Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings this week

- Short sellers stay the course with avocado grower Calavo

- Enquest targeted after recent production disappointment

- Asukanet is the most shorted Asian company announcing earnings

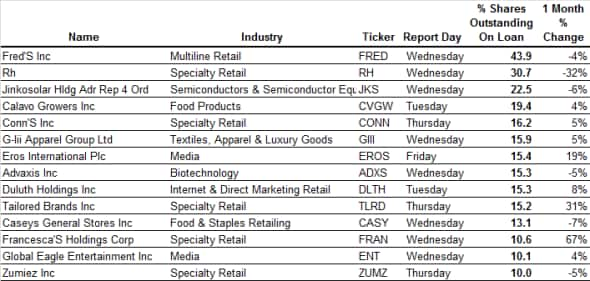

North America

Pharmacy operator Fred's is this week's runaway short play - it has a massive 44% of its shares out on loan to short sellers. Short sellers are targeting Fred's to play the tie-up between competitors Walgreen's and Rite Aide. Fred's doubled its footprint in a related transaction to help its much larger peers meet regulatory approval.

Short sellers were ultimately proven right in late June when the complicated deal came apart, and Fred's shares fell to a 15-year low. Despite their large recent payday, short sellers think there may be more bad news ahead for Fred's.

Although Fred's ongoing corporate action makes it a special case, it is not the only retailer with heavy short pressure ahead of earnings. The sector makes up more than two thirds of the companies seeing heavy short interest. Standout names in this group include homeware firm RH, teen fashion house Zumiez and department store Conn's.

One other interesting name popping up is avocado producer Calavo Growers. Its shares surged along with the demand for avocados, but short sellers are skeptical of this and have increased their bearish bets. With just under a fifth of its shares out on loan, Calavo short interest is at an all-time high.

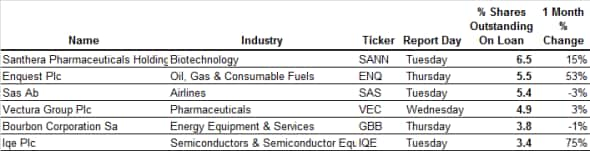

Europe

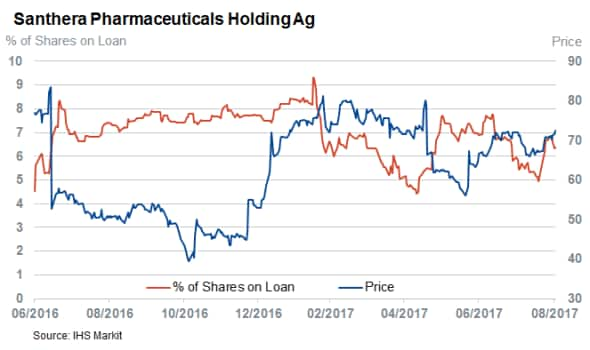

The largest short play among European companies is Swiss biotech firm Santhera. Short sellers took notice of the company in September of last year when its shares fell by more than a third on news that the US Food and Drug Administration (FDA) blocked the company's efforts to fast-track approval of its Raxone drug. Santhera has mostly recovered from this setback, but short sellers are still reticent to fully commit to this rally. More than 6% its shares are now out on loan.

UK oil and gas expoloration firm Enquest earns the runner-up spot on this week's screen of heavily shorted firms announcing earnings. Short sellers had given up on Enquest since the price of oil rallied in the second half of 2016. This covering turned out to be premature, and short sellers have returned with a vengeance. The demand to borrow Enquest shares increased by more than 50% in the last month to 5.5% of shares outstanding.

Scandinavian airline SAS is the only other European firm to see more than 5% of its shares out on loan ahead of earnings. While this figure is relatively high, it represents a massive improvement in investor sentiment. Short sellers borrowed more than three times this amount in the opening weeks of 2016.

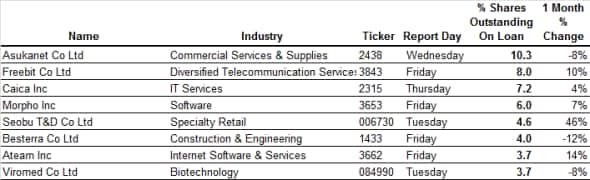

Asia

The only Asian firm with a short interest greater than 10% of shares is digital publishing house Asukanet. This fits the pattern of high momentum Japanese shares, which have attracted more short interest in the last few months, and the demand to borrow its shares surged following a 50% increase in its share price.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.