Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 11, 2020

US utilities follow a “shift to safety” strategy

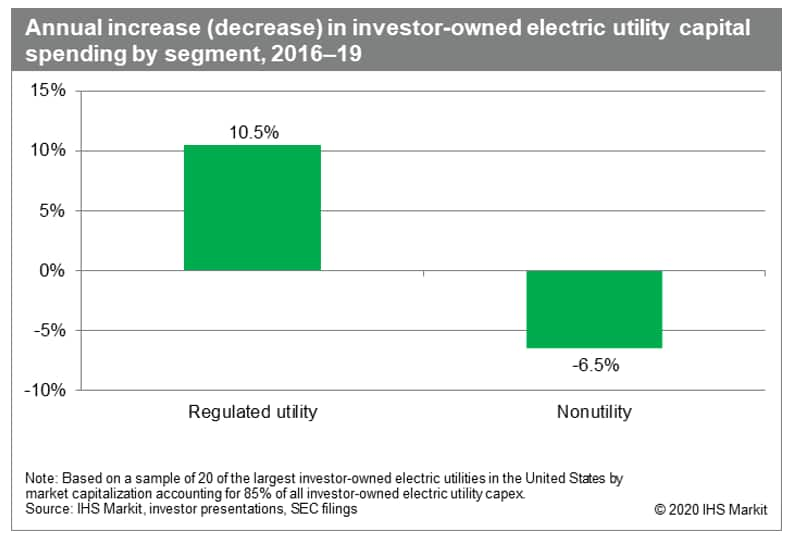

In recent years, many US utilities have begun to follow a "shift to safety" strategy by rapidly shifting shares of capital spending away from competitive ventures and toward safer, state-regulated utility projects. Between 2016 and 2019, capital spending on state-regulated utility projects increased 10.5% per year, while utility capital spending on nonutility projects fell 6.5% per year (see Figure 1).

The trend toward safety is likely to continue, as major announcements in 2020 from Avangrid (PNM Resources acquisition), DTE Energy (plans to spin-off midstream natural gas business) and PSEG (plans to divest nonnuclear competitive generation) all reflect an increase in strategic emphasis on regulated electric and gas utility operations.

Figure 1: Annual increase/decrease in investor-owned electric utility capital spending by segment, 2016- 19

Driving the shift to safety

A key factor driving the shift to safety is the rising risks and weakness associated with competitive, nonutility investments. In recent years, utilities that have followed a shift to safety had the lowest overall shareholder returns, indicating that underperformance, in many cases driven by nonutility projects, forced a change in strategic focus.

Another factor driving the shift to safety is the relative stability and consistency of regulated utility investment opportunities and returns. Over the past two decades, capital spending on regulated utility infrastructure projects has grown steadily, averaging 3 percent per year in real terms. At the same time, the average approved return on equity for regulated utility gas and electric infrastructure projects has been remarkably steady.

Outlook for the shift to safety

Utilities that follow the shift to safety strategy will likely enhance the stability and predictability of capital spending and the associated returns. Analyses from IHS Markit suggest that a successful transition to a largely regulated utility will boost shareholder returns, at least in the near-term.

The shift to safety strategy reveals a bet that existing utility franchises can sustain earnings growth for many years. Organic growth has been robust in recent years and utilities anticipate spending more on their existing utility franchises over the next several years, driven by upgrades of aging assets, system hardening, transitioning power generation fleets to cleaner energy resources and demand growth (in certain regions).

For now, the shift to safety looks to be a good bet for most utilities. But there is a potential for a new set of risk factors, like customer affordability or state regulatory changes, to disrupt the cover of safety provided by a fully regulated strategy.

Learn more about our global power and renewable services.

Current clients can access the full report in IHS Markit Connect.

Ben Levitt is Associate Director of Research and Analysis on the global power and renewable team.

Posted 11 Nov 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-utilities-follow-a-shift-to-safety-strategy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-utilities-follow-a-shift-to-safety-strategy.html&text=US+utilities+follow+a+%e2%80%9cshift+to+safety%e2%80%9d+strategy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-utilities-follow-a-shift-to-safety-strategy.html","enabled":true},{"name":"email","url":"?subject=US utilities follow a “shift to safety” strategy | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-utilities-follow-a-shift-to-safety-strategy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+utilities+follow+a+%e2%80%9cshift+to+safety%e2%80%9d+strategy+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fus-utilities-follow-a-shift-to-safety-strategy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}