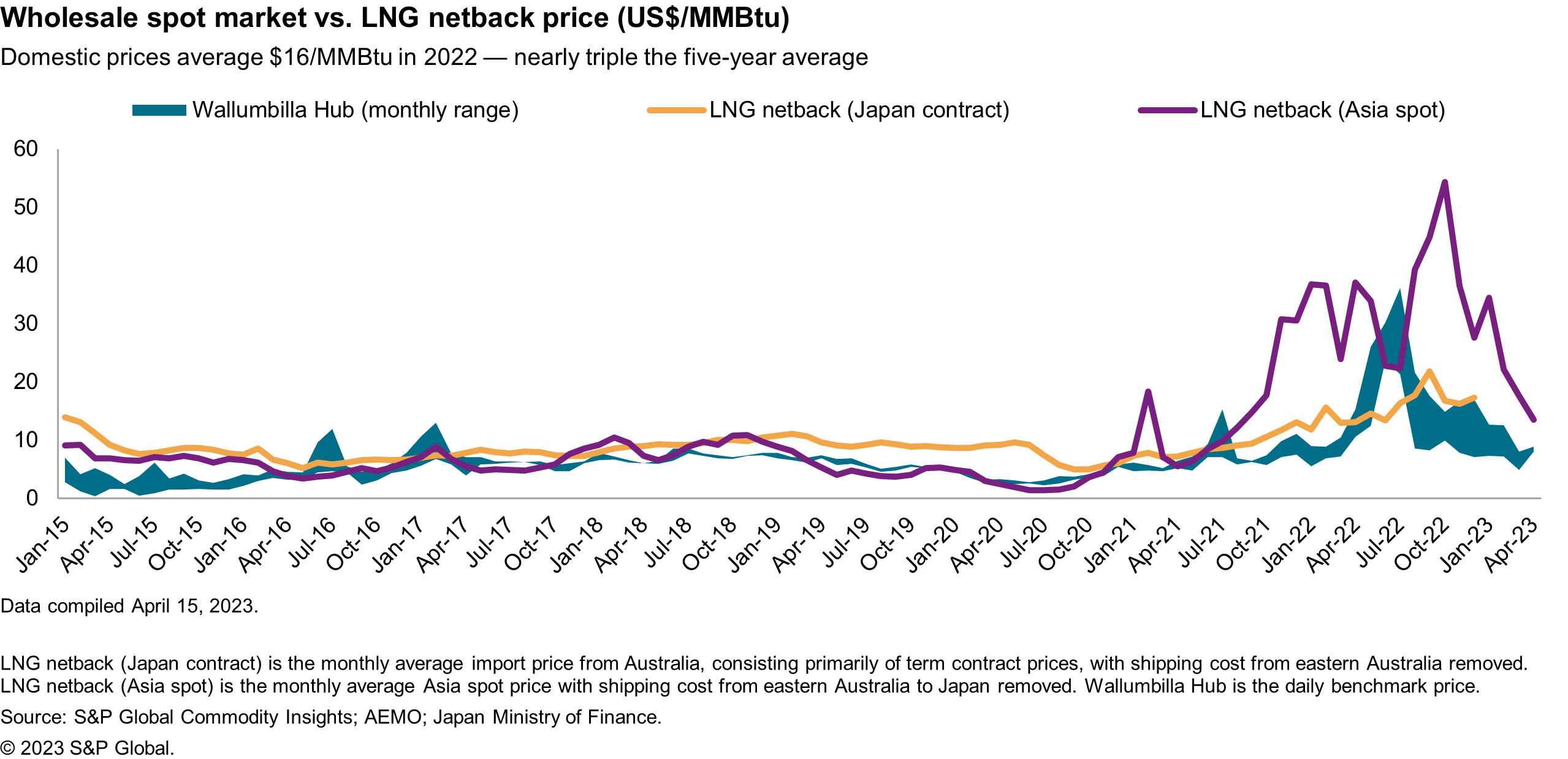

Recent developments in Australian gas and power markets have reinforced growing concerns over the security of low-cost gas supply in Australia's highly populated east coast. Since the commissioning of three LNG export terminals (2015-16), the Australian Energy Market Operator (AEMO) and the Australian Competition and Consumer Commission (ACCC) have repeatedly warned of the potential for gas supply shortfalls in east coast markets. The most recent warning was issued in AEMO's Gas Statement of Opportunities (March 2023) which warned of shortfalls starting in winter 2023 under very high demand conditions with a more prolonged supply gap emerging by 2026.

