Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 23, 2023

Sustaining momentum with the Malaysia Bid Round 2023

The Malaysia Bid Round 2023 (MBR 2023) was officially launched on 15 February 2023 with ten exploration blocks and two Discovered Resource Opportunities (DRO) clusters being offered. This comes after a successful MBR 2022 in which 12 out of the 21 opportunities on offer were awarded and new players entered. In this piece, we highlight some of the contributing factors to the success of the recent bid rounds and the key signposts that we will be looking out for in 2023.

Malaysia Bid Round 2022 (MBR 2022)

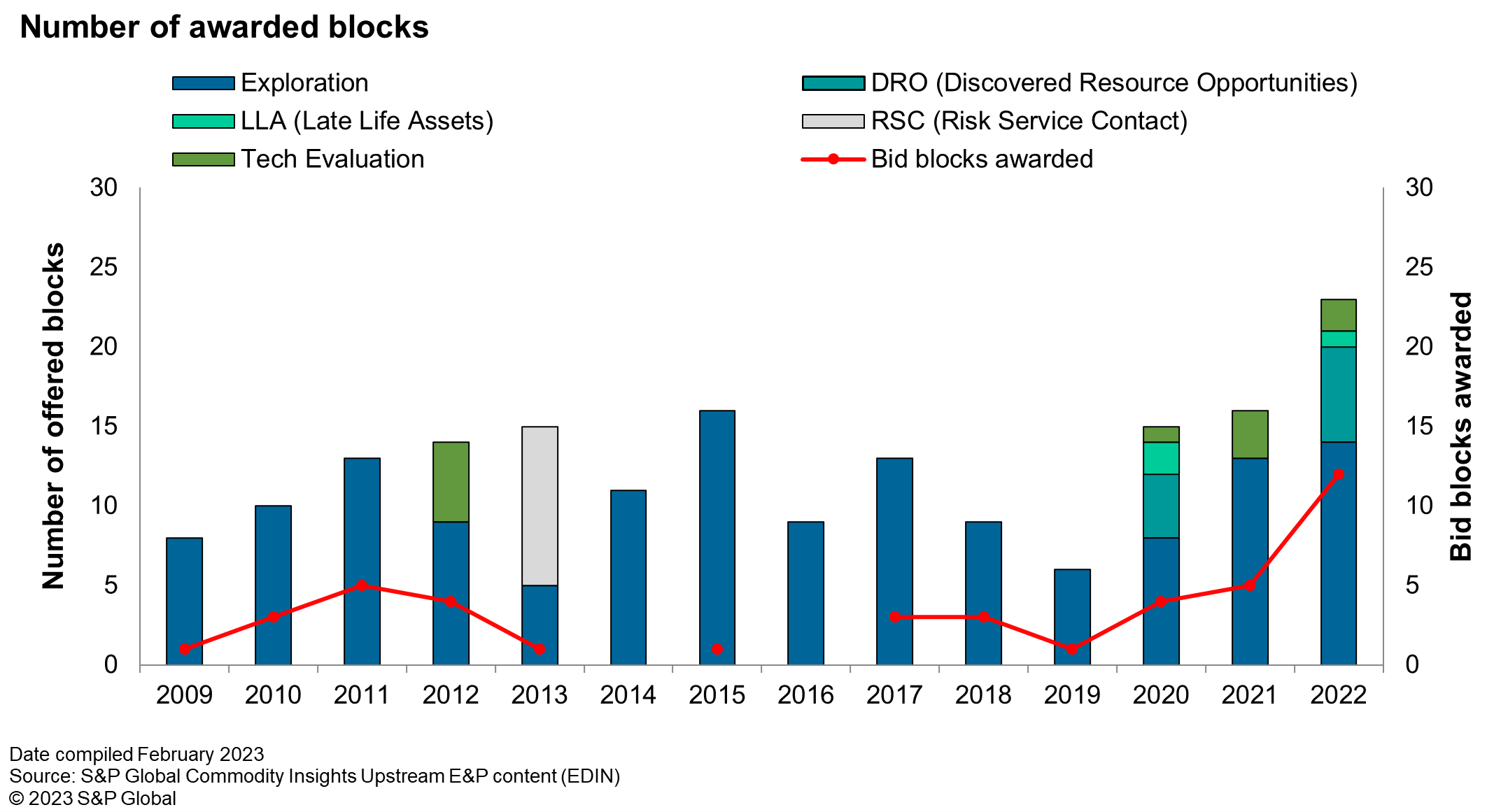

Figure 1. Offered and new awards in Malaysia from 2009 to 2022.

Nine out of the 14 offered exploration blocks and three out of the six DROs on offer were awarded in MBR 2022, which represents the highest number of awards since 2009. An increasing trend in terms of bid round awards is seen beginning 2020 (Figure 1).

