Week Ahead Economic Preview

US inflation and labour market data will help assess the future path of Fed policy, while China's trade figures will provide clues as to export and overall economic growth trends. A number of countries are also announcing second-quarter GDP numbers.

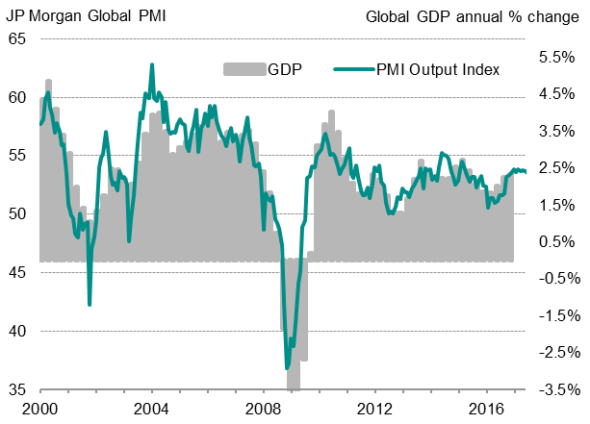

Worldwide release of sector PMI surveys (for US, Europe and Asia) will also add to insights into consumption and investment developments at the start of the third quarter. Latest national PMI surveys showed that the global economy enjoyed a sustained improvement in business conditions into the second half of this year.

Global economic growth

US inflation figures will be eagerly awaited for signs as to whether price pressures remained subdued in July, especially after the core PCE index again fell short of the 2% inflation target in June. The latest PMI data indicated that prices charged for goods and services increased at a slower rate despite another solid rise in firms' input costs during July. However, growth of US business activity gained further momentum at the start of the third quarter, suggesting higher demand could feed through to greater inflationary pressures in the coming months, adding to the Fed's view that the slowdown in inflation is transitory.

Other notable US data releases include the Fed Labor Market Conditions Index and JOLTS job openings, which will provide further steers on the health of the US labour market.

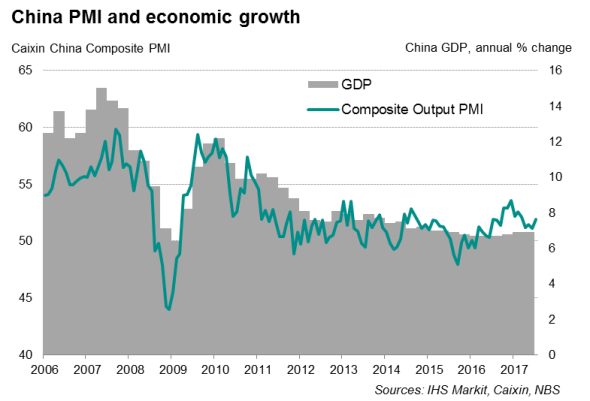

In China, analysts are eyeing the July data for updates on trade performance, especially after June figures outperformed expectations; a development which had been signalled in advance by the Caixin Manufacturing PMI survey's New Export Orders Index rising to a three-month high. A further acceleration in the growth of new export sales, as shown by the July PMI survey, suggests that external demand may support overall economic expansion in the third quarter.

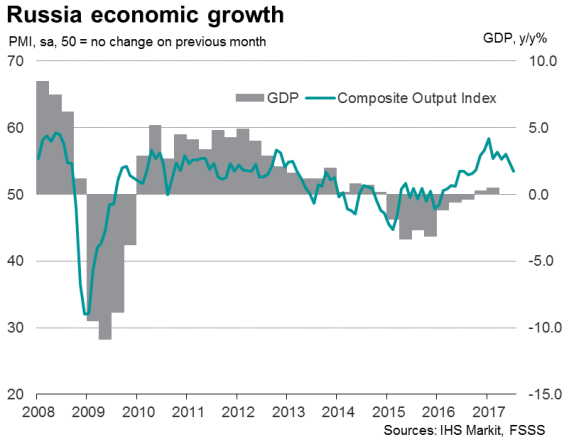

Elsewhere, second quarter GDP numbers are out for two of the world's largest emerging markets: Russia and Indonesia. The consensus view is that Russian economic growth has picked up from the annual rate of 0.5% seen in the first quarter. More recent PMI data indicated a pullback in growth at the start of the third quarter, reflecting slower service sector expansion. The new sanctions imposed by the US on Russia may also affect future economic performance.

In Indonesia, the release of second quarter GDP is one of a host of important data releases, including updates on business confidence and retail sales. Expectations are for a slightly stronger annual GDP growth rate than the 5.0% seen in the opening quarter.

Download the report for a full diary of key economic releases.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com