Malaysia PMI data signals stronger Q1 GDP in March

Despite a slight pull-back in March, the latest survey data suggests that Malaysian GDP growth in the first quarter would be much improved from the final quarter of 2016. Output expanded for the second successive month even with reports of weak sales at home and abroad. However, the economy continues to face strong inflationary pressures.

Output growth despite weak sales

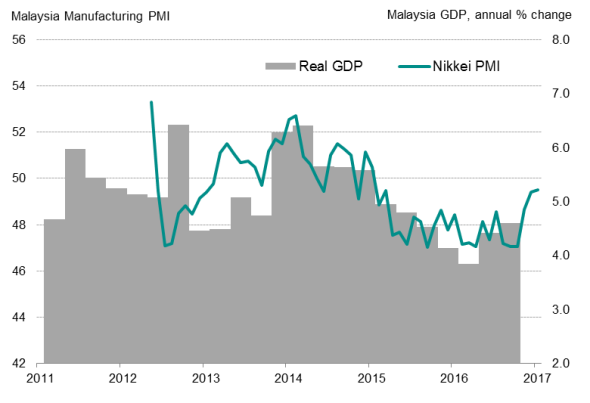

At 49.5 in March and up marginally from 49.4 in February, the Nikkei Malaysia Manufacturing PMI indicated the slowest rate of decline since March 2015, although the latest reading marked two years of deterioration in the health of the manufacturing sector.

Nevertheless, the average Q1 reading of 49.2 is higher compared with the Q4 2016 average of 47.1, and signals the best quarter in two years. Historical comparisons indicate that the survey readings are consistent with annual GDP growth of just over 5% in the first quarter.

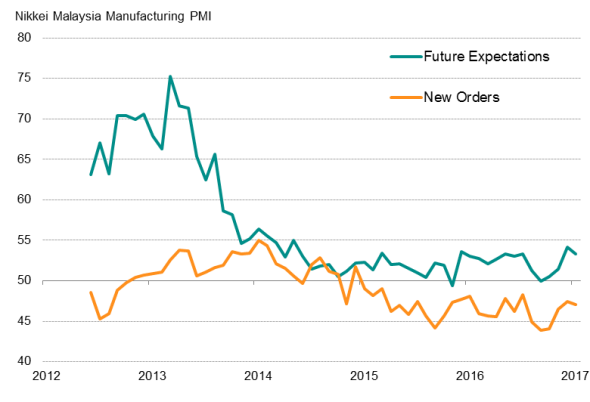

Malaysian manufacturers increased production for the second straight month and at the second-fastest rate in two years, surpassed only by the pace seen in February. However, new business continued to fall, raising concerns that the upturn in production will not be sustained unless demand strengthens.

The survey has also signalled a waning of expectations about future output, with business confidence undermined by worries about economic conditions. Falling inflows of new business and subdued optimism has been a key cause of lacklustre hiring. March employment was broadly stagnant despite increasing capacity pressures in the sector.

Malaysia PMI vs GDP

Waning business confidence

Strong price pressures

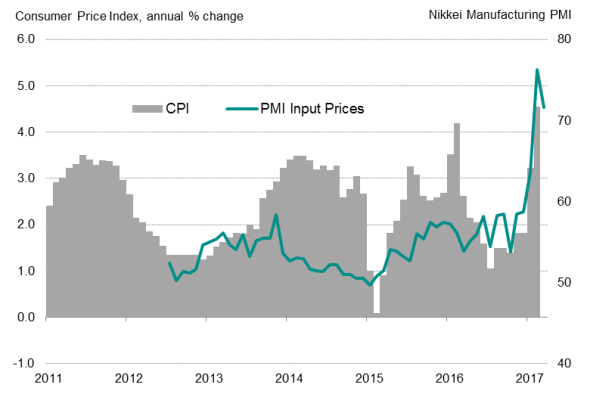

Surging prices

Malaysia's manufacturing industry continued to face strong cost increases. The weak ringgit continued to lift prices for imported inputs, with average input prices rising at the second-sharpest pace in the survey history, exceeded only by February's record increase.

Apart from unfavourable exchange rates, surging prices in the manufacturing sector were also connected in some instances to suppliers being increasingly able to negotiate higher prices due to shortages of certain raw materials. Malaysian goods producers were able to raise their selling prices as they sought to protect margins.

With the rise in price pressures remained driven largely by higher global commodity prices rather than domestic demand, Bank Negara Malaysia, the nation's central bank, is unlikely to consider tightening monetary policy to rein in inflationary pressures despite a spike in consumer price inflation in February. Moreover, the latest PMI Input Price Index signalled a slower rate of increase in the costs of manufacturing inputs, which portends a pull-back in consumer inflation in March.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com