Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 04, 2020

With US growth engine stalled, can other markets improve their ethane recovery?

Like crude oil, raw natural gas is a mixture of several different hydrocarbon components that can be separated out using specialized processing plants. One of the most important such components is ethane, which is a key feedstock for petrochemical and plastics production. Thanks to the surge in domestic oil and natural gas production over the past decade, the US has become by far the largest producer of ethane in the world - as well as the only significant waterborne exporter of the product. However, expected lower US oil and gas production going forward will have a corresponding impact on ethane output. For example, IHS Markit's current outlook for US ethane production in 2021 is 2.6 million b/d, down from a "pre-pandemic" forecast of around 3.0 million b/d that year.

There is a myriad of factors that influence how much ethane is actually recovered from a given hydrocarbon stream. At a minimum, specialized gas processing and fractionation plants are required to separate the various streams and pipelines are required to transport the resulting product to market. In regions where such infrastructure does not exist (or does not exist in sufficient capacity), the gas stream is simply flared at the field. Assuming the proper infrastructure does exist, the fraction of ethane recovered will still depend on the technical capabilities of the gas plant - as well as the processing economics. For example, a processor would not have an economic incentive to separate ethane from the gas stream if there is no readily accessible market for the product (e.g. a nearby ethane cracker). Even then, the relative pricing of pure ethane might not be high enough to support full extraction. And, of course, the ethane content of the raw gas stream naturally varies from region to region. That is, some streams are simply more "ethane-heavy" than others.

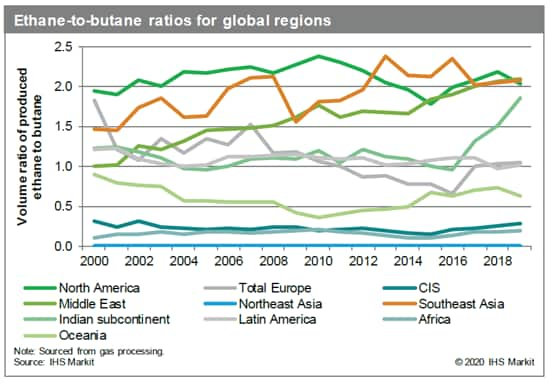

IHS Markit estimates there is a significant volume of ethane that goes unrecovered from gas streams around the world. This ethane is either flared at the field or simply left in the gas stream for consumption by the residential and power gen sectors. Actual data on the composition of the raw gas stream and/or the input stream for gas processing plants is lacking for most markets. That said, the ratio of ethane to butane produced can serve as a relatively reliable proxy for recovery rates. If this ratio is less than two-to-one, then the market in question is likely "under-recovering" the ethane in its gas stream.

Figure 1: Ethane-to-butane ratios for global regions

Using this methodology, IHS Markit estimates that most regions are not fully recovering their ethane. In Europe and Latin America, for example, the ratio is around one-to-one whereas in Africa and the CIS region, ethane production is less than half of butane production. And, importantly, the two-to-one ratio is a conservative target; the US average ethane-to-butane ratio is slightly above two-to-one but IHS Markit estimates that unrecovered ethane in the country is still as much as 1 million b/d. Thus, there is significant potential to increase global ethane production to offset the lower outlook within the US.

IHS Markit experts are available for consultation on the industries and subjects they specialize in. Meetings are virtual and can be tailored to focus on your areas of inquiry. Book in a consultation with Darryl Rogers and Walt Hart.

Darryl Rogers is a vice president and leads the global

natural gas liquids ("NGL") subscription products and midstream

consulting/advisory services business for IHS

Markit.

Keefer Douglas is a director for the Midstream Oil and NGLs

Research and Consulting team at IHS Markit.

Walt Hart is Vice President and Chief Strategist for Global

NGLs at IHS Markit.

Posted 04 August 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwith-us-growth-engine-stalled-can-other-markets-improve-ethane.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwith-us-growth-engine-stalled-can-other-markets-improve-ethane.html&text=With+US+growth+engine+stalled%2c+can+other+markets+improve+their+ethane+recovery%3f++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwith-us-growth-engine-stalled-can-other-markets-improve-ethane.html","enabled":true},{"name":"email","url":"?subject=With US growth engine stalled, can other markets improve their ethane recovery? | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwith-us-growth-engine-stalled-can-other-markets-improve-ethane.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=With+US+growth+engine+stalled%2c+can+other+markets+improve+their+ethane+recovery%3f++%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwith-us-growth-engine-stalled-can-other-markets-improve-ethane.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}