MBR 2022 saw the return of INPEX as an explorer in Malaysia with both operating and participating stakes in Blocks 4E and SK-418, respectively. INPEX previously held stakes in deep water Sabah with Block R and Block S. Aside from INPEX, there were also additional entrants in exploration with Norway-based Longboat Energy and UK-based Topaz Number One taking Block SK-2A in deep water Sarawak while local company Skye UMDP Exploration picked up block PM-340 in the shallow water Peninsular Malaysia. For DROs, we have local player Ping Petroleum as a new player getting the A Cluster and Meranti Cluster.

Existing players have also expanded positions from this round. Dialog took on its first operated block in the country with the Baram Junior DRO cluster. PTTEP and Shell, both of which had recent exploration success and upcoming key gas developments in Sarawak, built up their position in this basin by picking up interests in SK-325 and SK-3B, respectively.

Some of this success can be attributed to the savvy adoption of digital technology with the onset of the pandemic when PETRONAS launched its first virtual bid round event in Malaysia Bid Round 2021 (MBR 2021). However, much of this success can be attributed to the following:

- Improved fiscal terms with the introduction of the Enhanced Profitability Terms (EPT) for shallow water exploration blocks in MBR 2021, which simplified the structure with the removal of the supplementary payments and the National Oil Company (NOC) carry amongst other enhancements. The Small Field Assets (SFA) PSC was introduced in 2020 for DROs and was designed to incentivise the monetisation of marginal fields. While the 2018 Deepwater R/C PSC moved away from the previous production-based profits splits.

- A string of successful discoveries in the mature Balingian, Central Luconia and Baram Delta basins demonstrated that there was still compelling remaining potential in these basins. Frontier deep water exploration is also emerging with the Tepat discovery and recent appraisal in the Northwest Sabah Trough. More high impact wells in this basin are planned. In 2022, six new field wildcat successes in the country contributed approximately 380 MMboe discovered resources.

- De-risking through multi-client 3D seismic and full tensor gradiometry (FTG). Which has allowed the ability to re-map prospects through these new regional surveys.

- Availability of E&P data through its myPROdata subscription service. Core samples can also be viewed virtually via the newly launched platform, myCORE360.

- The role of Malaysia Petroleum Management (MPM), the unit of PETRONAS responsible for the bid rounds, which has been responsive to feedback from the industry as well as proactively reaching out and marketing to a wider universe of potential bidders.

Malaysia Bid Round 2023 (MBR 2023)

