Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 15, 2020

The demand for refined products is dropping globally due to COVID-19, leading to run cuts at refineries; shut-downs are inevitable as utilization rates at some units drop to 60%

Recent developments involving OPEC and COVID-19 have caused a historic downturn in global oil prices and national economies. This downturn is remarkable not only for its speed but also how it is causing different parts of the energy industry to react simultaneously, particularly the downstream sector.

Usually drops in oil prices are excellent news for downstream companies since they benefit greatly from reduced input costs. However, this current downturn is affecting both the commodity supply and demand sides and therefore negating that expected upside. Indeed, oil prices dropped owing to lingering oversupply but more importantly because of severe drops in the demand for products derived from that oil, such as gasoline, diesel and jet fuel.

As a result, while historically low oil prices would usually increase refinery activity, we are now seeing units become heavily under-utilized (perhaps even shutting down completely), leading to drops in costs for the equipment and labor needed to build them.

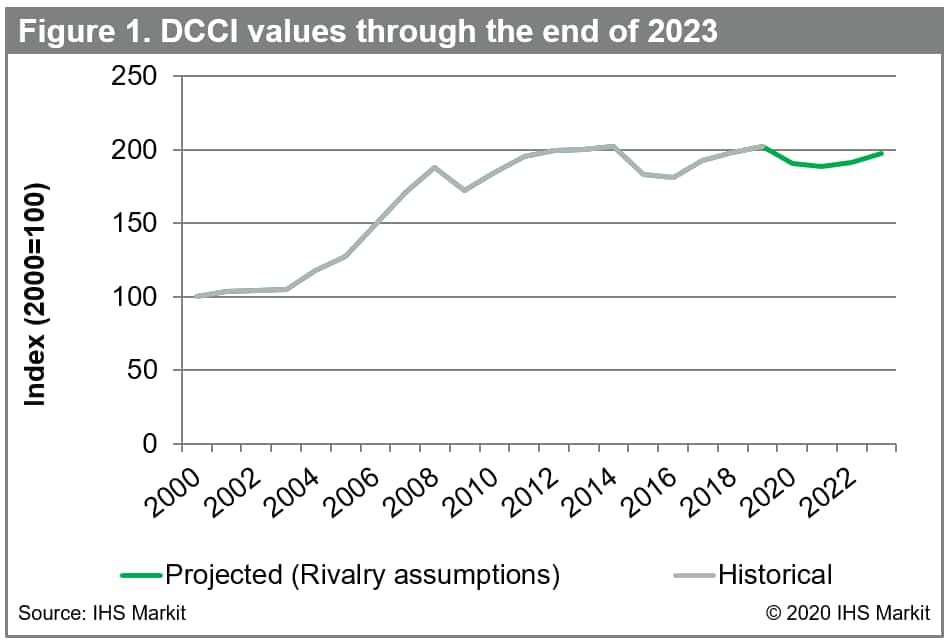

The Downstream Capital Cost Index (DCCI) tracks refinery construction costs around the world, and in response to the historic downturn of the past few weeks we performed cost analyses under three distinct scenarios. The "Rivalry" base case assumes, among other conditions, that new, global COVID-19 cases will peak by mid-second quarter 2020 and that Brent crude prices will generally be in the $10-$30/bbl range for the rest of 2020, rising to $30-$40/bbl in 2021 as demand growth returns.

Even though the presence of a base case inherently implies we have modeled a lower scenario, the foundational assumptions are still very bearish and indeed we project that the DCCI will fall 6% and 1% in 2020 and 2021 respectively from its Q4 2019 value of 203 as a result of recent developments (figure 1).

Figure 1: DCCI values through the end of 2023

Turning now to the individual markets of the DCCI, we have summarized their state below and full assessments are in the latest report.

- Construction labor: A prolonged period of low oil prices, lasting two or more quarters, would lead to a greater chance of decreased employment and wages in the downstream sector.

- Equipment: Not all equipment sectors will be affected equally since the oil and gas sector's share of the overall market varies. However, lower demand will lead to deferment of several downstream projects which will adversely affect suppliers, especially specialized equipment manufacturers.

- Steel: Buyers have been shifting to spot purchases as it is preferable to buy just-in-time as opposed to stockpiling supply in an environment where prices could be cheaper in the future.

- Engineering and project management (EPM): Smaller lump-sum contracts are expected in the short-term and more cost controls are expected in all regions of the world.

- Electrical and instrumentation: Even a short-term drop in oil prices, lasting one quarter or less, would contribute to slowing demand for building materials in the energy sector.

- Civil and construction: The downstream civil and construction material market is expected to experience a price decline immediately following the oil price collapse in early March 2020.

Find out more about Downstream Costs & Expenditures and contact us for questions about this research.

Jeff Otten is a Principal Research Analyst working

within the Costs and Technology team at IHS Markit.

Pritesh Patel is an Executive Director for Upstream Energy

at IHS Markit.

Posted 15 April 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-demand-for-refined-products-is-dropping-globally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-demand-for-refined-products-is-dropping-globally.html&text=The+demand+for+refined+products+is+dropping+globally+due+to+COVID-19%2c+leading+to+run+cuts+at+refineries%3b+shut-downs+are+inevitable+as+utilization+rates+at+some+units+drop+to+60%25+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-demand-for-refined-products-is-dropping-globally.html","enabled":true},{"name":"email","url":"?subject=The demand for refined products is dropping globally due to COVID-19, leading to run cuts at refineries; shut-downs are inevitable as utilization rates at some units drop to 60% | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-demand-for-refined-products-is-dropping-globally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+demand+for+refined+products+is+dropping+globally+due+to+COVID-19%2c+leading+to+run+cuts+at+refineries%3b+shut-downs+are+inevitable+as+utilization+rates+at+some+units+drop+to+60%25+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fthe-demand-for-refined-products-is-dropping-globally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}