The first steps to ensure domestic gas supply were taken in June 2017 following spikes in gas prices and as a response to a report released by the AEMO that forecasted a potential supply shortfall in the east coast market. In 2020, despite moderating pressures in the eastern gas markets and to support a gas-led COVID-19 economic recovery plan, the government renewed agreements with east coast LNG operators that reaffirmed a commitment to domestic supply security.

However, the change in government in May 2022, developments in the international gas markets, and spikes in domestic natural gas prices have brought with it a new approach that has resulted in unprecedented steps to strengthen existing and enact new binding and non-binding measures to ensure adequate low-cost natural gas supply to the domestic market and advance decarbonization goals.

Overview of Australian gas market reforms

The Labor government has extended and reformed LNG export controls, renegotiated a heads of agreement (HOA) with east coast LNG export projects, placed price caps on short-term supply agreements for 2023, introduced an industry code of conduct, and imposed emissions reduction targets on gas supply projects.

- Australian domestic gas security mechanism (ADGSM) strengthened in 2023 - Recent reforms to the ADGSM and associated guidelines include an extension of the export controls from January 2023 to 2030, shortening of the frequency of a shortfall assessment and term of the shortfall period from each year to each quarter, redefined the calculations and considerations for allowable volume export permissions, reallocation of shortfall liabilities to LNG projects in a shortfall region, and include a stipulation of the treatment of contracted volumes.

- Voluntary HOA renegotiated in 2022 to ensure supply - In September 2022, on the back of a notice of intent to invoke the ADGSM, the government renegotiated a strengthened HOA with east coast LNG projects (valid until January 2026). LNG exporters have committed to first offering uncontracted supply with reasonable notice to the domestic market before offering it to the international market, publish offers and expressions of interest for uncontracted supply and ensure domestic customers will not pay more than international customers.

- Temporary gas price cap introduced for new deals signed in 2023 - On Dec. 23, 2022, the Competition and Consumer (Gas Market Emergency Price) Order 2022 came into effect that subject all short-term gas supply agreements signed in 2023 for delivery in 2023 to a price cap of A$12/gigajoule (GJ). However, the legislation provides an exemption to the price cap for agreements entered into before Dec. 23, 2023, Western Australia, gas from undeveloped fields, exports, storage and the Declared Wholesale Gas Market (DWGM) and Short-Term Trading Market (STTM) spot markets.

- Code of Conduct released in April 2023 to address regulatory concerns - Coinciding with the release of the draft price cap legislation in December 2022, the federal government proposed a Mandatory Code of Conduct that would introduce a provision to ensure reasonable pricing for relevant domestic wholesale gas contracts with producers. A draft of the Code was published in April 2023, which followed significant industry pushback on the reasonable pricing provision. The initial price provision proposal was based on a cost-plus model that was ultimately abandoned in the final draft in favor of an (18-month) extension of the A$12/GJ price cap. The Code will cover new wholesale supply contract negotiations between large gas producers and buyers for natural gas in the east coast gas market and builds on the Voluntary code of conduct outlining requirements of parties in good faith negotiations of GSAs.

- Safeguard Mechanism aims to limit growth in greenhouse gas emissions - In March 2023, the federal government passed the Safeguard Mechanism (Crediting) Amendment Bill 2023 that requires a reduction of total emissions from safeguard facilities (facilities that emit more than 100,000 metric tons of carbon dioxide equivalent (CO₂e) per year) over time to reach zero emission by 2050. To meet the 2030 target, safeguard facilities will be required reduce their net emissions (baselines) by 4.9% each year until 2030. The safeguard reforms will not prohibit new gas developments, but existing gas projects covered under the safeguard mechanism will be required to reduce their net emissions through purchase of safeguard mechanism credit units (SMCs) and Australian Carbon Credit Units (ACCUs).

