Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 24, 2022

Restart or remain shuttered—Why rationalized US refineries will not come to the rescue

Despite President Biden's call on US refiners and the federal government to pull out all the stops to rescue US citizens from the high cost of gasoline, the US refining complex is currently running at full capacity and has few options to increase fuel production in the near term.

- Since June 2019, 1.482 MMb/d of refining capacity has been rationalized in the United States and Canada. Approximately 590,000 b/d was damaged in storms or refinery incidents and is not eligible for quick restart. Another 237,000 b/d was shut to convert to renewable diesel production. Approximately 375,000 b/d may be eligible for recommissioning but likely will remain shut. The cost of recommissioning could be significant, and the timing of the recommissioning is likely too late within the current window of opportunity.

- General market sentiment, our medium-term outlook included, is that the current high-margin environment will be fleeting. Recouping recommissioning costs will be difficult unless these strong margins are sustained beyond 2023. Refiners are unlikely to invest hundreds of millions of dollars in recommissioning costs for only one or two years of strong returns.

- Factors beyond economics have weighed into recent decisions to rationalize capacity. Some refineries were shut to lower corporate greenhouse gas emissions, while others were shut to convert to renewable diesel production facilities. These decisions were made at the corporate strategic level and will be difficult to reverse, even if the refineries are eligible for restart.

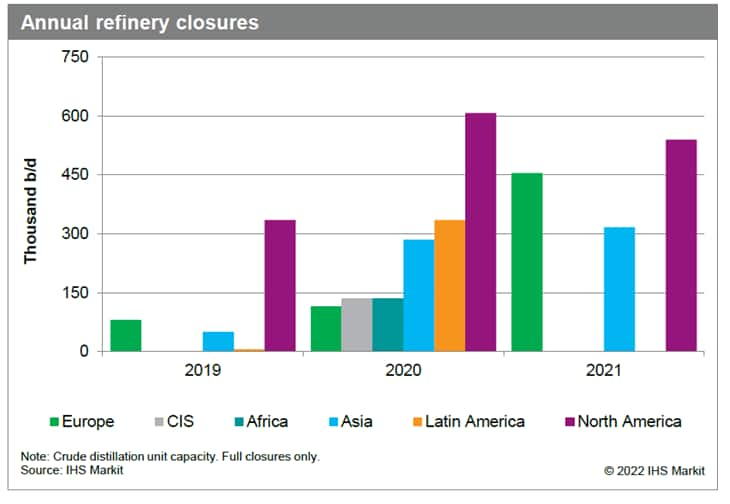

Figure 1: Annual refinery closures, 2019- 2021

Ask Susan or Debnil a question about the report.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhy-rationalized-us-refineries-will-not-come-to-the-rescue.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhy-rationalized-us-refineries-will-not-come-to-the-rescue.html&text=Restart+or+remain+shuttered%e2%80%94Why+rationalized+US+refineries+will+not+come+to+the+rescue+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhy-rationalized-us-refineries-will-not-come-to-the-rescue.html","enabled":true},{"name":"email","url":"?subject=Restart or remain shuttered—Why rationalized US refineries will not come to the rescue | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhy-rationalized-us-refineries-will-not-come-to-the-rescue.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Restart+or+remain+shuttered%e2%80%94Why+rationalized+US+refineries+will+not+come+to+the+rescue+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhy-rationalized-us-refineries-will-not-come-to-the-rescue.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}