Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 17, 2022

OECD Asia Power and Renewables Market Briefing, Q2 2022: Power demand increases despite high commodity prices

Moderate power demand growth forecasted for Japan and South Korea for the next 12 months

IHS Markit Climate and Sustainability is pleased to bring you the OECD Asia Power and Renewables Market Briefing covering the second quarter 2022 for Australia, Japan and South Korea. In this publication, we have added short-term power forecasts for Japan and South Korea until H1 2023.

Electricity demand continues to increase in all three markets during Q1 2022 despite of the continued increasein wholesale power prices. High fuel costs continue to apply upward pressure to thermal generation fees, with unplanned thermal outages and increased weather-related demand upticks lifting prices to over 170% y/y in Japan and Australia during Q2 2022.

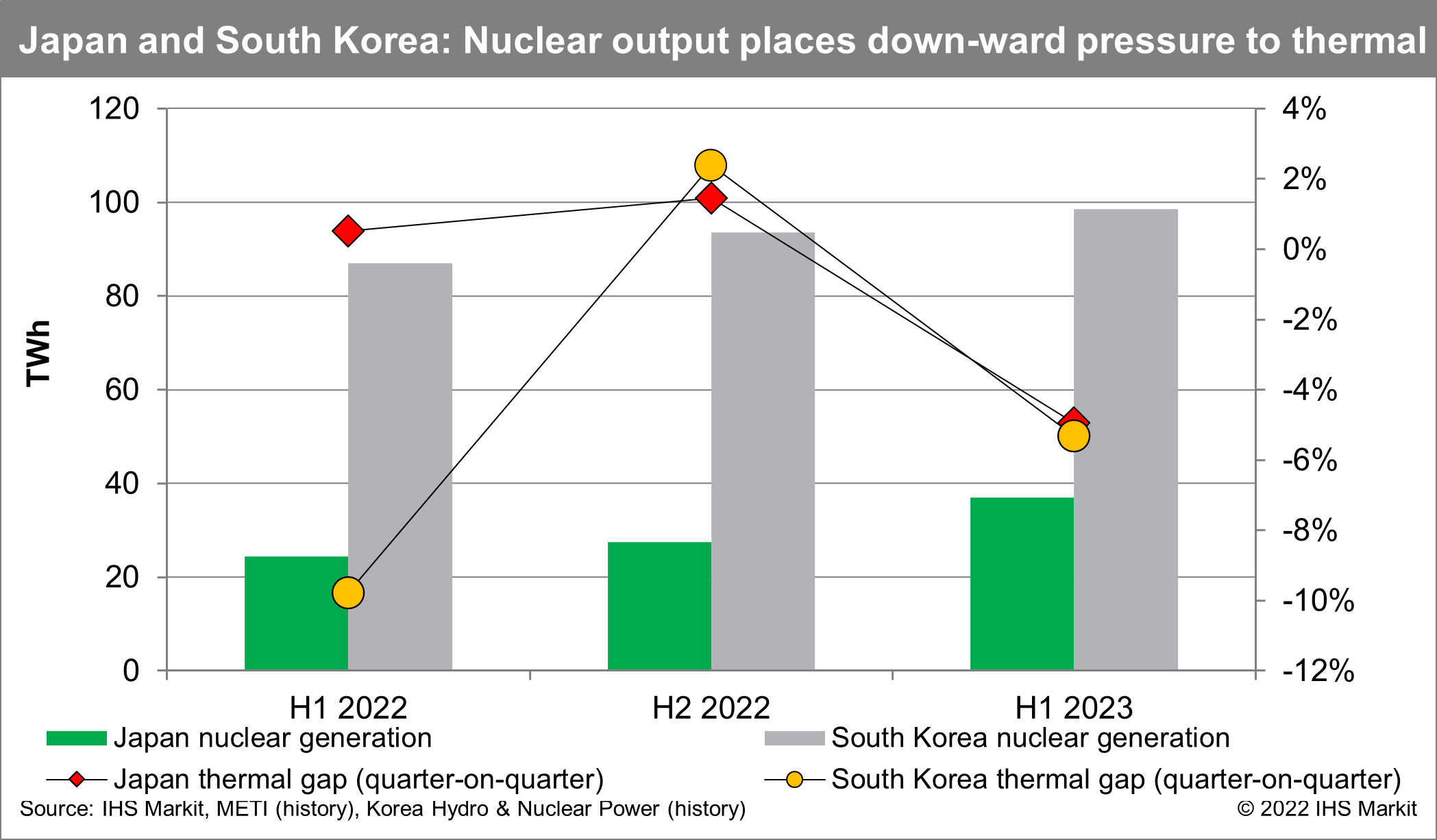

Our new short-term forecast indicate power demand will be modest in both Japan and South Korea. In Japan, higher nuclear output in H1 2023 will lead to a decrease in thermal power generation with coal taking the brunt of the decline. In South Korea, nuclear ouput is expected to increase consecutively with one new reactor coming online in 2023. The thermal gap will increase slightly during H2 2022 largely from higher out-put in coal-fired generation. However, higher nuclear capacity will again place down-ward pressure to the thermal gap in H1 2023.

As the the market faces new challenges, several new announcements and developments have been observed:

Australia

- On 23 May 2022, Anthony Albanese was sworn in as the 31st prime minister of Australia following a decisive victory of the Australian Labor Party over the Liberal-National Coalition, ending nine years of consecutive rule. Climate policy was at the forefront of the transition of power with the newly elected government committing to a national emission reduction target of 43% by 2030 and proposing a Powering Australia plan that would see renewables capture an 82% share of generation in the National Electricity Market (NEM) by 2030.

