Japan PMI signals slower growth in the third quarter as services activity eases

PMI data indicated the Japanese economy ended the third quarter on a positive note but lost some momentum in September, setting up a scene for slower GDP growth in the three months ending September. Jobs growth meanwhile eased further in line with slowing business activity and inflationary pressures intensified.

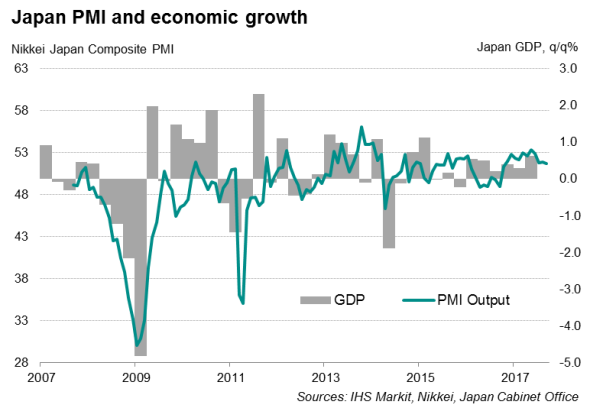

The Nikkei Japan Composite Output Index eased to 51.7 in September from 51.9 in August, showing the weakest pace of growth for nearly a year. The latest reading brought the third quarter average PMI figure down to the lowest since the third quarter of last year. Historical comparisons of the PMI with GDP suggest that the survey data indicate the economy grew at a quarterly rate of 0.5% in the third quarter.

There are signs that the slowdown in business activity may persist in the short term before turning a corner in the medium term. Despite being up slightly from August, growth in new business remained only modest in September. However, business confidence perked up since August, suggesting that firms are becoming more optimistic about output over the next 12 months.

Widening gap between manufacturing and service sectors

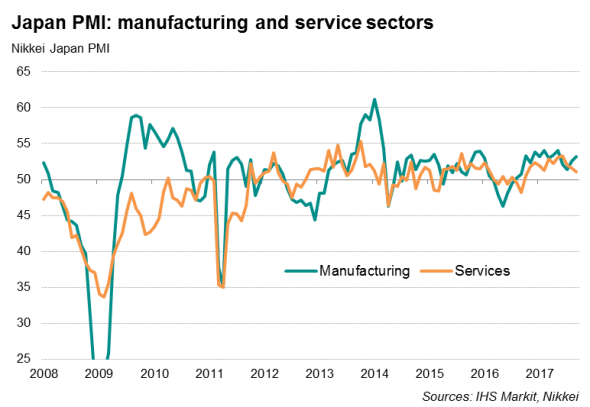

The service sector, which has shown solid growth throughout much of the year, acted as a drag on the economy in September, leaving manufacturing as the main growth driver. The rate of expansion in services activity eased to the weakest for almost a year in September, while manufacturing output growth accelerated to a four-month high, thereby widening the divergence between both sectors.

Strengthening demand for Japanese goods, particularly from foreign markets, drove the manufacturing upturn. Export sales increased at the quickest pace since February. Survey data suggest that factory output growth will likely be sustained into the fourth quarter as business confidence about the manufacturing outlook improved in September.

However, the impact of higher production on employment prospects is less clear. Despite greater operational demand in September, factories raised manpower at the slowest rate since last November. The lack of capacity pressures in the sector, as signalled by a broadly unchanged level of backlogs, also limited the extent to which goods producers took on more workers, especially when they faced an ongoing squeeze on profit margins.

Meanwhile, PMI data suggest that the slowdown in services activity may persist, at least for the next month. With modest growth in new business and expectations about future activity still underwhelming, a potential pick-up in business activity seems unlikely. More encouraging was the service sector hiring trend, which picked up slightly, registering the ninth successive month of net job gains.

Price pressures

Price pressures intensified in September, with input cost and selling price inflation gathering pace for a second straight month. Prices charged for Japanese goods and services rose to the greatest extent in over two years, but the rate of increase continued to run below cost inflation, underscoring the ongoing squeeze on profit margins. Signs of rising inflation will be welcome news for the Bank of Japan, but the recent slowdown in economic growth could bolster expectations that the BOJ will maintain its current stimulus scheme for the time being.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com