Manufacturing dominates Asia sector performance in February

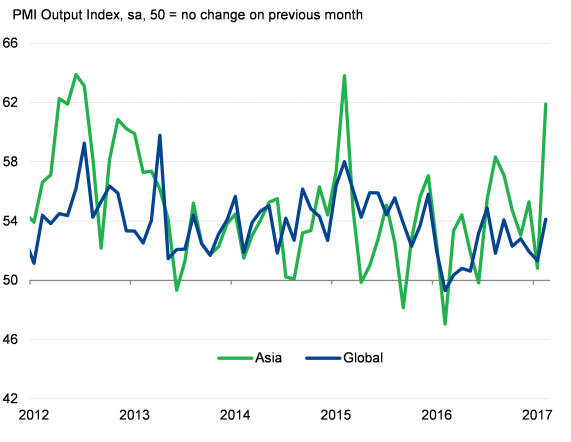

Manufacturing sectors led growth in Asia during February, according to the Nikkei Asia Sector PMI".

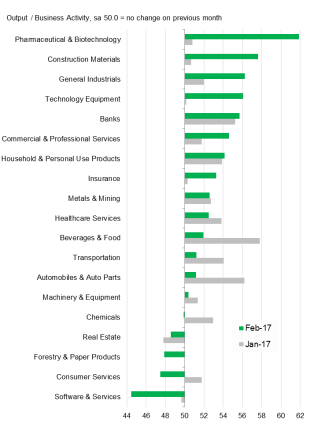

In February, 14 of the 19 sectors covered by the survey indicated growth of output, down from 16 in January and the lowest since September 2016. Consumer services, forestry & paper and chemicals products joined real estate and software & services in suffering a decline in output.

After a relatively slow start to 2017, pharmaceutical & biotechnology rebounded in February to record the strongest output expansion of all sectors. Construction materials, general industrials and technology equipment also saw growth accelerate substantially since January.

At the bottom of the rankings was software & services, which registered a marked acceleration in the rate of decline in business activity, to the sharpest in nearly eight years.

Solid underlying demand continued to drive Asia sectoral growth, with total new business expanding in 16 of the 19 sectors covered by the survey. Further increases in output and new orders also encouraged companies in most sectors to take on more workers.

Asia Sector PMI ranking

Growth in pharma & biotech accelerates

February saw pharmaceutical & biotechnology firms build on a solid performance in 2016, reviving after a January lull. After receding to a seven-month low at the start of the year, the rate of growth rebounded to a marked pace in February, with the increase in output the sharpest in two years. Moreover, inflows of new work picked up significantly from January, suggesting that strong growth momentum in the sector should continue into March. In response to rising demand, pharmaceutical & biotechnology companies increased their staff numbers for the fifth consecutive month in February.

Pharmaceutical & biotechnology

Sources: IHS Markit, Nikkei

Manufacturing upturn

February data also signalled strong expansions in other manufacturing sectors. Construction materials, general industrials and technology equipment all registered robust growth in production, underscoring the manufacturing upturn seen across the global economy. Encouragingly, both construction materials and technology equipment also saw strong growth of new business during the month, suggesting that further improvements in business conditions within these sectors can be expected in coming months.

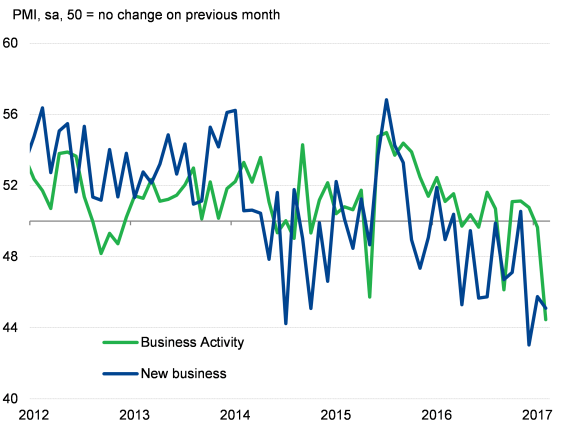

Declining software & services

The downturn in the software & services sector meanwhile intensified in February. A second straight month of decline in Asia contrasted with an upturn in the software & services sector globally. The near-term outlook for the software & services industry in the region remained bleak, as lower volumes of new business were reported again. New orders have now fallen in ten of the past 11 months.

Software & services

Sources: IHS Markit, Nikkei

Rising costs

Most Asia sectors reported higher output at a time when input costs are also rising. All 19 sectors indicated greater costs in February, up from 18 in January, with manufacturing industries dominating the rankings. Chemicals saw the largest rise in input prices again during February.

Companies widely reported that increased prices for raw materials, particularly oil and metals, were mainly responsible for cost inflation. Companies in some Asian countries, such as Malaysia, South Korea and Vietnam, also linked higher prices for imported inputs to currency depreciation, which acted to intensify overall inflationary pressures.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com