- On 30 June 2022, the Australian Energy Market Operator (AEMO) released the biannual Integrated System Plan (ISP) for the development of the NEM through 2050. The updated ISP optimal development path projects the retirement of the NEM coal fleet to be accelerated beyond the current schedule, with a complete phaseout of coal-fired capacity in the NEM by 2043. In addition, the ISP estimates renewable generation will capture an 83% market share by 2030, in line with the new governments Powering Australia plan. However, the high level of penetration of intermittent renewable capacity will require significant investment in firming supply such as energy storage and gas-fired capacity.

- From 15-24 June 2022, for the first time in history, the AEMO suspended the electricity spot market in the NEM as a last-resort emergency market-management mechanism to ensure supply security. AEMO's decision was a result of planned and unplanned thermal outages, an early onset of winter, fuel supply issues, and high fuel spot prices. The suspension of the market exposed vulnerabilities of power supply security to a decline in coal-fired generation and access to low-cost natural gas fuel supply.

Japan

- On 27th of June, the Ministry of Economy, Trade and Industry (METI) issued the 1st official warning that power balance in the Tokyo was at risk amidst extreme heat waves expected to hit the region. The warning was issued under the new power shortage alert system created after the March 2022 power crisis where yet again, Japan faced another power supply crisis this time due to an earthquake damaging several thermal power plants supplying the region (see IHS Markit insight report, accessible to customers only: Tokyo and Tohoku face blackout fears after Fukushima earthquake). While the crisis was averted through wheeling power from other regions and power conservation, power shortage is becoming a recurring issue in Japan due to lack of adequate thermal supply in demand centers, fuel supply, and limited inter-regional transmission capacity.

- Residential electricity prices continue to rise and is up 31% year on year (y/y) as commodity price reaches an all-time high. With many of the LNG contracts in Japan indexed to oil, residential power prices have been on the rise since commodity prices began to increase after H2 2021. rise. The August 2022 price calculation indicates a model residential household in the Tokyo region will have to pay an electricity bill that is 31% higher year on year (y/y), and is the highest level seen in the last five years.

- METI as announced a revised contractor evaluation process for bids under the Act of Promoting Utilization of Sea Areas in Development of Power Generation of Facilities using Marine Renewable Energy Resources" (herein, the Act). The revised contractor evaluation process will be weigh earlier commencement dates more heavily than before, and also ensures that lower cost alone does not overly favor the outcome of the selection process. The revised process will go through further evaluation inviting public comments and is scheduled to be finalized within this fiscal year. The bid for Akita-Happocho will be announced once the evaluation process is finalized.

- Looking twelve months ahead, Japan will see nuclear power generation increase consecutively every quarter. As power utilities continue to import LNG on mostly long-term contracts, IHS Markit does not expect large changes to gas-fired power generation. In the immediate future, operators have scheduled less maintenance than normal at gas-fired power plants, which allows for higher running of the gas fleet during the summer. Towards next summer, the forecast of lower spot LNG prices also supports sustained use of LNG for power generation. Gas-to-oil switching is unlikely to move much higher than current levels.

South Korea

- The state-owned utility KEPCO has been under significant financial pressure due to the surging crude and LNG import prices have lifted the wholesale power price (System Marginal Price) above retail tariffs since September 2021. As fuel prices are expected to remain elevated for at least 2022/23, KEPCO will likely raise retail tariff substantially through basic fuel costs in 2023, the only possible solution with no constraints on the annual price increase cap.

- Green premium has become the most attractive short-term procurement option, with 4.7 TWh of successful bids recorded in its latest auction in February 2022, up more than threefold compared with the previous year. However, the upward pressure in retail tariff will make corporate PPA economically attractive for electricity consumers in the long-term. Currently, a PPA price for corporate PPA (CPPA) has been set at a significant premium to other procurement options, mainly due to a high sleeved fee charged by KEPCO. However, CPPA price is shielded from a volatility in retail price and carbon price, which are all exposed to tight commodity markets. Since the country plans to continue to raise the retail tariff to address financial burden on KEPCO, CPPA will likely become the most cost competitive option before 2030 if retail rates increase 3% per year.

- Policy related closures of coal capacity are likely to take place during the upcoming winter, but the impact should not be higher than for the previous winter. This will allow for high coal burn during the peak winter demand period. As the thermal gap declines with higher nuclear output, the use of coal will decline less than gas.

Learn more about our coverage of the Asia Pacific energy research through our Asia-Pacific Regional Integrated Service.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fesg%2fs1%2fresearch-analysis%2foecd-asia-power-and-renewables-market-briefing-q2-2022-power.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fesg%2fs1%2fresearch-analysis%2foecd-asia-power-and-renewables-market-briefing-q2-2022-power.html&text=OECD+Asia+Power+and+Renewables+Market+Briefing%2c+Q2+2022%3a+Power+demand+increases+despite+high+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fesg%2fs1%2fresearch-analysis%2foecd-asia-power-and-renewables-market-briefing-q2-2022-power.html","enabled":true},{"name":"email","url":"?subject=OECD Asia Power and Renewables Market Briefing, Q2 2022: Power demand increases despite high commodity prices | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fesg%2fs1%2fresearch-analysis%2foecd-asia-power-and-renewables-market-briefing-q2-2022-power.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=OECD+Asia+Power+and+Renewables+Market+Briefing%2c+Q2+2022%3a+Power+demand+increases+despite+high+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fesg%2fs1%2fresearch-analysis%2foecd-asia-power-and-renewables-market-briefing-q2-2022-power.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}