Strong performances for European Pharma & Biotech and Transportation sectors

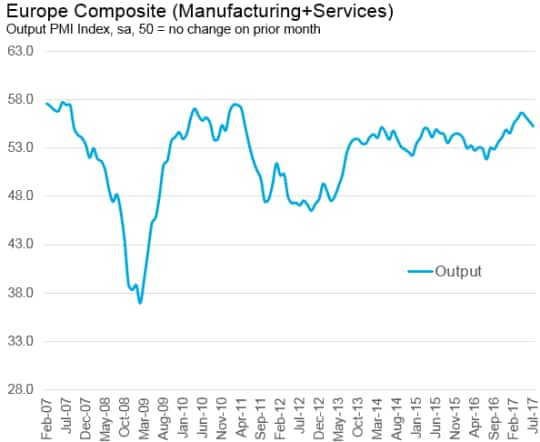

The IHS Markit Europe PMI Composite Output Index declined from 55.8 in June to a six-month low of 55.3 in July. However, despite the slight cooling, economic growth remained strong and among the highest for six years.

Beneath the headline number, detailed sector data suggested different trends across sectors and highlighted the best performers for July. Two particular sectors, pharmaceuticals & biotechnology and transportation, are currently gaining momentum and may attract more attention from investors in the near-term future. Companies in both sectors are experiencing positive developments, seeing their order books grow while keeping their profit margins under control.

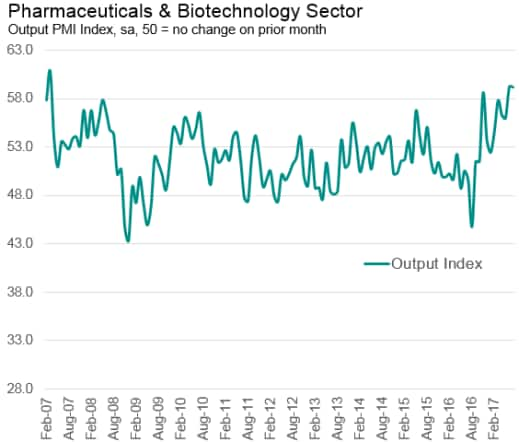

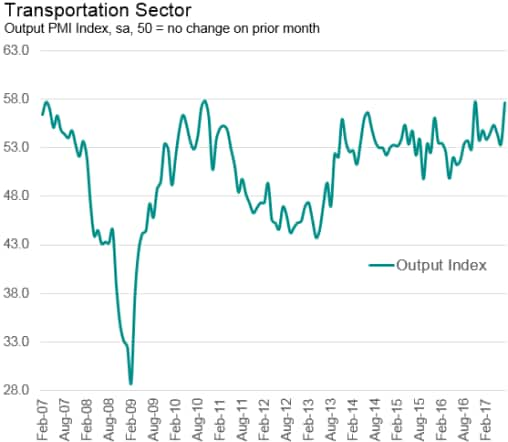

Lift in output for Pharma & Biotech and Transportation

Pharmaceuticals & biotechnology companies indicated that growth of output held at the fastest for ten years in July. This recent boost is even more significant considering that the sector was in contraction just a year earlier.

Transportation also experienced a sharp rise in output in July. Growth was the second-highest for just under seven years, behind last November’s recent peak.

As an example of the upturn in the transportation sector, BBA Aviation in the UK recorded an improved profit performance during the first half of the year. In the half year ended June 30, the company made a pre-tax profit of $84.7m compared with a loss of $269m the year before. The same was true for Fraport AG Group in Germany whose revenue advanced to €1.4b in H1, representing an increase of 10.7% year-on-year.

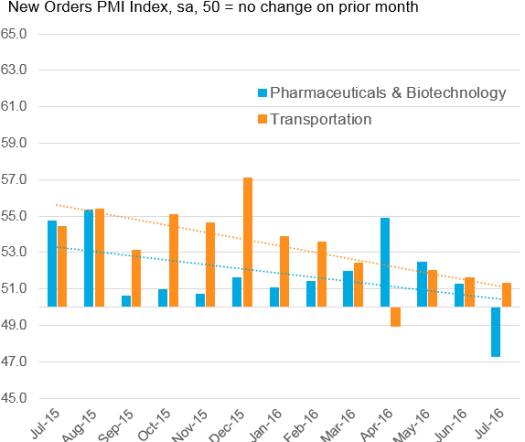

Order books back on the rise

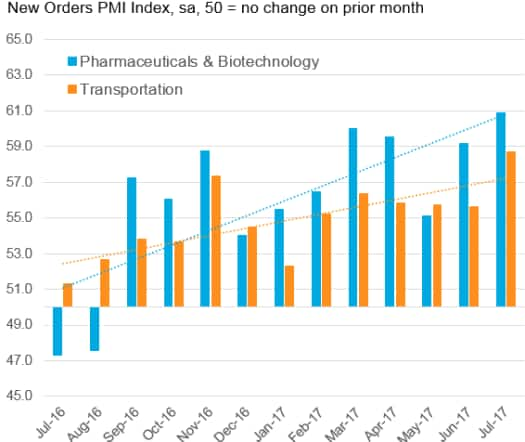

The pick-up in output growth for the two sectors has been the result of an upward shift in momentum in new orders.

As indicated in the accompanying charts, the trend in new orders had been negative from the start of the second half of 2015 to mid-2016. Companies in both sectors had experienced a slowdown until July/August 2016, when pharmaceuticals & biotechnology was even indicating an outright contraction.

From that point, a rebound was initiated and a change in momentum occurred. Order books in both sectors improved significantly since and a continuous progression has been evident. We note that the turnaround appears to be sharper for pharmaceutical & biotechnology companies than in the transportation sector.

Negative trend from July-15 to July-16…

…but gaining momentum from Aug-16 to July-17

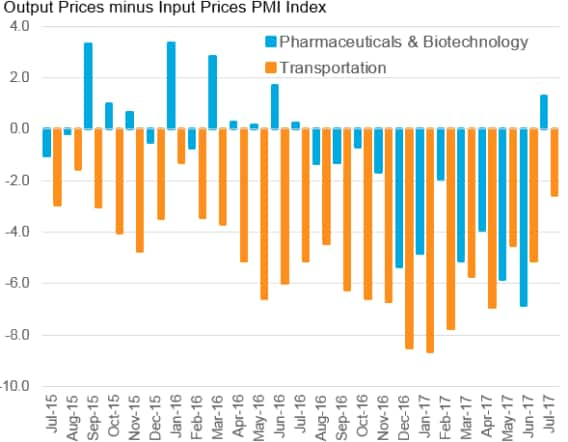

Early positive sign for margins

However, some risks remained during late-2016 and early-2017, as input prices rose at a sharp pace and therefore placed pressure on sector margins. The transportation sector appeared to be the more sensitive to the rise in costs.

During July, however, the risk eased significantly. Pharmaceuticals & biotechnology indicated stronger growth in output prices than for input costs for the first time in 12 months, and in the transportation sector the difference between input cost and output price inflation was the least marked for one-and-a-half years.

Pressure on margins eases in July

Mathieu Ras, Economist at IHS Markit

Posted 10 August 2017