Week Ahead Economic Preview

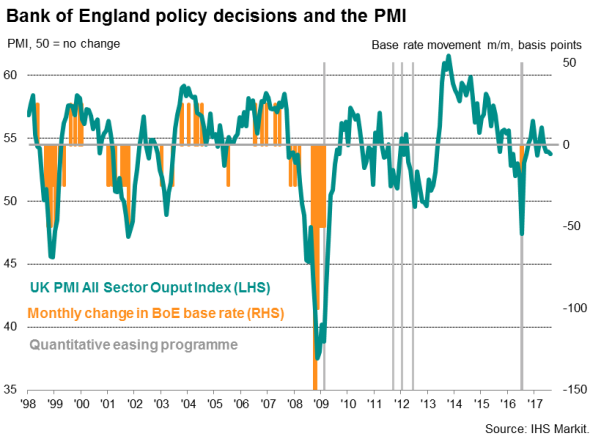

Among the highlights next week are a fresh batch of UK economic data on jobs, earnings, retail sales and inflation, which could influence the voting among the Bank of England’s Monetary Policy Committee who also meet next week.

Other key data releases include US retail sales and inflation figures, which will help gauge consumer conditions and therefore future Fed policy, as well as China’s credit, fixed investment and industrial output data.

In the UK, the focus is on labour market and wage data, alongside retail sales and inflation numbers for further guidance on consumption trends and future monetary policy. The recent squeeze on households’ spending power remains a risk to future growth, with the latest UK HFI report showing that household finances remained under pressure in August. And real earnings are likely to continue falling for some time as inflation exceeds pay growth.

Although a rise in price pressures, as signalled by the August PMI survey, suggests that inflation could pick up again in coming months, the belief is that the Bank of England is more worried about economic growth than inflation for the moment. Survey data showed economic growth edging lower in August, and the current reading of the PMI remains historically consistent with a slight easing bias as far as monetary policy is concerned.

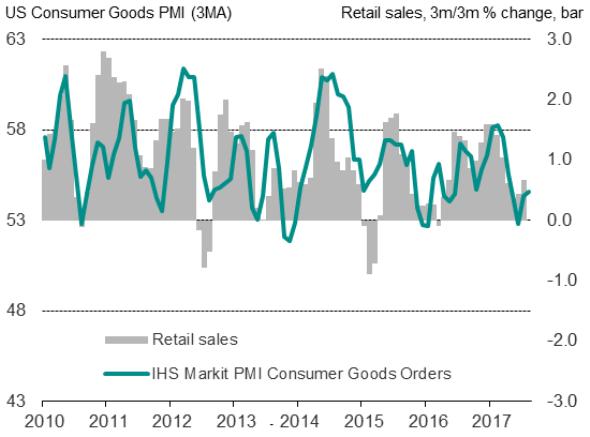

Meanwhile, US retail sales will indicate whether consumer spending has gained further momentum midway through the third quarter. July data showed the largest monthly rise in retail sales so far this year, alongside upward revisions to the numbers for June and May, setting the scene for another solid rise in GDP following growth of 3.0% in the three months to June.

US retail sales and PMI consumer goods orders

Sources: IHS Markit,Commerce Department.

August’s IHS Markit PMI showed an economy gaining growth momentum, although it is yet unclear what the impact will be from hurricanes Harvey and Irma on economic activity.

For Fed-watchers, an upturn in the inflation rate would confirm the picture already signalled by the PMI surveys, which in turn could raise expectations of another rate hike before the end of the year.

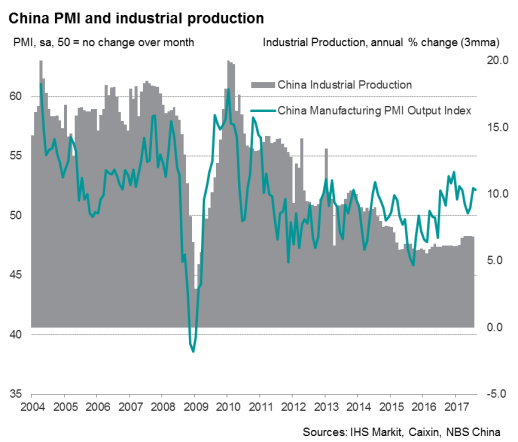

China analysts will be eyeing a range of economic data, including retail sales, industrial output, fixed investments and credit, to assess the health of the economy in the third quarter. The strength of China’s performance in the second quarter prompted many, including IHS Markit, to upgrade their GDP forecasts for 2017. And the ongoing robust PMI data for August underscore this improved outlook.

Download the report for a full diary of key economic releases.