Implications of gas market reforms

The implications of gas market reforms will be limited in 2023 (assuming normal weather conditions) with a large share of demand contracted through GSAs prior to this year. However, the extension of the ADGSM and renewal of the HOA will provide assurances to domestic consumers that the east coast LNG projects will help ensure adequate supply to the domestic market through the deferral of some spot cargoes, and the 2023 gas price caps will limit the upside risk to domestic gas prices in the event of a spike in domestic gas demand. Nevertheless, the long-term impact of decisions made by the new government in the wake of rising gas prices in 2022 and to support emissions reduction targets could have long-lasting implications on upstream investment and place Australia's reputation as a reliable and secure supplier of energy at risk in the international market.

Upstream implications: Companies express concern about new supplies

In terms of implications for the upstream industry in Australia, a lot of energy company response has been focused on the gas price caps. For those that have made public comment, there has been recognition of the fact the caps won't have immediate impacts due to contracts already made, but the underlying message is of widespread condemnation for the plans. The fears are that the cap will lessen the attractiveness of Australian hydrocarbons and lead to a lack of investment for reserve replacement and future supply, leading the country towards later shortfalls. There is the opinion that to tackle a high gas price market, more supply is the correct solution.

LNG export implications: Minimal short-term impact, but net-zero requirement will affect projects

Impacts on LNG exports in the short term from these reforms are expected to be minimal. It is now expected that the government will not impose curbs on LNG exporters from Queensland in 2023 as suppliers both forecast increased production and committed to make more supply available into the domestic market to avoid shortfalls. The new ADGSM reforms, specifically Section 10, which gives the government the authority to divert contracted LNG supplies to the domestic market, could affect newer contracts that did not underpin FID of the plant. This may have more medium-term effects as while it would not affect any current contracts, it may deter suppliers from signing new sales purchase agreements (SPAs) with larger volumes in the mid-2030s as they would be responsible for the risk of failing to meet contractual obligations to their offtakers.

The larger implication for LNG exports lies in the safeguard mechanism's conditions on new fields for both existing and new LNG projects that may add significantly to exporters costs, which will be difficult to pass onto buyers in a competitive market. Once the safeguard reforms are implemented in July 2023, new upstream developments will effectively be net-zero from first gas while existing projects will be required to reduce net emissions starting in 2024.

Domestic market implications: Strengthened terms to ensure security of supply

Despite the track record of east coast LNG operators adhering to the HOA and diverting supply to the domestic market, the extension of the ADGSM and renegotiated HOA have helped provide additional certainty for the availability of domestic supply in 2023. In addition, the voluntary code of conduct was seen by end users as a first step in providing much-needed transparency and establishing standard guidelines to assist in the negotiation of GSAs with terms often dictated by suppliers.

The most significant implications for the domestic market in the near term arise from the uncertainty surrounding the impending mandatory code of conduct and the reasonable pricing provision. End users have noted the reluctance for suppliers to enter negotiations which could expose consumers to additional spot market risks if they are unable to secure supply agreements.

In the long term, the threat of export controls will continue to provide some certainty to the availability of supply in Queensland but reduced upstream investment that could arise from the final version of the Mandatory Code of Conduct and increased costs associated to reducing emissions (as mandated by the safeguard mechanism) could lead to higher domestic prices. Furthermore, the reforms do not alleviate growing supply concerns for the Southeast markets where supply gaps are expected to emerge by 2026 owing to declines in legacy production and limited pipeline capacity into the region.

Learn more about our energy research across the Asia-Pacific region.

Logan Reese, an associate director with the Gas, Power, and Climate Solutions team at S&P Global Commodity Insights, covers the gas, power, and renewables markets in Australia, focusing on market fundamentals, power and renewable developments, and policy developments.

William Plampton, Technical Research Associate Director for the Australasia Regional team at S&P Global Commodity Insights, is responsible for the editorial and data content of GEPS for Australia is expertise and technical analysis are focused on the fields and prospects database modules.

Greg McAndrews, a research analyst with the Global LNG team at S&P Global Commodity Insights, focuses on markets, companies, and both liquefaction and regasification projects across East Asia (particularly mainland China), South Asia, and Oceania.

Posted on 27 April 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freforms-reshape-the-australian-gas-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freforms-reshape-the-australian-gas-market.html&text=Reforms+reshape+the+Australian+gas+market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freforms-reshape-the-australian-gas-market.html","enabled":true},{"name":"email","url":"?subject=Reforms reshape the Australian gas market | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freforms-reshape-the-australian-gas-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Reforms+reshape+the+Australian+gas+market+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2freforms-reshape-the-australian-gas-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}