Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 31, 2022

Weekly Pricing Pulse: Natural gas spike offsets otherwise weak commodity pricing

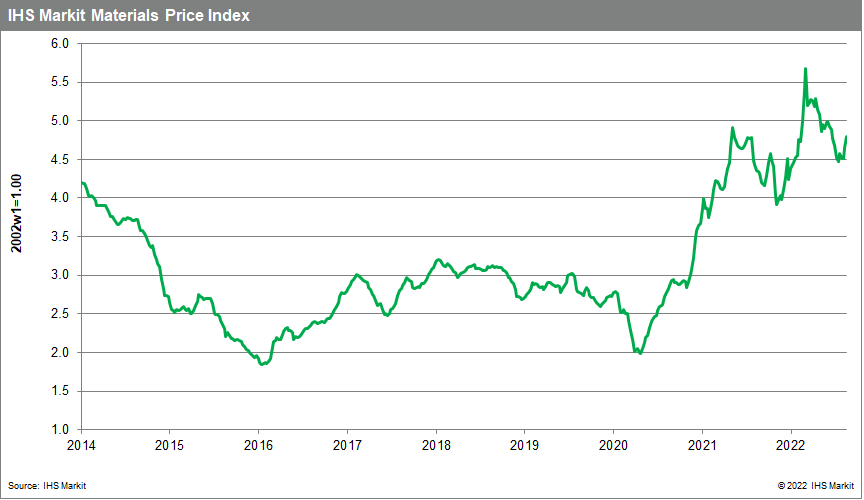

Our Materials Price Index (MPI) rose 2.9% last week, marking back-to-back weekly increases near 3% for the first time since early March. The recovery in prices was almost entirely driven by the energy component, however, with seven out of the index's ten subcomponents either decreasing or remaining flat. Even though the MPI jumped strongly last week, it is still 15.5% below its all-time high established in early March.

