Rising price pressures in Czech Republic spark interest rate speculation

The Czech economy has been growing strongly in 2017, with the latest survey data showing the robust pace of expansion being sustained at the start of the fourth quarter. Inflationary pressures have intensified further, however, with prices charged by manufacturers rising at the steepest pace for over six years in October, leading to heightened speculation regarding an imminent interest rate rise.

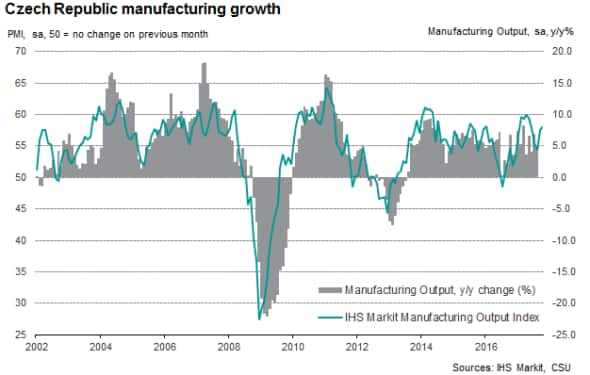

Industrial production in the Czech Republic has been heavily influenced by the impressive performance of the manufacturing sector throughout 2017 so far. The latest IHS Markit PMI survey data indicate that robust growth and improving demand showed no signs of abating at the start of the fourth quarter, with upturns in new orders and export sales accelerating further in October, pushing output higher. The headline PMI rose to 58.5 in October, its highest since April 2011.

Production rises despite labour shortages

Unfortunately, the upturn has been accompanied by rising labour shortages and a growing scarcity of raw materials, which have in turn led to inflation concerns. A tight labour market and strong demand conditions have added to speculation that the Czech National Bank will decide shortly to raise interest rates from 0.25% to try to cool price pressures.

Consumer price inflation increased in September to reach a five-year high, pushed up largely by rising transportation and food costs.

Anecdotal evidence throughout 2017 has meanwhile indicated the difficulties that manufacturers have faced in finding suitable candidates for both skilled and unskilled work, which is feeding through to higher wages. Annual wage growth ticked up to 7.5% in August.

Encouragingly, production has continued to rise despite a lack of labour. The latest upturn signalled by the IHS Markit PMI Output Index was marked and the fastest in four months. Strong demand from domestic and foreign markets also led to an increased accumulation of backlogs of work, which rose at the quickest pace in six-and-a-half years in October. Despite difficulties in sourcing appropriate workers, job creation also accelerated and was the most robust since February.

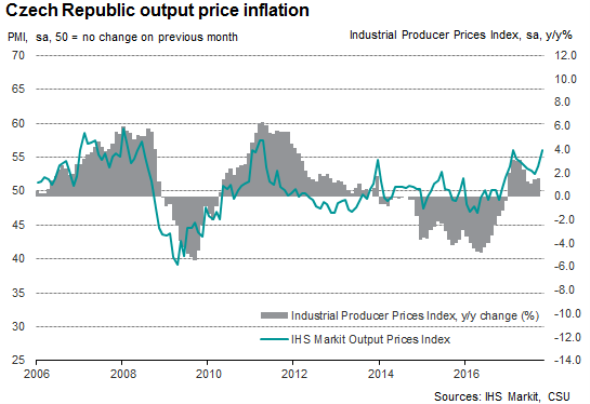

Cost burdens rise sharply

Input prices paid by Czech manufacturing firms have now risen for 18 consecutive months according to the October IHS Markit PMI Input Prices Index. Sharp peaks in inflation were seen at the beginning of the year and again in September and October, despite the koruna strengthening following the end of the currency cap. Panellists commonly attributed greater cost burdens to higher raw material prices and supply shortages. October's PMI Suppliers' Delivery Times Index indicated that vendor performance had deteriorated to the greatest extent in the series history, which stretches back to June 2001.

Firms have also been forced to raise their wages in order to keep and attract employees, as supply constraints tighten their grip.

Average prices charged for goods spiked in October, with output price inflation jumping to the fastest since April 2011. Despite demand conditions being conducive to rising charges, increased competition has generally kept prices down. However, recent sharp cost increases have pushed firms to pass more of the burden onto clients.

Going forward

The current benchmark interest rate is only 0.25%, and it is unlikely there will be a significant change if a rate rise is announced. Although the cost of credit will rise slightly, higher input prices and substantial foreign demand will continue to influence production requirements and cost pressures on companies. Following the end of the koruna cap in April, the currency has strengthened which should help ease cost burdens in the future. This is a consideration monetary policy makers will allow for when deciding the pace of any policy tightening.

Currently, IHS Markit forecasts Czech GDP growth of 3.8% in 2017. The consensus expectation for the annual expansion has been revised up as the strength and consistency of the upturn has progressed throughout the year. The latest projection is supported by greater consumer spending and a broad-based expansion.

Forthcoming economic data releases:

- November 2nd: CNB Interest Rate Decision

- November 9th: CPI inflation

- November 14th: Preliminary Q3 GDP data

- December 1st: Final Q3 GDP data

Sian Jones | Economist, IHS Markit

Tel: +44 14 9146 1017

sian.jones@ihsmarkit.com