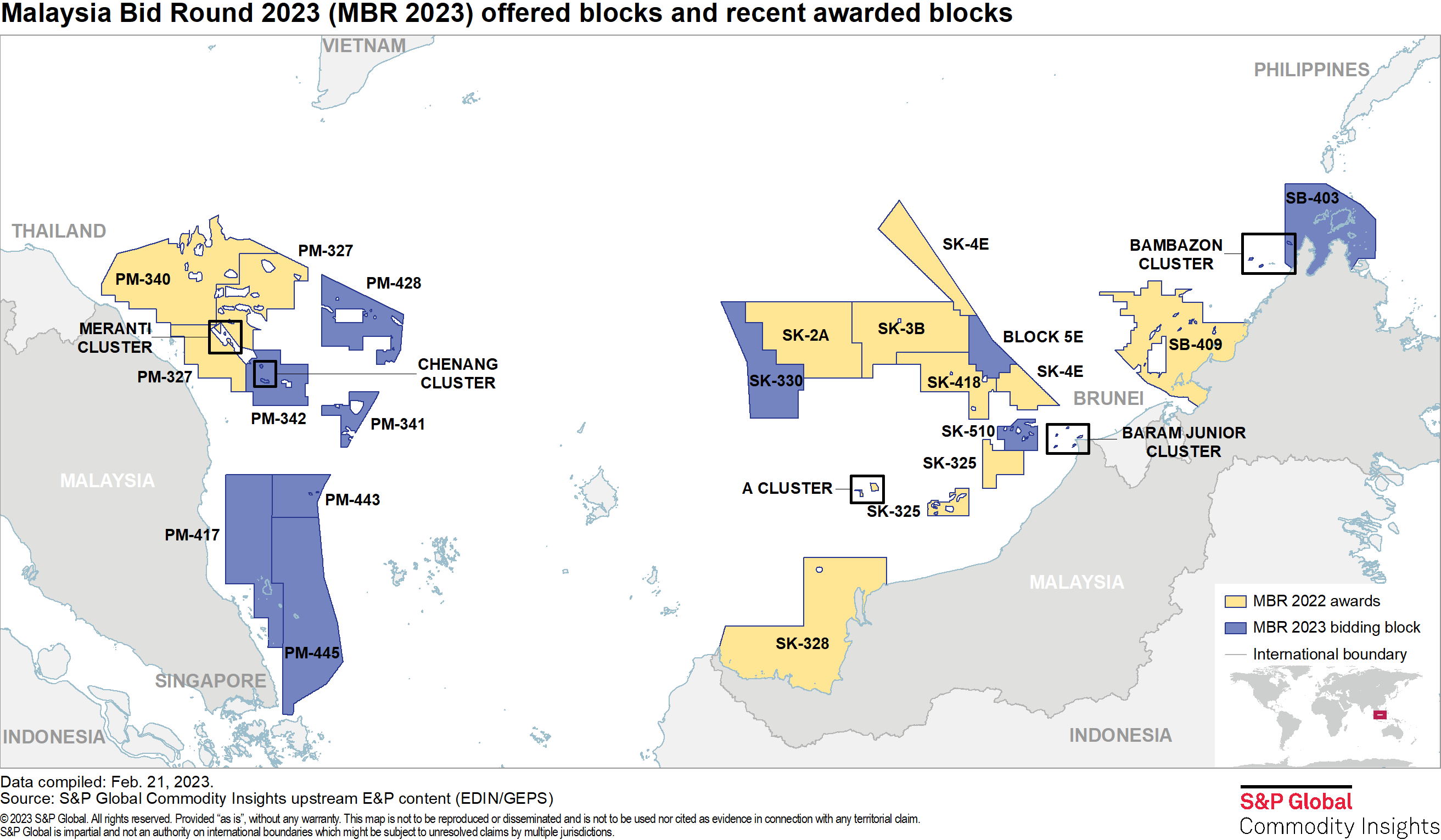

The launch of MBR 2023 saw ten exploration blocks and two DROs (Discovered Resources Opportunities) clusters being offered, with a mixture of frontier to mature basins (Figure 2). Six of the exploration blocks are located in offshore Peninsular Malaysia (PM-341, PM-342, PM-417, PM-428, PM-443 and PM-445), three blocks are in shallow to deepwater Sarawak (SK-330, SK-510 and 5E) and one block is in shallow water Sabah (SB-403). The available DROs include the Chenang Cluster in offshore Peninsular Malaysia and Bambazon Cluster in shallow water Sabah.

How well received this round will be will depend on multiple factors. Here are some of the signposts we will be watching out for in 2023:

- Between 25 to 30 exploration wells planned, impactful wells include PETRONAS Carigali's Layang-Layang 1 in the Northwest Sabah Trough.

- The DRO cluster offers opportunity for early monetization. It offers a lower development cost due to shorter distance of tie-in, availability of ullage at production hubs to accommodate the production from the cluster and multiple tie-in hubs will allow concurrent or independent developments. Progress realization would be key on the Diwangsa Cluster and Rhu-Ara DRO clusters which were offered in MBR 2020 and awarded to Rex International Holdings Ltd.

- Final Investment Decision (FID) on the Lang Lebah development which would form part of the Sarawak Integrated Sour Gas Evacuation System (SISGES). The development hub would serve as a monetisation path for any sour gas discoveries offshore Sarawak.

- Malaysia holds significant potential for CO2 storage sites (more on this below). However, more clarity on the regulations surrounding carbon storage is required. A carbon tax has been mooted while the previous draft of Malaysia's Budget 2023 included tax incentives for carbon capture and storage projects. Bursa Carbon Exchange (BCX), a voluntary carbon market was introduced to enable companies to trade voluntary carbon credits from their projects and solutions to offset emissions footprints and meet their climate targets. The first trade auction is targeted to commence in March 2023.

Figure 2. MBR 2023 offered blocks and DROs.

Carbon Capture and Storage (CCS) Potential

CCS has been identified as an integral component for PETRONAS to achieve net zero carbon emissions by 2050. Aside from anchor CCS projects linked to key gas developments, PETRONAS has now offered parties to do an initial assessment for CO2 storage in the three offered blocks in the Penyu Basin. This will support PETRONAS in building its storage portfolio wherein it has already conducted initial capacity assessment of depleted oil and gas fields. This was showcased in last year's bidding round. Approximately 9 Tcf of CO2 (504 Mil tCO2eq) could be stored in the Jerneh, Lawit, Bintang, Resak, and Duyong fields in Peninsular Malaysia. In addition to that, 37 Tcf of CO2 (2,072 Mil tCO2eq) could be sequestered in M1, M3, M4, Jintan, Saderi, Serai, B11, B12, F6, F23, K5, and Golok fields in Sarawak.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsustaining-momentum-with-the-malaysia-bid-round-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsustaining-momentum-with-the-malaysia-bid-round-2023.html&text=Sustaining+momentum+with+the+Malaysia+Bid+Round+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsustaining-momentum-with-the-malaysia-bid-round-2023.html","enabled":true},{"name":"email","url":"?subject=Sustaining momentum with the Malaysia Bid Round 2023 | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsustaining-momentum-with-the-malaysia-bid-round-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sustaining+momentum+with+the+Malaysia+Bid+Round+2023+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fsustaining-momentum-with-the-malaysia-bid-round-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}