Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

INFOGRAPHIC

Oct 16, 2023

Stormy Seas Ahead for US Offshore Wind

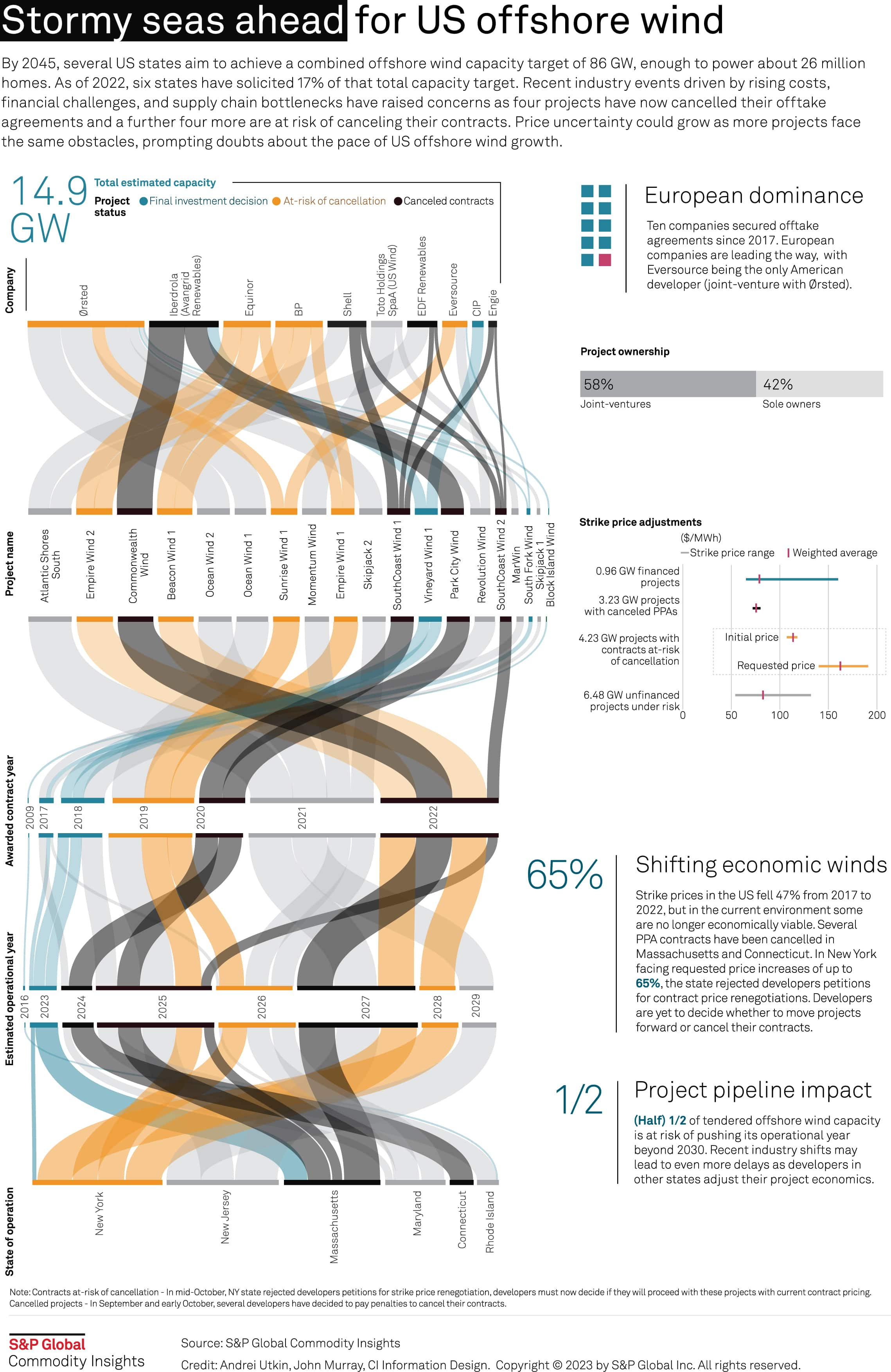

The offshore wind industry is expected to become a major contributor to the United States' net-zero emissions goal by 2050. The country aims to have 30 GW in operation by 2030 and at least 110 GW by 2050. This is a significant push as only 42 MW are currently operational, and the first major project is under construction. To achieve these lofty ambitions, 10 states have already leased a total of nearly 2.5 million acres for future projects, 6 of them having tendered 14.9 GW of capacity.

However, a perfect storm of rising costs, permitting delays and transmission grid issues has put projects under pressure, challenging the rapid deployment of offshore wind in the United States. Higher than expected costs have put many contracted projects below their breakeven point. The cost of financing has been significantly affected by high inflation and consequent rising interest rates, while high raw material prices and supply chain delays have translated into capex increases. As a result, more than half of the contracted projects are trying to renegotiate or cancel their contracts, in order to get higher strike prices in future tenders.

By October 2023, the combined canceled and revised capacity has mounted to 7.5 GW - half of what has been solicited so far. But even more projects are at risk as they were auctioned at similar prices, which are no longer economically viable.

States and most developers are viewing these increasing costs and price adjustments as short-term growing pains of a nascent industry. Optimism remains due to the expected long-term economic benefits of developing offshore wind capacity. These include green jobs creation, increased investment in domestic manufacturing, and the ability to offer large amounts of clean and consistent energy, close to high electricity consumption areas. However, to overcome current hurdles, authorities, developers and the supply chain will have to work closely and openly. How quickly the industry can get back on the cost reduction track will determine if the US meets its 2030 ambitions.

For more information regarding our onshore or offshore wind market coverage within our Clean Energy Technology service, please click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstormy-seas-ahead-for-us-offshore-wind.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstormy-seas-ahead-for-us-offshore-wind.html&text=Stormy+Seas+Ahead+for+US+Offshore+Wind+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstormy-seas-ahead-for-us-offshore-wind.html","enabled":true},{"name":"email","url":"?subject=Stormy Seas Ahead for US Offshore Wind | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstormy-seas-ahead-for-us-offshore-wind.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Stormy+Seas+Ahead+for+US+Offshore+Wind+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fstormy-seas-ahead-for-us-offshore-wind.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}