Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 26, 2020

US election implications for a clean energy transition in the power sector

The Democratic presidential nominee has put forth a far-reaching US decarbonization plan, seeking to eliminate emissions from the power sector by 2035 and the economy as a whole by 2050. The ambitious "Biden Plan" released this summer was framed in the context of job creation and infrastructure investments, but envisioned a much more rapid energy transition than most policy proposals over the past decade. President Donald J Trump, on the other hand, would likely continue to further an agenda of relaxing environmental regulations and supporting fossil resource production and use.

Both policy platforms face a variety of implementation and efficacy challenges. The makeup of the US Congress will, of course, factor into policies requiring enabling legislation. While the long term goals of the Biden Plan would dramatically reshape how energy is produced and used (with many parallels to our Fast Transition scenario), there are several more focused and specific federal policy changes that could plausibly emerge early in a Biden administration. Only some would necessitate a supportive Congress. The most impactful early prospects include:

- Regulatory appointments would likely reduce hurdles for states pursuing their own clean energy agendas. Offshore wind and some onshore renewable development driven by state policies can be influenced by those appointed to key federal positions, most notably at the Bureau of Ocean Energy Management (BOEM) and the Federal Energy Regulatory Commission (FERC). BOEM permit delays have slowed the progress of two notable offshore wind projects on the east coast, a course likely to be altered under a Biden administration. Some recent FERC rulings have the potential to challenge the states' pursuit of renewable energy goals at the lowest cost. If elected, Biden would appoint a new chair in 2021, and a FERC with a Democratic majority would likely be substantially more accommodative of state policies than the current FERC.

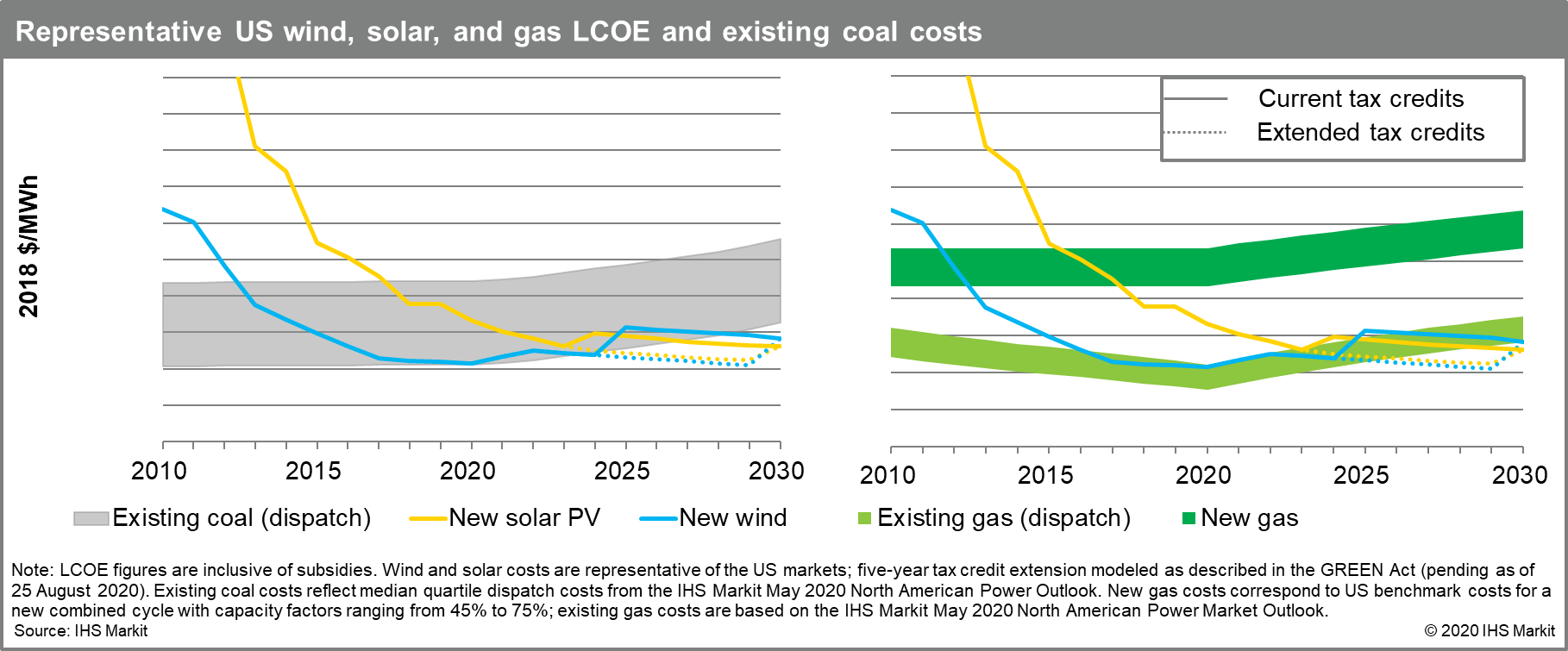

- Tax credit extensions would increase already significant wind and solar growth expectations. Congressional extension of tax credits to wind and solar resources —similar to what has been included in recent legislative proposals such as the GREEN Act—would increase IHS Markit's outlook for new supply by roughly 40% over current expectations for the 2024-29 period.

- A number of other policy actions would have more material impacts but not before 2030. A Biden administration would likely reverse course on federal land drilling, attempt to tighten the regulation of greenhouse gas (GHG) emissions from fossil-fueled power generation, and accelerate decarbonization of nonpower sectors. A focus on deploying advanced heating and cooling systems could have significant upside for both natural gas and electricity consumption, but would likely take the better part of a decade to result in truly meaningful changes to annual consumption. Another aspect of Biden's energy policy vision to achieve net-zero economy-wide emissions by 2050 would be to encourage adoption of zero emissions vehicles (ZEV). Biden's platform includes a plan to support building 500,000 electric-vehicle (EV) charging stations to help kickstart this transition. Perhaps more importantly, a Biden administration would also likely move to reinstate California's waiver to set its own fuel economy standards and accommodate state policies in other regards.

These policies established early in a Biden term would be of foundational importance to a long-term energy transition, although significant impacts would be unlikely to emerge until the 2030s and would require ongoing policy support.

Learn more about our North American power research.

Patrick Luckow, an associate director of IHS Markit Gas, Power, and Energy Futures, focuses on regional and national carbon policy and associated markets, including the Regional Greenhouse Gas Initiative and the linked, economy-wide greenhouse gas markets in California and Quebec.

Posted on 26 October 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-election-implications-for-a-clean-energy-transition-power.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-election-implications-for-a-clean-energy-transition-power.html&text=US+election+implications+for+a+clean+energy+transition+in+the+power+sector++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-election-implications-for-a-clean-energy-transition-power.html","enabled":true},{"name":"email","url":"?subject=US election implications for a clean energy transition in the power sector | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-election-implications-for-a-clean-energy-transition-power.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+election+implications+for+a+clean+energy+transition+in+the+power+sector++%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-election-implications-for-a-clean-energy-transition-power.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}