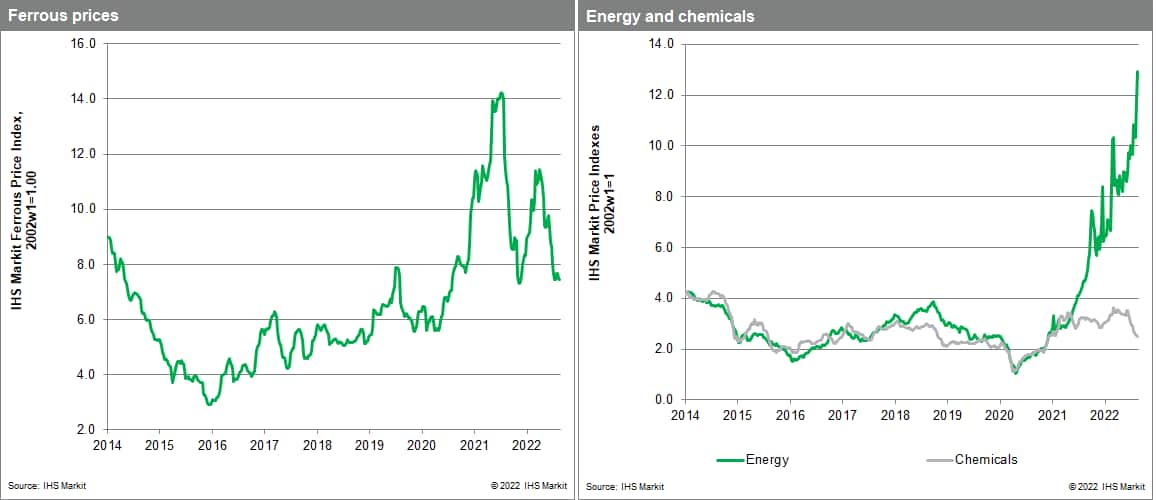

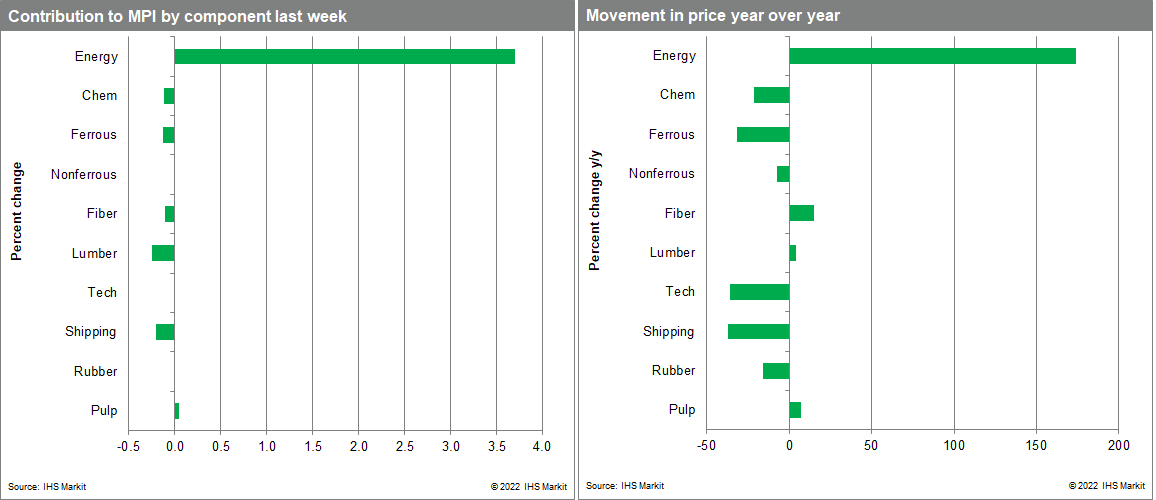

Energy prices again pushed the overall MPI higher, posting a 9.8% increase just one week after a 14% jump. Non-energy prices were in fact down by 1.2% last week and are down 31% since the first week of March. Natural gas was again the main story as strong demand in Europe, amid an uncertain supply outlook, and Asia, dealing with a heat wave, drove spot prices of liquefied natural gas (LNG) to $70/MMBtu. Reflecting the stark contrast between energy prices and other commodity prices, the gap between the headline MPI and the MPI ex-energy is at an all time high, dating back to 1996. On the opposite end of the spectrum, lumber prices slid 10.9% last week as housing starts and permits in the US continue to retreat. The freight rate subcomponent also moved significantly lower last week as demand for iron ore imports into mainland China has cooled. The freight index is a four-week moving average of rates of ships carrying ores from Australia and Brazil to mainland China. The subcomponent has declined in 11 of the past 12 weeks.

There are multiple macroeconomic factors pointing to downward pressures on industrial materials prices, with energy as the wildcard. This past weekend, central bankers reinforced their commitment to fighting inflation, suggesting financial conditions will continue to tighten into 2023 and remain tight through much of next year dashing market hopes that conditions could begin to ease as early as next spring. The mainland Chinese economy also continues to show softness due to ongoing containment measures as part of the "zero-COVID" policy. Moreover, policymakers are signaling that they are willing to sacrifice growth in order to maintain the zero-Covid policy due to public health concerns. In Europe, energy shortages and skyrocketing prices threaten to push the eurozone into a recession in the fourth quarter of 2022. Notwithstanding the rise in the MPI over the last two weeks, with central banks aggressively tightening financial conditions, global economic growth slowing, and supply chains bottlenecks easing, inflation is peaking.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fweekly-pricing-pulse-natural-gas-spike-offsets-weak-price.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fweekly-pricing-pulse-natural-gas-spike-offsets-weak-price.html&text=Weekly+Pricing+Pulse%3a+Natural+gas+spike+offsets+otherwise+weak+commodity+pricing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fweekly-pricing-pulse-natural-gas-spike-offsets-weak-price.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Natural gas spike offsets otherwise weak commodity pricing | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fweekly-pricing-pulse-natural-gas-spike-offsets-weak-price.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Natural+gas+spike+offsets+otherwise+weak+commodity+pricing+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fweekly-pricing-pulse-natural-gas-spike-offsets-weak-price.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}